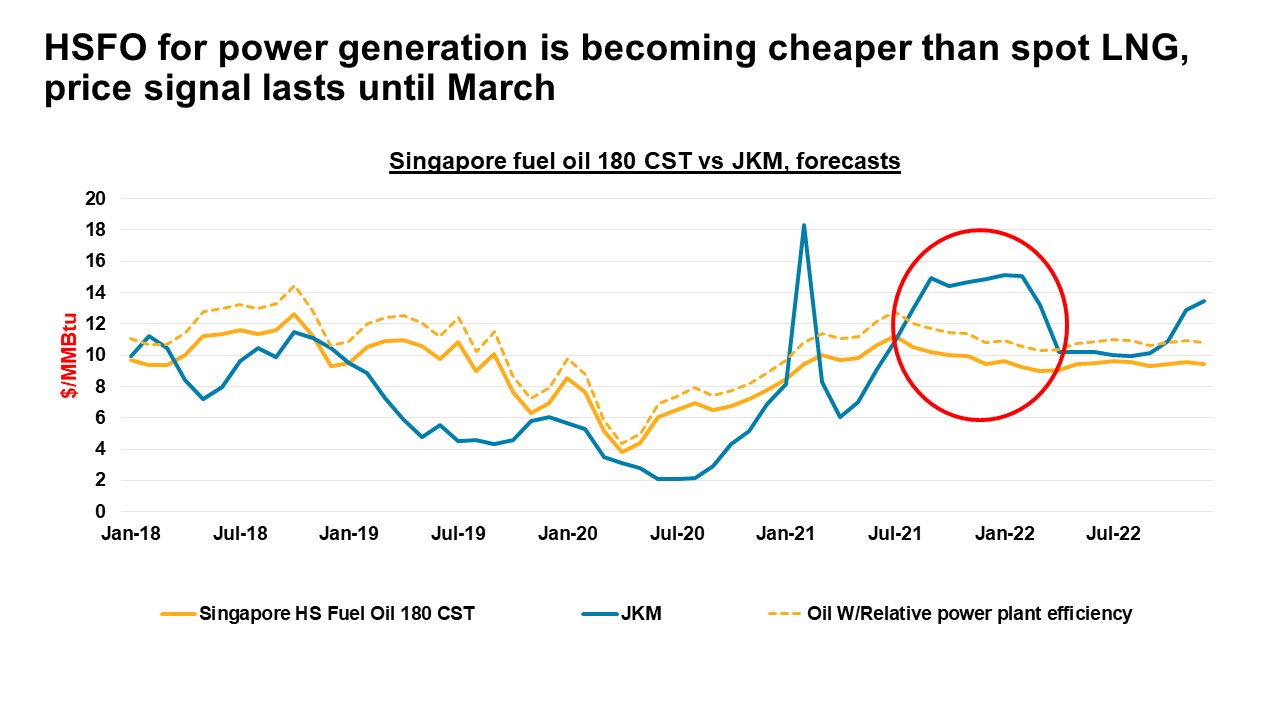

Price signal strong, consistent for all winter

With the recent rise in spot LNG prices, HSFO is becoming cheaper than LNG for power generation. While we observed a similar development in Jan. 2021, that signal was short lived. However, this signal is strong and consistent from September to March 2022, effectively covering the entire winter period.

Most switching should take place in Bangladesh, Pakistan

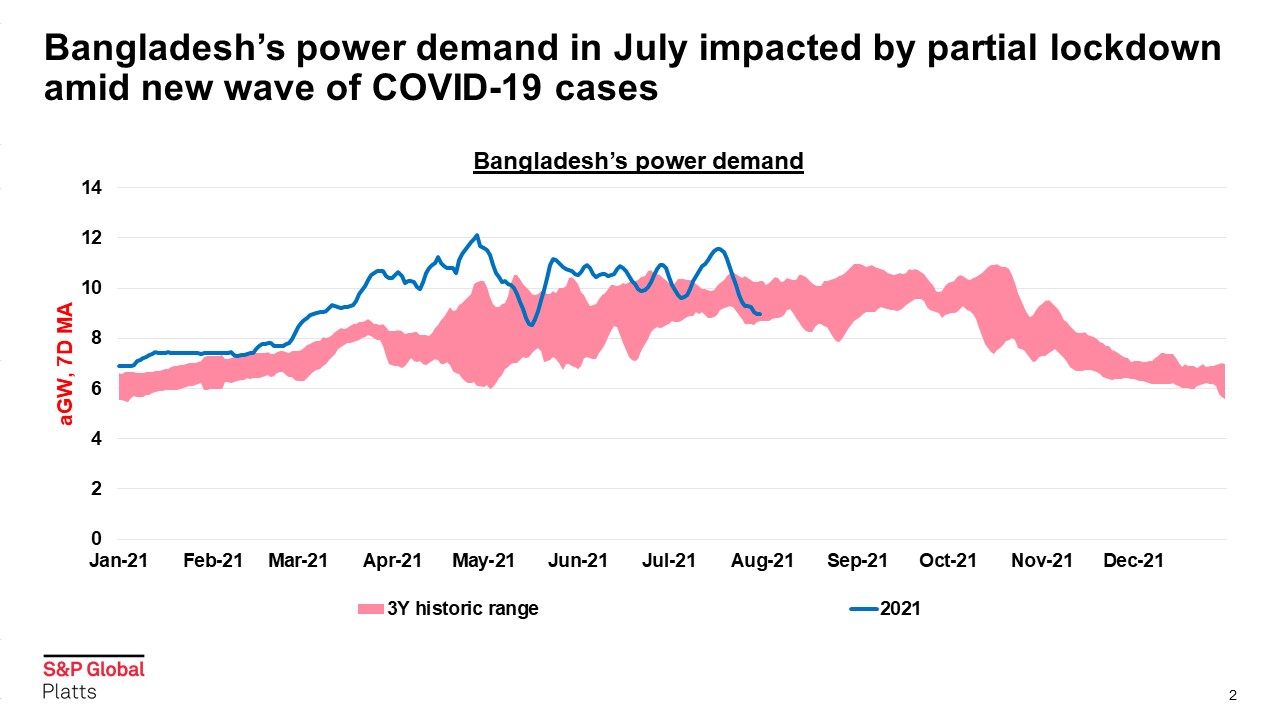

We are expecting countries in South Asia to take advantage of the situation and switch some volumes from imported spot LNG to oil for power generation. Both Bangladesh and Pakistan import LNG and have fairly large fleets of unused oil-fired power plants. We see a combined switching potential of four to five LNG cargoes per month. We assume initial switching will start in September and reach full potential by the end of the year. The volume to be switched also depends on top-line power demand, so we are watching the situation closely for both countries, which are currently under partial lockdown due to COVID-19.

Besides the large potential in Japan, as noted in our recent spotlight (link), we anticipate limited switching for other large power markets in Asia. South Korea only has about 2 GW of oil-fired capacity, and there is very little capacity installed in both China and India.

Bangladesh

Bangladesh has 7.5 GW of oil-fired power plant capacity, and is currently using about 2.5 GW. Gas generation is around 6 GW. For July, LNG imports were 20 million cu m/day, long-term LNG contracts account for 17 million cu m/d, so spot was only about 3 million cu m/d. We think the spot volume will be switched to oil, which is only about 0.6 GW.

Over the last few years the Bangladesh government has been very vocal in saying it wants to move power generation from oil to gas, but it is currently contemplating renewing leases for several oil-fired power plants, which leases are expiring, suggesting it wants to keep its options open.

Pakistan

Pakistan has about 7.5 GW of oil-fired power plant capacity, and we believe they are currently using 1.5 GW (data is delayed by a couple of months). Gas generation should be around 6.5 GW. For July, LNG imports were 34 million cu m/d and long-term LNG contracts account for 30 million cu m/d. So, again there is just a small portion of spot of about 4 million cu m/d, which is equivalent to around 0.8 GW.

However, Pakistan just bought some spot cargoes, so the spot need is likely higher at around 10 million cu m/d. After the recent purchases, a string of articles were posted in the local press, effectively putting the heat on the government for buying spot LNG at high prices.

Source: Platts