Australian and India GDP reports

Australia and India are among the last Asian economies to release their 2Q21 GDP performance next week.

Like elsewhere in the region, both economies should post big year-on-year GDP bounces – we forecast 9.4% YoY for Australia and 17.1% YoY for India, up from 1.1% and 1.6% respectively in 1Q21.

However, large year-on-year growth rates mask the underlying weakness caused by the latest Covid-19 outbreak. Maybe not so much in Australia, but certainly in India, where the second wave of the outbreak spread over most of the second quarter and was far deadlier than the last year. Underlying our forecast of a 17.1% YoY jump in India’s GDP is the expectation of -15% QoQ contraction, the steepest in Asia. The re-opening of the Indian economy should make 3Q a bit better, although the next wave of Covid-19 looks like it is already here, with the latest daily case tally already over 50,000.

Australian 2Q GDP should post reasonable growth of 0.7% QoQ, although down from 1.1% QoQ in the first quarter. But since then, Australia has gone back into lockdowns, so it tells us nothing about 3Q, and the third quarter is likely to revert to a contraction. With the Reserve Bank of Australia still on the sidelines as far as any policy changes are concerned, this should not have much market impact.

Chinese economy loses steam

Monthly activity indicators will steal the focus away from GDP data and help gauge the impact of the delta variant on regional economies over the rest of the year, while we should also get further evidence that China’s economy is losing steam.

China’s manufacturing PMI for August will reflect the impact of the latest Covid-19 cases which resulted in closures at marine ports and airports, with knock-on effects to trade and industry as well as tourism and leisure. The rapid spread of the Delta variant globally could also hurt overseas demand for Chinese goods – watch out for China’s export orders PMI component for any evidence of this. Adding to these woes are sustained shortages of semiconductor chips. The non-manufacturing PMI will capture the impact on domestic services including travel, leisure activity and cross-province duty-free shopping.

The growing headwind has prompted the latest downgrade of our 2021 growth outlook for the Chinese economy to 8.9% from 9.2% (here is more on that).

Delta dulls the outlook for rest of Asia too

Elsewhere, July industrial production and August export data for Korea will set the scene for other countries around the region.

We suspect it is becoming harder for production to push higher given capacity constraints, which could also be reflected on the trade side, where faster import growth could exceed export growth and further compress the surplus. Something similar may be evident in the Australian trade figures but could be distorted by the latest lockdowns.

Meanwhile, inflation in the regional economies continued to retrace its recent spikes. Korean inflation for August is likely to show some moderation and may temper thoughts for a succession of Bank of Korea rate hike that some suggest. In Indonesia, the supply bottlenecks due to the latest wave of the pandemic may lead to a slight pickup in inflation in August, but depressed demand due to tighter movement controls likely kept the overall reading at 1.6%, below the central bank’s target.

Thailand’s forthcoming manufacturing and balance of payments figures for July may dent this week’s market exuberance on the Thai baht on news that the authorities are preparing to live with the virus and potentially reopen borders for vaccinated tourists. A sharply narrower customs-basis trade surplus in July signalled a further widening of the current account deficit last month – not a good message for THB bulls.

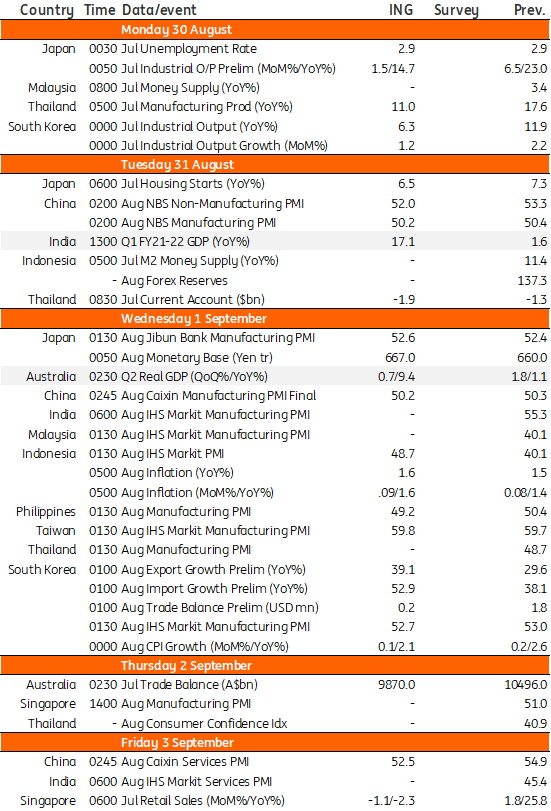

Asia Economic Calendar

Source: ING

Source: ING