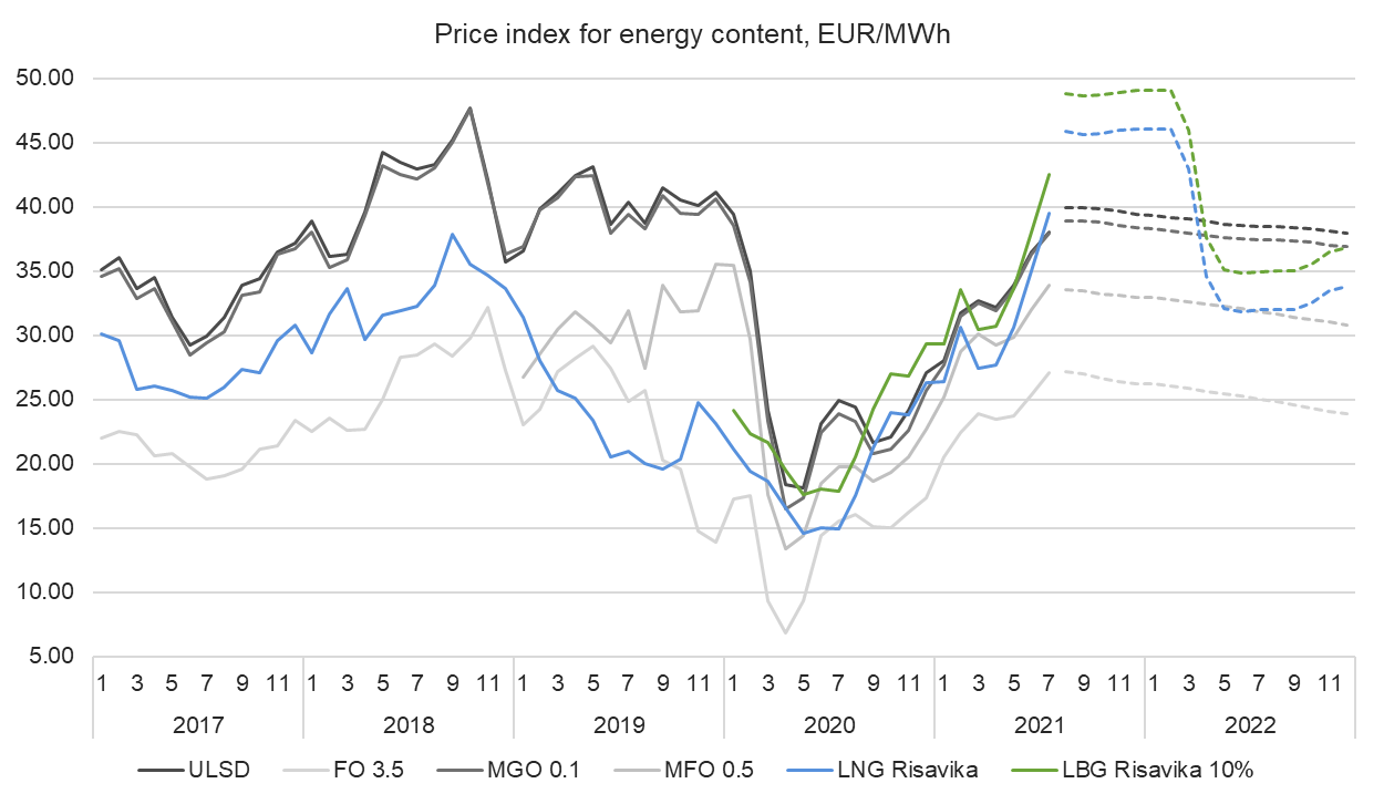

European gas markets prices rally continued to end of June and beginning of July, Risavika LNG gained 7.7 % week on week and was at 45.83 EUR/MWh by the end of lats week. European gas markets are bullish on annual maintenances of import pipelines and LNG terminals, while demand for storage injections and cooling remains. Russian flows to Europe have been lower this year, and with Gazprom holding off from booking additional capacity via Ukraine also during this summer, the pipeline gas supplies to stay tight. Commissioning of Nord Stream 2 could ease the situation, however, the operation shall start only after the certification process, a subject to potential delays. Global LNG supplies have increased in June, but additional supplies were delivered to Asian markets, leaving Europe with the volumes unchanged from previous year.

Oil product prices showed upside with benchmark Brent crude price increasing over 77 USD/BBL and anticipation of further demand recovery. Fuel oil 3.5 (FO 3.5) price gained 1.5 % to 408.15 USD/t, low sulphur oil (MFO 0.5) was up by 2.3 % to 524.70 USD/t, and marine gasoil (MGO 0.1) gained 2.1 % to 602.39 USD/t. The prices have potential for future upside on the back of crude prices as OPEC+ has failed to agree on future production policy. The discussions were roadblocked by the United Arab Emirates objections to a deal extension under the current baselines. With no agreed date for the next meeting, oil prices are likely to stay supported.

LNG Risavika – LNG FOB Risavika

LBG Risavika 10 % – 10 % blend of Liquified Biogas

FO 3.5 FOB Rdam – European 3.5% Fuel Oil Barges FOB Rdam (Platts) Futures Quotes

MFO 0.5 FOB Rdam – European FOB Rdam Marine Fuel 0.5% Barges (Platts) Futures Quotes

MGO 0.1 FOB ARA – Gasoil 0.1% Barges FOB ARA (Platts) Futures Quotes

ULSD FOB ARA – European Diesel 10 ppm Barges FOB ARA (Platts) Futures Quotes

Source: Gasum