The EU’s new ‘Fit for 55’ climate plan will increase carbon costs and capex for European metals and fertiliser producers and for those exporting to the EU, Fitch Ratings says. Fewer free carbon allocations, a lower annual emissions cap for the Emission Trading System (ETS), and an introduction of the Carbon Border Adjustment Mechanism (CBAM) are key policies that affect these sectors. We expect cost pressures to be limited in the medium term with most impact coming in the longer term.

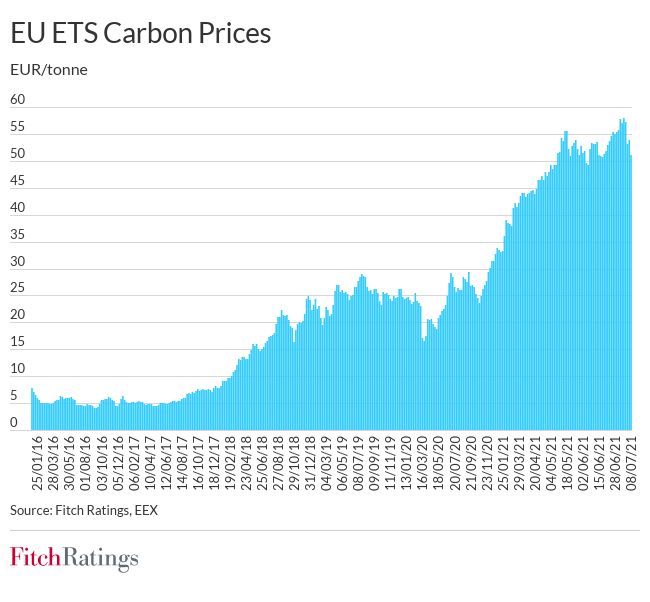

Last week the European Commission unveiled its new interim ‘Fit for 55’ plan, which will help cut emissions by at least 55% by 2030 (compared to 1990) on its road to carbon neutrality by 2050. The proposal is subject to approval by the European Parliament. EU domestic metals and fertiliser producers will be most affected by a steeper free annual carbon allocation reduction of 4.2% – instead of 2.2% currently – and a lower emissions cap. Carbon prices have already reached new records this year and are likely to increase further as the policies are implemented.

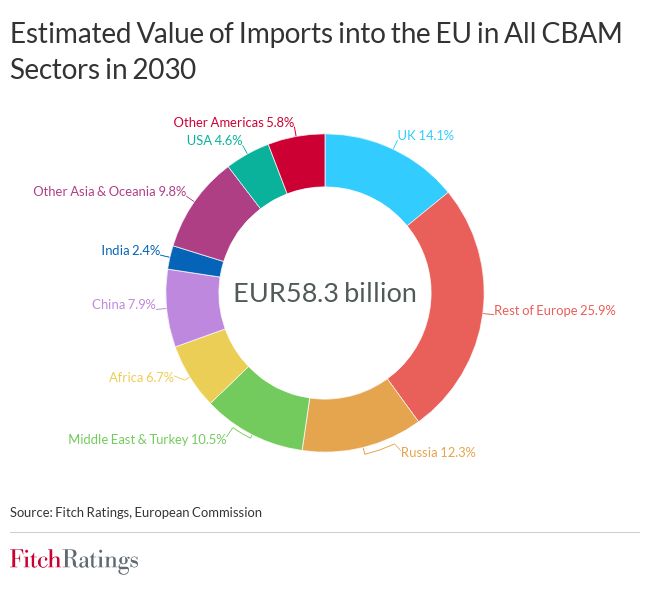

The CBAM should help avoid carbon leakage from imports and will mirror carbon costs of domestic producers for importers in polluting sectors, including iron and steel, aluminium, and fertilisers. The CBAM will be rolled out in stages from 2023, with actual payments by importers starting from 2026. This move may spur EU trading partners to consider their own carbon trading systems.

Fitch-rated producers could mitigate the impact from cost increases on their credit profiles through the decarbonisation programmes implemented by many producers, financial policy flexibility and the availability of funding to invest in further decarbonisation. Furthermore, high commodities prices in 2021 helped companies to materially reduce leverage. We do not expect any significant medium-term impact on companies’ leverage profiles.

The European steel sector faces over EUR50 billion in capex by 2030 to achieve emission-reduction targets, according to Eurofer. It will also incur high carbon costs at least until 2026 when the CBAM is in effect, and experience quicker free allocation cancellation. The proposal also means higher energy costs for European producers. However, some policies, including the construction of renewable energy generators and housing decarbonisation, will support steel demand longer term. Funds generated from carbon trading will be predominantly spent on the energy transition, partially covering related capex budgets. This will mitigate the pressure on European steelmakers ArcelorMittal and thyssenkrupp.

Many Fitch-rated Russian exporters (into the EU) of steel and aluminium have the lowest production costs, according to CRU, and will be able to absorb higher costs. NLMK will be most affected by the CBAM because of its significant exports into the EU. Severstal and Metalloinvest also have sizeable EU exposure, while EVRAZ and MMK will be the least affected. Aluminium producer Rusal has announced a demerger of its high-carbon assets. It will continue to export low-carbon aluminium produced using hydropower into the EU, thus avoiding material CBAM payments.

Some northern African and Russian fertiliser producers will be exposed to the CBAM as the largest exporters to the EU. Russia’s PhosAgro and EuroChem sell just over a quarter, and Morocco’s OCP about 20%, of their production in the EU. Some fertilisers, including phosphate rock and MOP, are not covered by the CBAM. EuroChem, PhosAgro and OCP have very low cost bases and are well positioned to absorb new carbon costs. At least some costs will be passed onto consumers.

The proposed ETS expansion to shipping may benefit fertiliser products, such as Yara and OCI, currently investing in green ammonia and methanol, which will be used in shipping fuel decarbonisation.

Source: Fitch Ratings