Global container port congestion has increased port operators’ costs and put pressure on their margins, Fitch Ratings says. However, the operators’ performance has been supported by the strong rebound in volumes in 2H20 and 2021. We expect bottlenecks to be resolved by 2022, although some supply chain changes could be permanent.

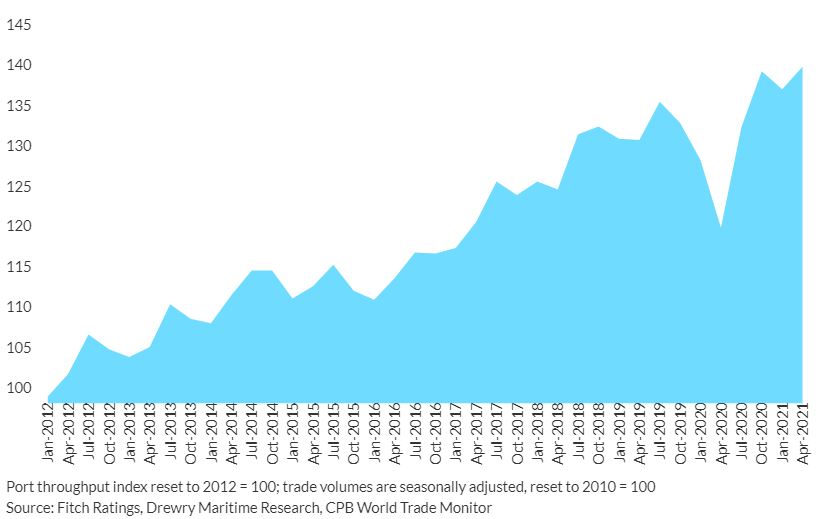

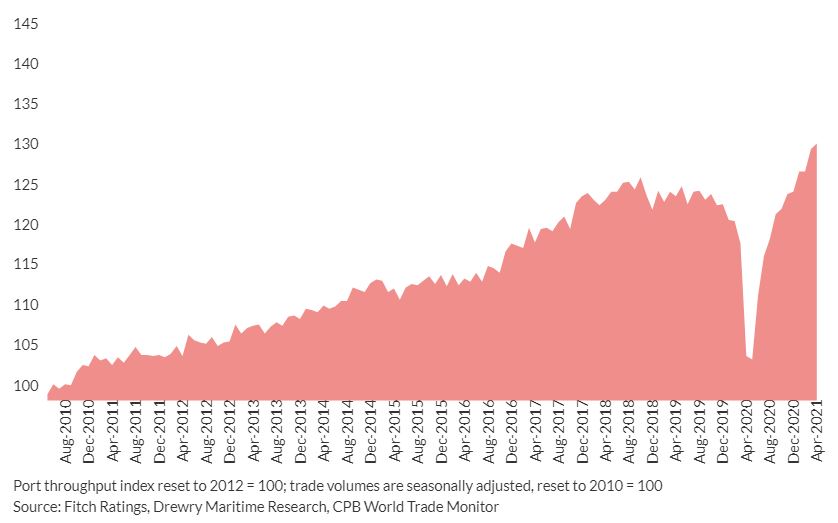

Demand for container transportation and trade volumes recovered sharply in 2H20 and continued to grow in 1H21 supported by increased consumption of goods, after a contraction in 1H20 when lockdowns peaked. We expect shipping volumes to normalise in 2022 if there are no further pandemic waves, with growth rates consistent with those in 2018-2019 and largely in line with GDP growth .

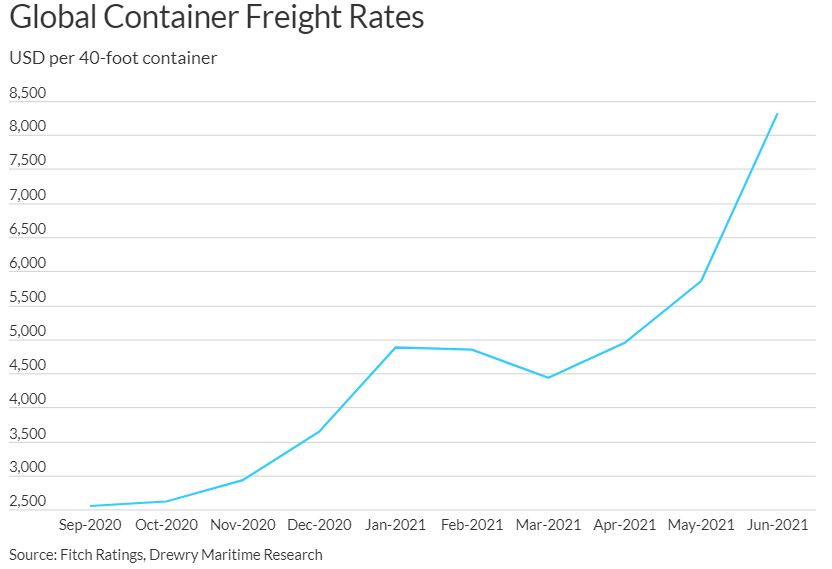

Global shipping has been battling with chaotic schedules for months due to swings in consumer demand for goods, as well as factory closures and pandemic containment measures, which have slowed down ports’ operations. As a result, there has been a shortage of empty containers in places where they are needed. This shortage has been exacerbated by the Suez blockage: roughly half the goods that pass through the Suez Canal do so on container ships. The scale of congestion has led to significant delays in unloading. Many ports are already operating at full capacity, but storage charges at ports have increased, offsetting some ports’ costs.

Container port throughput index

Some port operators are suffering lower margins due to higher processing costs caused by safety measures, greater inefficiencies and increased waiting times. Longer-term structural overcapacity in many port markets in Western Europe prevents many operators from increasing charges to cover for higher congestion-related expenses.

Strongly rebounding but unpredictable demand for goods, container shortages and port congestion have led to significantly increased shipping freight rates. Shipping lines are currently enjoying very high profitability. For many years, overcapacity in the shipping industry led to industry consolidation, price competition, low freight rates and counterparty risk for ports. Currently, shipping companies have improved liquidity positions.

World trade volume index

We expect bottlenecks at ports and congestion-related effects to last until end-2021. We also expect consumer expenditure on services and experiences to recover once restrictions are lifted, resulting in a shift away from temporarily increased expenditure on goods.

However, there could be some permanent impacts on supply chains, including a pivot towards shorter regional supply chains. Inventory management may move away from ‘just-in-time’ deliveries to more ‘just-in-case’ contingency planning, with large inventories of supplies, parts and warehousing resources.

Some measures taken by port operators during the pandemic to improve efficiency will remain in place once congestion is resolved, including increased automation and some reduced personnel costs. These gains, despite being relatively minor, will support operator’s profitability when conditions normalise.

Geographically diversified port operators and those handling “stickier” types of cargo are the least affected by congestion. A temporary shift away from containers to conventional cargo due to extraordinary high container freight rates means ports with less containerised volumes had earnings opportunities in 2020 and 1H21 by taking volumes from container ports.

Fitch-rated port operators overperformed our 2020 assumptions due to higher-than-expected volumes in 2H20. Their performance in 2021 YTD has been in line with our assumptions. DP World’s consolidated throughput grew by about 4.6% in 2020, though, on a like-for-like basis, it fell by 1.8% – a limited overall contraction. Russia-based Global Port Investment’s container volumes grew by 6.6% in 2020 in contrast to the overall market fall in Russia of 1%. However, UK-based ports group ABP Finance Plc faced the twin impact of the pandemic and Brexit in 2020 with its bulk cargo volumes and revenue reduced by about 10% and 7.6%, respectively, but still broadly in line with our forecast.

Source: Fitch Ratings