The number of negative Outlooks and Watches on global financial institutions’ (FIs) ratings continued to decline in 2Q21, signalling that pressure from the pandemic is receding, Fitch Ratings says in a new report. The proportion of bank ratings on Negative Outlook or Watch went below 50% for the first time since before the crisis and was about 40% by the end of the quarter. For non-bank financial institutions (NBFIs) and insurers, about 20% and 15%, respectively, of ratings were on Negative Outlook or Watch at end-2Q21, almost back to pre-crisis levels.

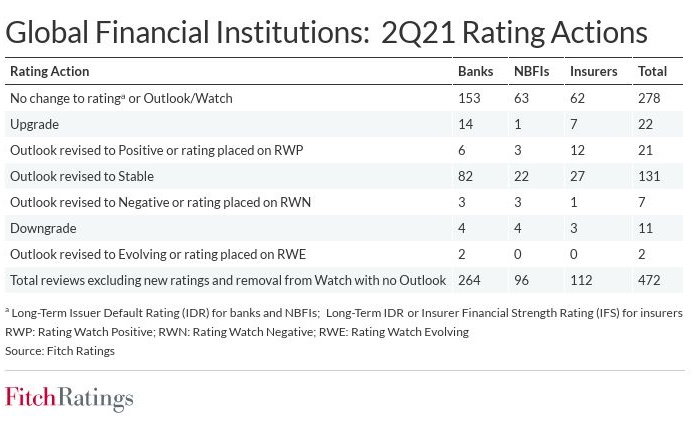

Of the 472 rating actions taken on global FIs in 2Q21, about 30% were Outlook revisions to Stable from Negative. About 60% of actions led to unchanged ratings and Outlooks.

Insurance ratings had the highest proportion of positive actions, mostly driven by strong capitalisation or M&A. For banks, positive rating actions were largely due to a combination of improved operating environments and intrinsic creditworthiness. For NBFIs, positive actions were mostly due to improvements in credit profiles or to M&A.

Fewer Latin American rating actions were negative than in 1Q21, reflecting better economic growth forecasts for Brazil and Mexico. In other regions, less than 5% of rating actions were negative. Downgrade risks for global FIs are still concentrated in Latin America, along with some banking sectors in western Europe, the Middle East and Africa, which could face pressure as monetary policy normalises and as fiscal support wanes.

We expect regional variations in rating trends to continue due to uneven recoveries from the pandemic, with emerging markets generally more at risk, partly due to slower vaccine deployment.

Source: Fitch Ratings