The recent incident to “mega” container vessel, Ever Given in the Suez Canal highlighted the impact one break in the supply chain can mean to global trade. The Ever Given’s 20,388 TEU (20-foot equivalent unit) capacity and cargo remains anchored in the Canal at the aptly named Great Bitter Lake. With insurers staring at a jaw-dropping $900m compensation claim and shippers looking at slot availability amidst surging freight rates, the aftermath may have consequences for both the container and insurance industry that extend far beyond the 205m width of this critical shipping route. This article looks at the container fleet development, what it’s meant for trade, notably the relationship with the Suez Canal, and considers how long the advance in size will continue and if ‘big’ will remain beautiful.

Mega Containership Fleet Development

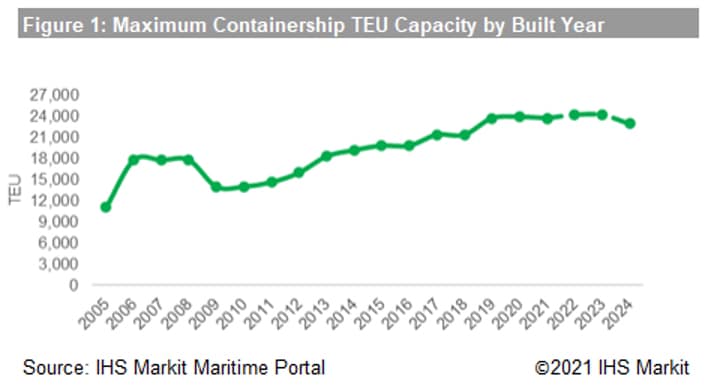

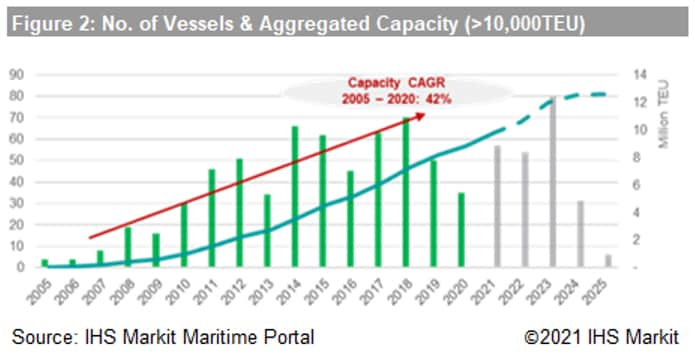

Regardless of the issues of perennial overcapacity and a wary insurance community fearing the worst (those fears are now home to roost), as IHS Markit’s maritime portal figures show, the punctuated leaps in vessel size and the growth of the container fleet overall have been nothing short of remarkable.

To put this into perspective, in 2005 the container fleet in total was under 2,000 vessels, the largest vessel capacity was 11,078 TEU with a Deadweight (dwt) value of 115,700 tonnes. By close of 2020 it had rocketed to 5,234 vessels, with some boasting a capacity of 23,964 TEU and 232,606 dwt. This has driven overall Compound Annual Growth Rate (CAGR) by 42%, from 44K TEU in 2005 to 8.82 million TEU in 2020. Various factors have driven the growth notably economies of scale vs transportation costs, a dominant Asia Europe trade lane fuelling enough cargo, and fierce competition amongst owners. All have played into the burgeoning desire for more of what have become known as “mega” container ships.

As for the future, in the short-term there seems to be no slowing of the TEU arms race. The first vessels set to breach 24,000 TEU are projected in 2022 and significant additions to the fleet can be expected in 2023. Looking further forward to 2024 the current orderbook suggests a levelling off, but whether this is indicative of earlier phases of vessel development before the next leap forward remains to be seen. Considerations around advances in size vs cost benefit, viable infrastructure, plus factors like IMO 2020 regulation, are all playing into the decision-making process now for owners too. The container fleet is estimated to be responsible for 30% of shipping emissions but some owners are taking measures with new mega vessel orders, for example Hapag Lloyd’s recent 24,000 TEU vessel orders boasting LNG / dual fuel capability.

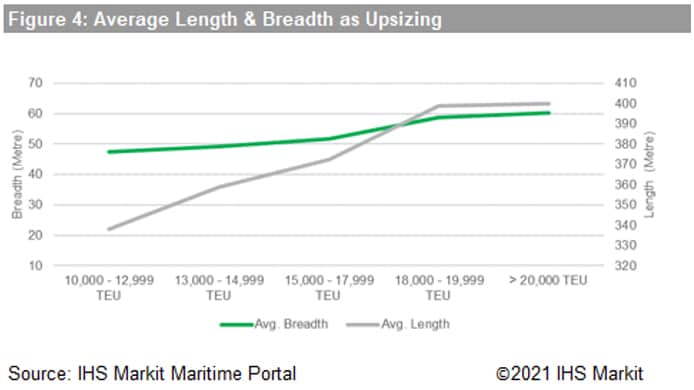

Vessel growth has meant dimensions have also expanded rapidly since 2005 to accommodate capacity, but the correlation with rising capacity vs length and breadth hasn’t been a simple upward curve. As analysis shows, the correlation started to level off at the point vessels reached 18,000 TEU (in effect since the arrival of Maersk’s triple E class vessels in 2013). Taking the next step on those dimensions may well have implications for larger vessel orders. As for operational implications, considering the Ever Given incident and Suez Canal accommodation, the Canal authority requires vessels over 400m in length to receive assistance, and Ever Given dimensions pushed that to the limit with a length overall of 399.944m. By way of comparison the largest container vessel currently in service by TEU is HMM Le Havre, built in August 2020, and boasting a TEU capacity of 23,964, a dwt of 232,000, though “only” a length overall of 399.900m.

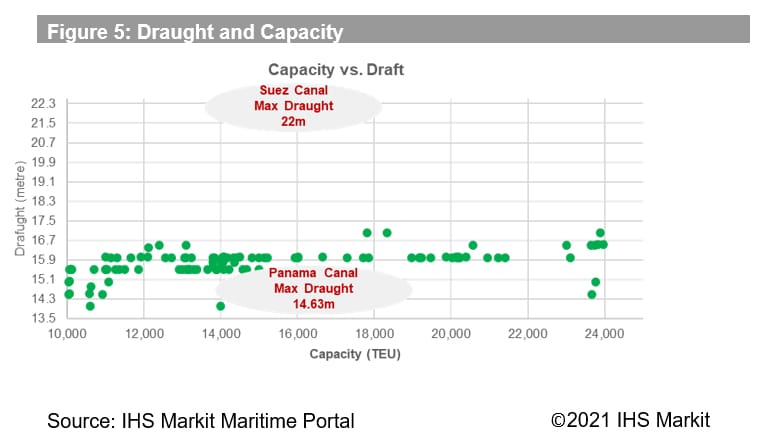

If we look at capacity and the impact on draught for example, (maximum draught in metres to summer load line), as per figure 5 the minimum water depth for container vessels >10,000 TEU and >100,000dwt is 14m. For vessels >20,000 TEU, notably the aforementioned HMM Le Havre, this rises to 16.5m. Larger vessels have naturally driven developments in port infrastructure and handling facilities, notably to ensure deep-water container port availability, plus investment in the required dredging in estuaries and rivers. In addition, key waterways such as Suez (see below), Malacca and Panama have all had to develop to accommodate size demands.

Voyage areas of Very Large Mega Containerships

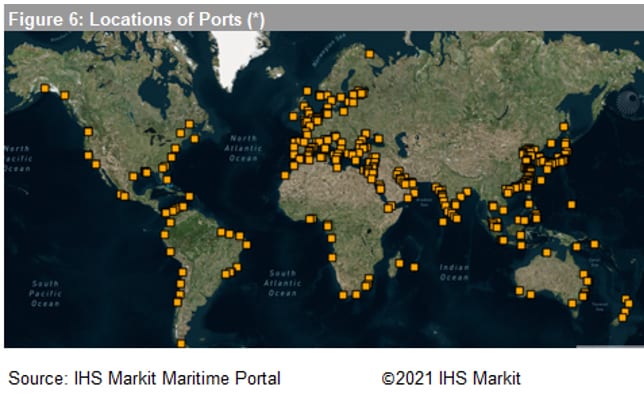

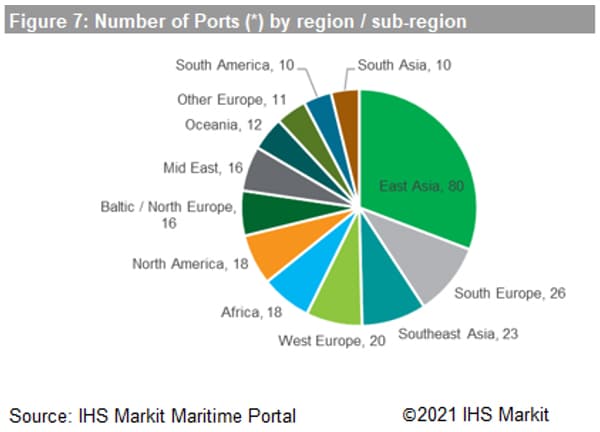

There are distinct concentrations of ports able to handle vessels at >10,000 TEU with draughts of 14m even considering that the primary Asia Europe trade routes via Suez Canal. South and East Asia, for example, are home to 40% of viable ports. This handling capability distribution becomes more acute when looking at vessels >20,000 TEU and >200,000 dwt with draughts of 16.5m notably aligned with the Suez Canal enabling much shorter voyage times vs alternative routes around the Cape. As a case in point, due to the Ever Given incident one vessel that took the Cape route thereby adding a week to the journey time, was sister vessel Ever Greet.

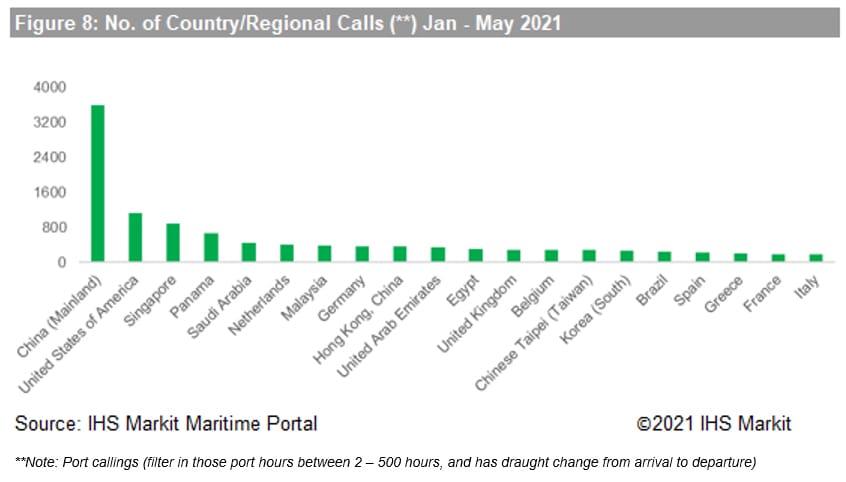

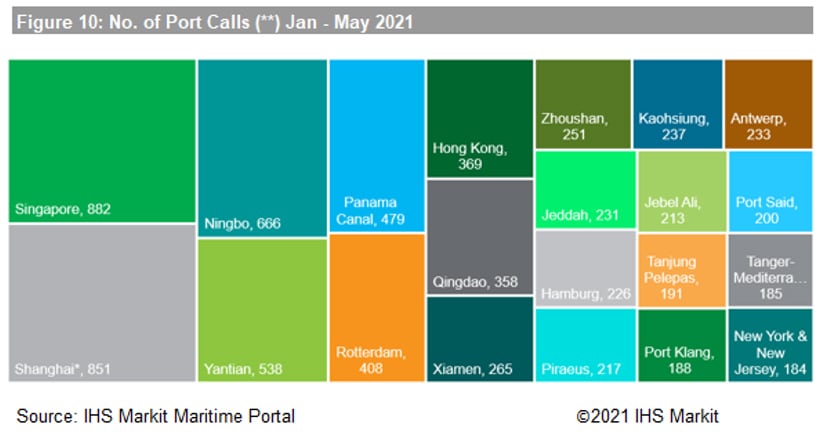

Looking at data from the last six months, callings are concentrated in China, USA, EU (all member states) and Singapore, reflecting the largest economies and busiest routes in terms of containerised trade globally.

At the port level, Singapore tops the list with 882 port calls by vessels >10,000 TEU, followed by Shanghai (*incl. Yangshan) and Ningbo. As expected, of the top 20 ports on the list, the majority are situated along the Eurasia and Transpacific trade routes. As data from IHS Markit Global Trade Atlas shows, as a regional and even global trans-shipment hub, a large portion of Singapore’s export trade is due to re-exports owing to its transport connectivity advantage.

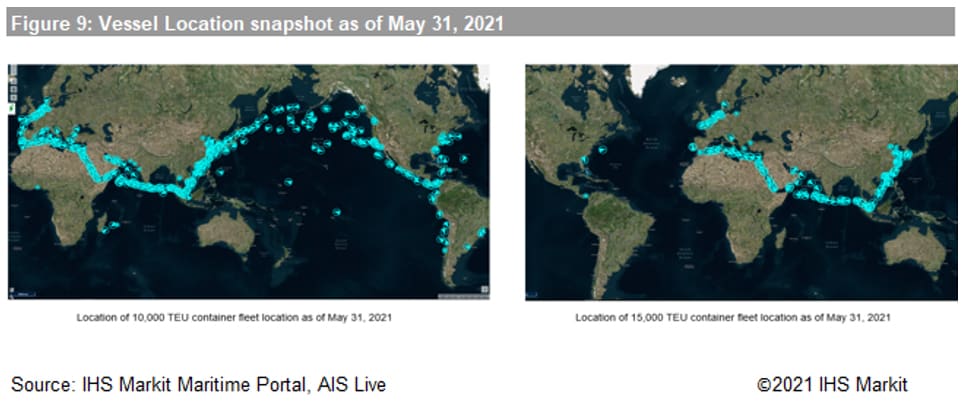

The port call statistics are also clear if we look at a snapshot of fleet positions as of May 31, 2021, both for containerships >10,000 TEU and then >15,000 TEU. The density is obvious on the Eurasia trade lane passing through Suez, notably considering cost implications for alternative routes via The Cape.

The respective calling destinations reflect the trade deployment driven by demand.

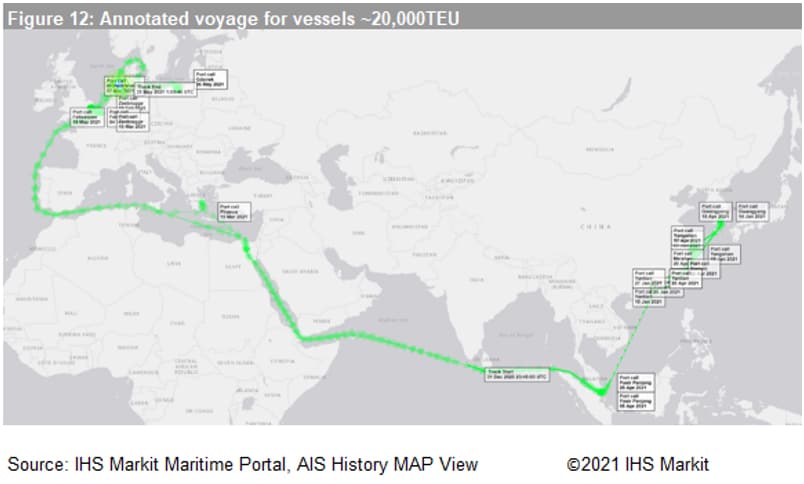

A typical 20,000 TEU vessel’s voyage on Eurasia route

To further understand the mutual benefit with vessel size and trade we can follow the voyage of a typical ~20,000 TEU containership. Taking a typical vessel voyage in 2021, a journey from and to Poland starting in February took 85 days. For a hypothetical weekly container service, that would mean 12 similar size ships deployed to maintain the sailing schedule assuming no delays.

Of note and considering the draughts above, no values registered a 16m threshold. Few, if any, ports can handle vessels of this size fully loaded and these averages suggests that vessel utilisation was (and is) around 80 – 85%.

Mega vessels and Suez Canal accomodation

The Canal has done much to facilitate larger container vessels (and vessels of all types) and of course containerised trade. In 2010 canal expansion increased draught capacity from 20m to 22m (Canal figures state 66ft) so that even accounting for tidal ranges of 1.9m in the South, it was able to accommodate 100% of container vessels. Eleven years later that’s still the case. Whilst the 2010 expansion also increased dwt limits from 210,000dwt to 240,000dwt, since 2010 dwt values have rapidly caught up with canal accommodation. Assessing the 2022 orderbook in particular two vessels under construction, Shanghai Jianghai ChangxingH1858A andJiangnan H2630, are noteworthy as they have a reported 241,000 dwt, in effect beyond the canal’s stated capacity.

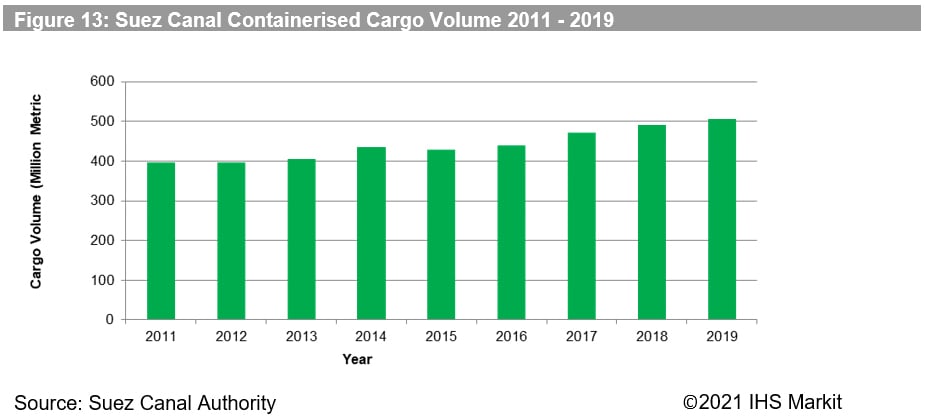

Since the 2010 expansion overall cargo volumes transiting the canal have risen steadily from 692 million tonnes to 1,031 million tonnes. Containerised cargo volumes have accounted for much of that growth as shown below in figure 12. Marked gains from 2017 align with the arrival of the mega vessels >20,000TEU and containerised cargo alone accounted for 49% of total volume by 2019.

Whilst cargo volume and the vessels have got larger conversely the total number of container vessels using the Canal has dropped significantly. According to canal statistics container vessels have dropped from a 40% volume share by type in 2011 to 28% in 2019. That share has mainly been taken by tankers (19% in 2011 rising to 27% in 2019) and bulk carriers (14.5% in 2011 rising to 22% in 2019).

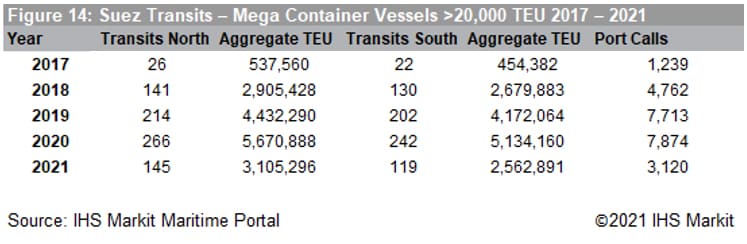

The relation with mega vessels shows no signs of slowing though, quite the reverse. The first mega container vessel >20,000 TEU to transit Suez (northbound) in May 2017 was MOL Triumph, a suitable name. A moot point perhaps but Ever Given first transited the canal in October 2018 and completed 21 transits up to the incident. Since 2017, the volume of vessel transits and port calls have risen quickly and whilst the overall volume for container vessels has declined, even factoring in COVID-19, transits N and S in 2020 were up 22% on 2019 for this size class.

As for 2021, normalising data and projecting forward that will go well past 300 transits N (and close S). To date 82 of the 85 largest container vessels in service have used the canal, a combined TEU capacity of 1.7m accounting for 7.2% of total TEU.

Risk reward

The Ever Given wasn’t the first mega vessel to ground in the canal. The dubious honour of the first “mega grounding” goes to vessel OOCL Japan, 21,413 TEU and dwt 191,640, October 2017, just months after MOL Triumph’s transit. Fortunately, this was a non-serious incident and IHS Markit recorded that the vessel was quickly refloated within 2 hours with tug assistance and continued its voyage. One can only speculate what the fall out would have been four years ago if the vessel had suffered a similar fate to Ever Given, though the insurance industry had been considering possible $1bn losses involving mega vessels as far back as 2015 (see Allianz – Safety and Shipping Review, March 2015).

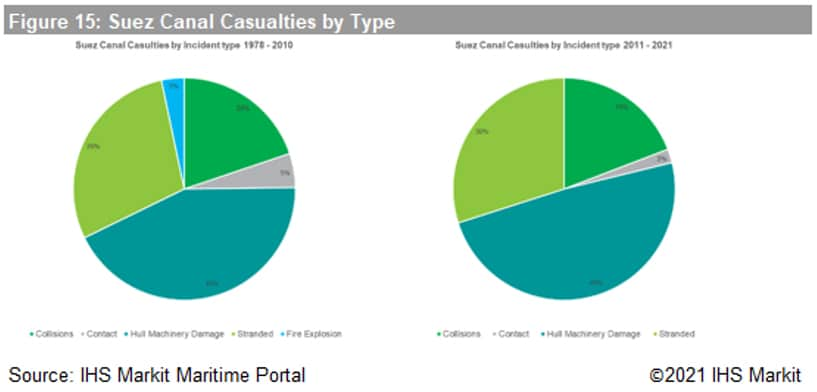

Since 1978 IHS Markit casualty records show a very low number of total incidents to container vessels in the canal, 22 in total. By comparison the two other primary cargo types, bulk carriers and tankers, have recorded 147 incidents in total.

Looking at the reports for the periods pre and post 2010 Canal expansion, pre 2010 there were only 7 recorded container vessel incidents, four of them involved in a “stranding” (i.e. grounding or machinery damage requiring refloating or towage assistance). Comparing again to bulk carriers and tankers, between 1978 and 2010, IHS Markit recorded 121 canal incidents in total, of which 28 involved strandings, all non-serious. Post-2010, whilst there have been far fewer incidents, only 26 recorded, of the six which have involved strandings, three have been serious incidents.

Post 2010 expansion there have been a total of 15 recorded container vessel incidents, 12 of which were strandings with 11 recorded since 2017 (i.e. since the arrival of vessels >20,000 TEU), and of those 7 incidents were deemed serious, including of course Ever Given. Black swan event or whatever the label of choice, this particular incident has certainly highlighted the simple fact that with dwt and dimension values now approaching maximum canal accommodation, the margins for error, human or mechanical, are getting smaller and smaller.

Mega Vessels – Maritime and Trade Outlook

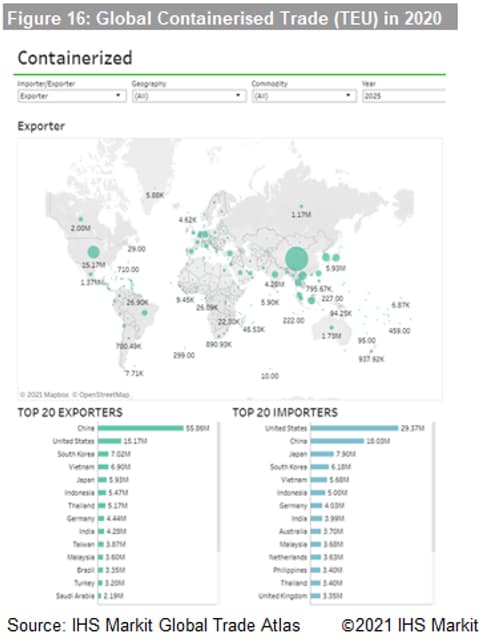

Will big remain beautiful? The answer is highly likely, at least in the short-term. Assessing demand, according to latest IHS Markit Global Trade Atlas Forecasts, estimated seaborne containerised trade (TEU volume) indicates that global container trade could reach 174 million TEU in 2025, and 232 million TEU by 2035. Whilst these forecasts should be treated with caution, especially in a VUCA environment, what is clear is that the mega vessels are being built to facilitate any rise in demand. Looking at the top exporters and importers, trade between Asia, Europe and The United States will lead that demand, so associate port handling and performance capability will also be key.

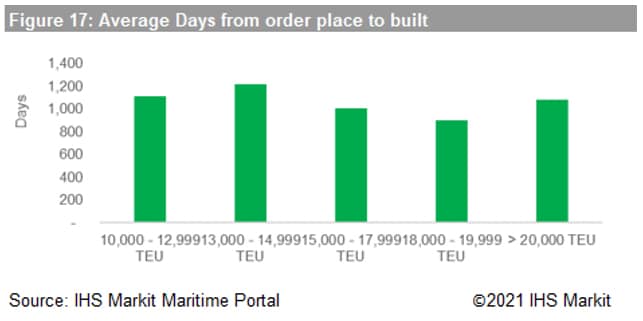

Finally, considering the orderbook and fleet development, analysis shows the average period of new building to delivery is three years for any vessel >10,000 TEU and slightly longer at 14,000 TEU. Considering demand decision making now, cost benefit and, Ever Given aside, relatively low operational risk, the mega vessels are still hugely attractive.

What the orderbook will yield post-2024 and whether steps will be taken to drive the next leap forward in vessel size continues to be closely monitored.

Source: IHS Markit