On a Week 32, MABUX World Bunker Index continued its moderate decline. The 380 HSFO index decreased by 7.91 USD: from 452.70 USD/MT to 444.79 USD/MT, the VLSFO index fell by 6.67 USD: from 553.06 USD/MT to 546.39 USD/MT, while the MGO Index lost 10.71 USD (from 646.92 USD/MT to 636.21 USD/MT).

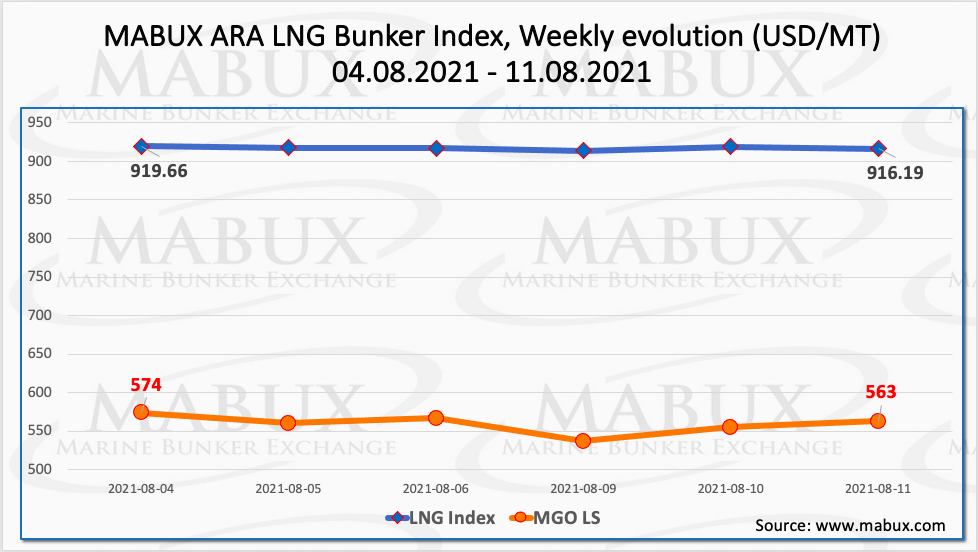

MABUX ARA LNG Bunker Index, calculated as the average price of LNG as a marine fuel in the ARA region, showed a slight decrease in the period of August 04-11: from 919.66 USD/MT to 916.19 USD/MT (minus 3.47 USD). At the same time, the average value of the LNG Bunker Index increased by 110.87 USD compared to the previous week. The average price for MGO LS in Rotterdam during the same period decreased by 26.84 USD/MT, while the average price difference between bunker LNG and MGO LS in Rotterdam increased by 137.69 USD and exceeded 300 USD: 357.91 USD (versus 220.22 USD last week). LNG bunker price indices, TTF, NBP and Henry Hub gas futures, LNG bunker market news and more are available in the LNG Bunkering section at www.mabux.com.

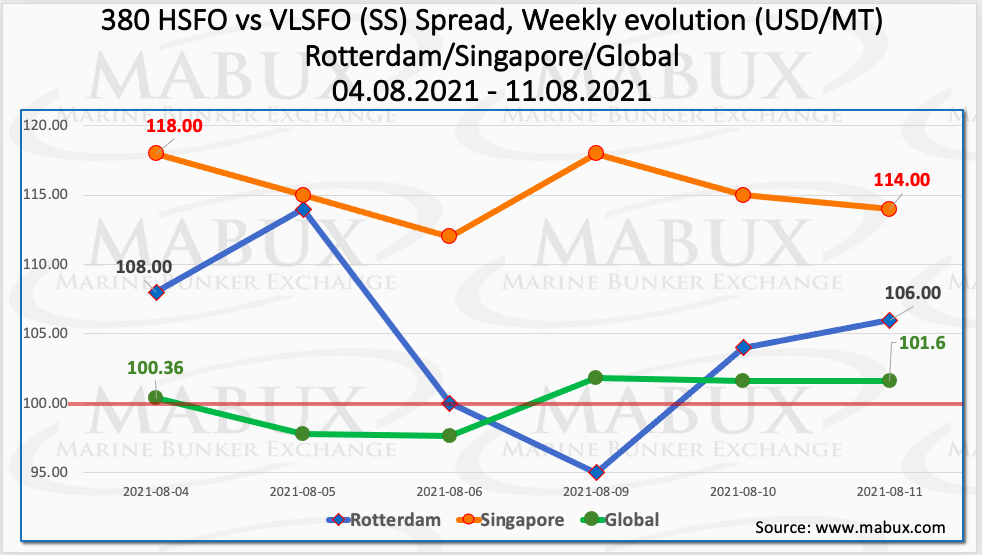

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – came close to $ 100 during the week: $ 100.13 (versus $ 103.18 last week). At the same time, the average value of SS Spread in Rotterdam also decreased by $ 5.50 and reached $ 104.50 ($ 110.00 last week). In addition, the SS Spread in Rotterdam dropped below $ 100 twice during the week. In Singapore, the average SS Spread also fell by $ 7.50 to $ 115.33 ($ 122.83 last week). The SS Spread averages in both ports remain above the $ 100 mark so far. More information is available in the Differentials section of www.mabux.com.

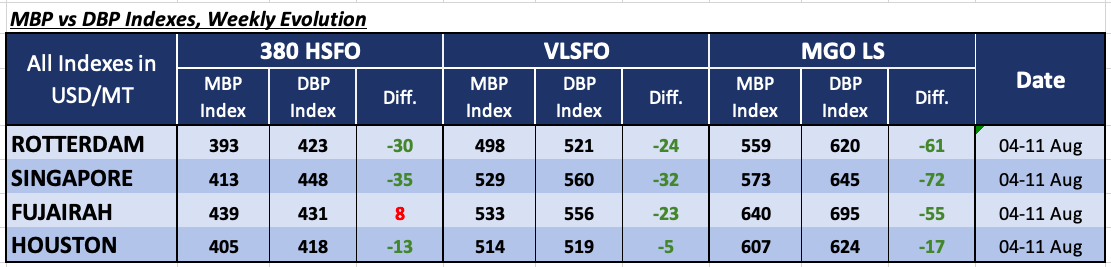

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO fuel remained undervalued in all selected ports, except Fujairah, where this type of fuel was overvalued on average by $ 8 (versus minus $ 20 last week). In other ports, the underpricing was: minus $ 13 in Houston (vs. minus $ 20 last week), minus $ 30 in Rotterdam (minus $ 33) and minus $ 35 in Singapore (against minus $ 43). In general, the trend towards a further reduction of underestimation margins in three ports continues.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, was also underestimated in all four selected ports: in Houston the underpricing was minus $ 5 (minus $ 14 last week), in Rotterdam – minus $ 24 (minus $ 26), in Fujairah – minus $ 23 (versus minus $ 37), in Singapore – minus $ 32 (versus minus $ 39). Fujairah has seen the most significant change in the MBP / DBP Index: plus $ 14.

As for MGO LS, MABUX DBP Index has registered an undercharge of this grade at all selected ports ranging from minus $ 17 (minus $ 28 last week) in Houston to minus $ 61 (minus $ 55) in Rotterdam, minus $ 72 (vs. minus $ 75) in Singapore and minus $ 55 (minus $ 64) in Fujairah. The MGO LS’s MBP/DBP Index has changed irregular, increasing in Rotterdam, and declining in all other ports.

According to DNV, the LNG-fuelled vessel order book continues to build this year with 21 vessels booked in July. This is currently the monthly average for orders to date this year. If this level of monthly orders continues it would result in an order book of 250 vessels for 2021. According to the AFI platform, there are now 213 LNG-fuelled vessels in operation and 350 on order. A further 199 vessels are ‘LNG-ready’. It was also noted that four methanol-fuelled vessels were booked in July, bringing the total in operation and on order to 30.

Source: www.mabux.com