The oil market looks set to remain very tight through the end of 2021, even with OPEC and its allies planning to steadily hike crude production each month, the organization said Aug. 12, as it comes under pressure from the US to cool off rising gasoline prices.

In its latest market outlook, producer bloc kept its global oil demand forecasts for 2021 and 2022 unchanged, while boosting its projections of non-OPEC supply, largely due to Russia’s increases under the OPEC+ pact to collectively raise output by 400,000 b/d every month through the end of 2022.

Even so, oil demand will likely remain higher than supply over the coming months, the report states, which could maintain upward pressure on near-term prices, with OPEC noting the steepening backwardation in major crude benchmarks.

“Forecasts continue to point to a significant supply/demand deficit in H2 2021,” OPEC said, adding that “refined product prices in H2 2021 are likely to continue benefiting from a seasonal strength in transport fuels, although current high refinery run rates could dampen some of the upside in the immediate near term.”

The report was published a day after the US criticized the OPEC+ alliance for not pumping more and endangering the global economy’s recovery from COVID-19. Citing crude prices that are now higher than pre-pandemic levels, US National Security Advisor Jake Sullivan said the current OPEC+ deal “is simply not enough.”

US retail gasoline prices averaged $3.14/gal in July, the highest monthly average since October 2014, the US Energy Information Administration said Aug. 10.

The OPEC+ alliance, which next meets Sept. 1, has not responded to the US comments.

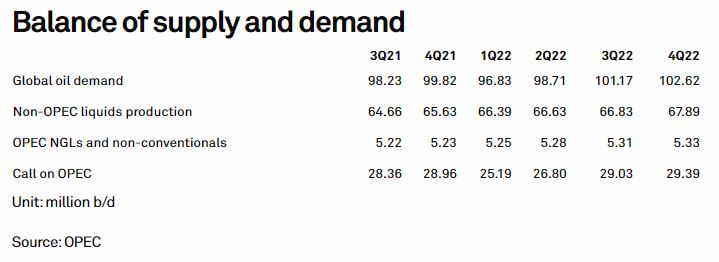

The OPEC report estimated that demand for its crude would hit 28.36 million b/d in the third quarter and 28.96 million b/d in the fourth quarter, compared to its production of 26.66 million b/d in July, according to secondary sources used by the organization to track output.

Of the OPEC+ deal’s planned 400,000 b/d monthly production rises, about 250,000 b/d will be allocated to OPEC members. Assuming steady volumes by Iran, Libya and Venezuela, which are exempt from production quotas, and full compliance by the other members, OPEC production will remain under 28 million b/d by the end of the year.

But starting in the first quarter of 2022, the call on OPEC crude falls to 25.19 million b/d, and will remain muted at 26.80 million b/d in the second quarter.

The OPEC report stood in contrast to the International Energy Agency’s latest forecast, issued hours earlier, which showed faltering oil demand growth and higher output from outside the OPEC+ alliance, “stamping out lingering suggestions of a near-term supply crunch or super cycle.”

Source: Platts