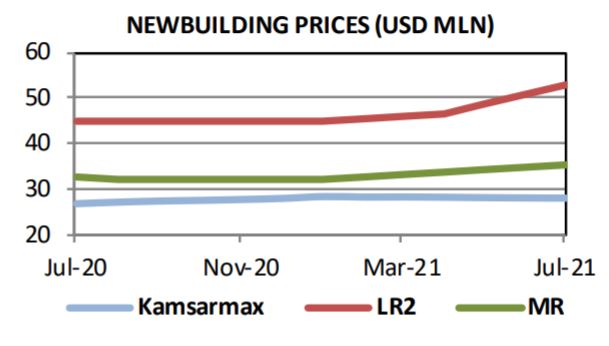

The incredible surge in the container shipping market has also fuelled the newbuilding market for container carriers. In its latest weekly report, shipbroker Allied Shipbroking said that “newbuilding market continues on a fairly active mode, with the well performing sectors attracting most of the buying appetite. In the dry bulk market, it was a week with only one Kamsarmax order, but interest remained vivid. The bullish freight market in the sector has lifted sentiment considerably, boosting enquiries for newbuilding projects. The stability of newbuilding prices during the last few weeks has helped in the rising interest, despite the fact that we have reached multi-year highs. It is expected that robust activity will continue to be seen in the dry bulk segment, on the back of strong fundamentals. Concurrently, the minimal activity noted in the tanker sector resumed for yet another week, nourished by the persisting poor freight rates. The oversupply concerns are still a headache and potential buyers remain overall reluctant to proceed with newbuilding projects for now. Adding on to this, asset prices continued for another week on an upward trajectory. However, the freight market seems to be close to a bottom and thus we have started to see some buying appetite gradually return. Despite all this we saw one order for 6 MRs come to light during this past week”.

In a separate note this week, shipbroker Banchero Costa added that “it was till a bullish week, with container vessels and gas dominating business. Seaspan has ordered 8 x 7,000 teu containerships from Shanghai Waigaoqiao; the price per unit is around $73 mln, and deliveries will begin in December 2024. Capital Maritime Greece purchased a Hyundai Mipo for a 4 + 2 feeder 1.800 teu at a cost of $31.1 mln per unit, with deliveries beginning in late 2022.

In terms of LNGs, Celsius Shipping Denmark has placed three firm LNG Mark III Flex type at Samsung 180.000 cbm for $193.3 mln per unit, with deliveriesstarting in late 2024. H-Line (1) and Sovcomflot (2) both placed orders for 171.000 cum LNG at Hyundai Samho for $192 mln per unit”.

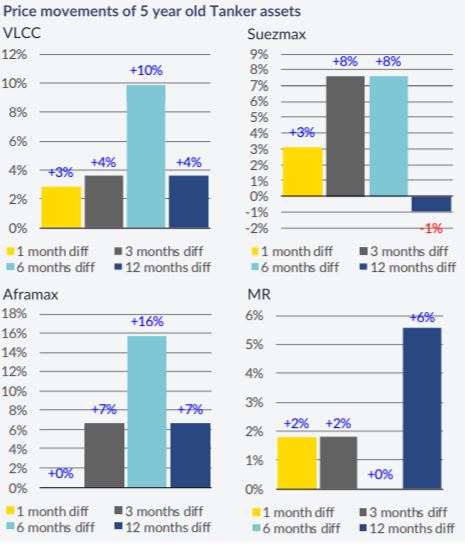

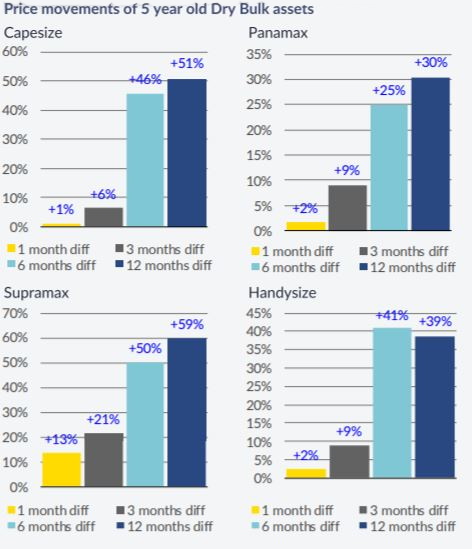

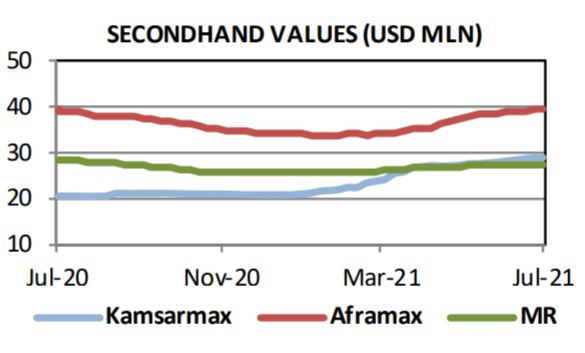

Meanwhile, in the S&P market this past week, Allied added that “on the dry bulk side, vivid interest was once again apparent in the SnP market. The bullish freight market, the robust sentiment and the positive outlook for the following quarters have elevated buying appetite as of late. The ratio of potential earnings to current asset prices seem to be considered as fair for now from the potential buyers, while at the same time though keen sellers have started to further inflate their price ideas. This is likely to lead to another batch of upward asset price movements in the near future. On the tanker side, there are several weeks now with limited to moderate activity and this past week was no exception. The fundamentals remain uninspiring, but hopes for a potential upturn in the market have revived some buying interest, even if the number of deals taking place remain limited. It is worth mentioning that imbalance between oil product and crude oil tankers activity was clear for yet another week, with the majority of deals including MR units”.

Banchero Costa also noted that “during the week a vintage capesize Leadership abt 171k blt 2001 Koyo (SS/DD due October 2021) has been sold to Far Eastern buyers at $12 mln. Some week ago King Sail abt 177k blt 2002 Mitsui (SS/DD due March 2022) was reported at $12 mln. A Panamax bc Qc Matilde abt 76k blt 2002 Tsuneishi (SS due 2025 ) was done at $10.8 mln basis delivery during Q4 of 2021. In the Supramax segment Jinhui Shipping was reported to be behind purchase of Belfri abt 56k blt Kawasaki (SS/DD due 06/2022) at $15.18 mln last week another similar supramax Lara abt 56k blt 2008 IHI was done at $15.1 mln. In the Handy segment, a modern 28k Imabari Lukcy Life abt 28k blt 2013 Imabari (SS due June 2023) has been sold at $13.8 mln and last month Global Aquarius abt 28k blt 2010 Imabari was reported at $10 mln.

In the tanker market c.of Soechi were mentioned to be behind purchase of aframax Bai Lu Zhou abt 110k blt 2007 Dalian (SS due 06/2022) at $14.25 mln, in the past weeks Ocean Crown abt 110k blt 2007 SWS (SS/DD due July 2022) was sold at $15.3 mln. A shallow draft MR1 CPP trader Gold Ocean abt 37k blt 2007 STX was sold at $8.8 mln. Please note: last week the sale of Centurion (76,000 dwt, built 2005 by Oshima) was correctly reported at $12.5mln, what was missing is that the vessel was sold basis TC attached at $10,000/d till January 2022”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide