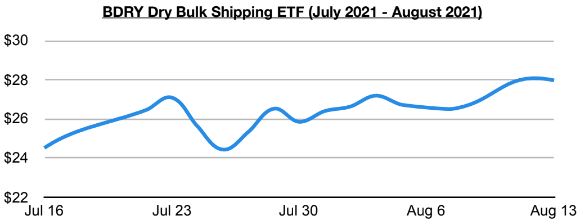

The Breakwave Dry Bulk Shipping ETF (BDRY) finished last week up by 5% as dry bulk FFA values increased further. The ETF ended last week at its highest weekly close since late June. BDRY and FFA values rose last week primarily as spot freight rates in the dry bulk market have continued to rise (to be discussed in greater detail in our upcoming Weekly Dry Bulk Report). Market sentiment is improving as spot freight rates have continued to strengthen.

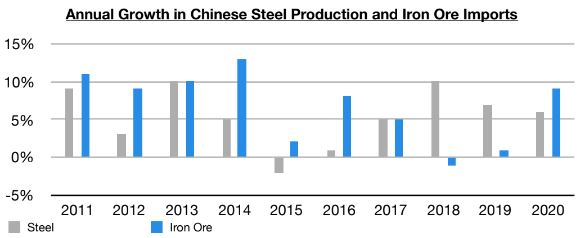

While spot freight rates and FFA values rose last week, not everyone is bullish for the dry bulk market. For some, there is a sense of fear (and for uber bears, a call for panic) regarding the ongoing steel output cuts in China. Still unknown and/or ignored by many, though, is that China’s annual iron ore imports have historically remained resilient during the years where steel output has achieved relatively low growth or even contracted. As we first discussed in our August 2nd Weekly Dry Bulk Report, the last ten years have seen three years where China’s steel output did not grow by at least 5% (2012, 2015, and 2016) — and during all of these years iron ore imports still set records. 2021 could of course finally be different, but so far global iron ore mining has historically dictated annual iron ore import volume. Overall, not everyone is bullish for the dry bulk market. Mixed opinions are great and typically lead to wonderful opportunities as well as volatility.

Source: Commodore Research & Consultancy