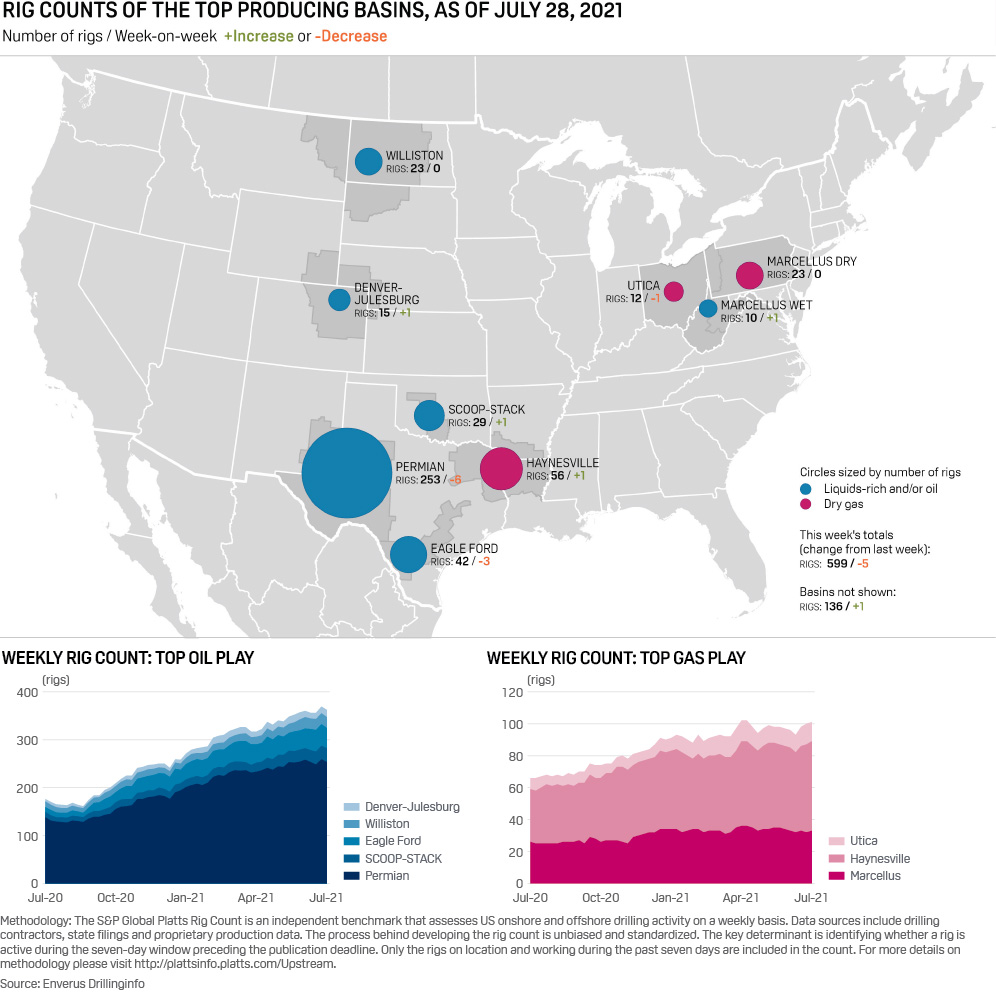

The slowdown in drilling activity was primarily seen in oil-focused plays, where rig counts fell 10 to 457. In contrast, the number of rigs primarily chasing gas climbed five to 142, the highest since the week ended March 18, 2020.

The decline was concentrated in the Permian Basin, where the number of active rigs fell six to 253. It was the largest one-week drop in the Permian rig count since the week ended Aug. 5, 2020, when the basin shed seven rigs.

Drillers idled three rigs in the Eagle Ford play of south Texas, leaving the total active there at 42, a four-week low.

The SCOOP-STACK rig count climbed one to 29, the highest since the week ended April 1, 2020. In the Denver-Julesburg Basin, the rig count moved one higher to a five-week high 15.

The Bakken rig count was steady at 23 for a third straight week.

Despite the broader uptrend in gas-focused drilling activity, most of these gains were seen outside of the major named basins. Operators added a single rig each in the Haynesville and Marcellus plays, putting total rigs up to 56 and 33, respectively. But in the Utica shale, the rig count fell one to 12.

Haynesville drilling activity was last higher in 2019, and the growth in rig count has been accompanied by an increase in well completions and wells drilled.

In both May and June, well completions in the Haynesville totaled 50, the highest monthly completion rate in nearly seven years. Over the same two-month period, producers bored almost as many new wells, with 49 drilled in May and 50 in June, data from the US Energy Information Administration’s most recent Drilling Productivity Report shows.

As of June, the internal rate of return for an average Haynesville producer has climbed to an estimated 21%, based on a half-cycle, post-tax analysis; a gain that comes largely on the back of higher spot and forward gas prices in 2021. Compared with year-ago levels, IRRs are up sharply from estimates below 10% in June 2020, S&P Global Platts Analytics data shows.

Strong gas prices could test producer discipline

On July 29, Henry Hub forward contracts settled above $4/MMBtu until March 2022, which finished at $3.919/$MMBtu. Spot prices broke above $4/MMBtu during July 23 trading for the first time since February’s winter storm as warmer temperatures hit most parts of the Southeast US and Texas. The strength in the forwards markets remains a function of rising demand amid flat production.

These strong prices are likely to test North American producers’ commitment to stick to their capital expenditure guidance and tempt them to grow production beyond current plans. While capital discipline from public companies is reducing oil and gas growth, smaller, private companies are capitalizing on higher prices and ramping up drilling activity.

The rig count for small, private operators is only around 2% below pre-pandemic levels, while majors are still closer to 68% below.

With gas-to-coal switching unable to curb demand during the peak summer months, Henry Hub prices have few anchors to keep them from jumping further. In addition, storage inventories are struggling to inject, bringing refreshed concerns on stock levels if any colder-than-normal weather arises this winter.

Working gas in storage increased by 36 Bcf to 2.714 Tcf for the week ended July 23, EIA data showed July 29. While the injection exceeded the five-year average build of 28 Bcf and last year’s 27 Bcf injection in the corresponding week, it was less than the 40 Bcf addition expected by an S&P Global Platts survey of analysts.

Storage volumes now stand 523 Bcf, or 16%, less than the year-ago level of 3.237 Tcf, and 168 Bcf, or 6%, less than the five-year average of 2.882 Tcf.

Source: Platts