NASDAQ-Adv: 792 Dec: 3,720 NYSE-Adv: 659 Dec: 3,549(Source: Nasdaq)

NASDAQ-Adv: 792 Dec: 3,720 NYSE-Adv: 659 Dec: 3,549(Source: Nasdaq)

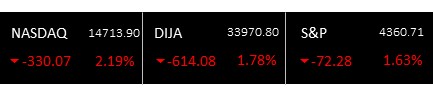

U.S. stocks fell on Monday, with the Nasdaq down more than 3%, as worries mounted over the pace of economic growth and a possible spillover from China Evergrande’s troubles.

Investors were also nervous ahead of the Federal Reserve’s policy meeting this week.

Microsoft Corp, Google-owner Alphabet Inc, Amazon.com Inc, Apple Inc, Facebook Inc and Tesla Inc were among the biggest drags on the S&P 500.

But all of the 11 major S&P 500 sectors were lower, with economically sensitive groups like energy down the most.

The banking sub-index shed more than 4%, tracking U.S. Treasury yields as worries about the default of Evergrande appeared to affect the broader market.

The S&P 500 is down about 4.8% from its intra-day record high hit on Sept. 2 and is on track to snap a seven-month winning streak.

“Today, the market is down because of the Chinese real estate contagion threat, despite a lot of good headlines recently on COVID,” said Jake Dollarhide, CEO of Longbow Asset Management in Tulsa, Oklahoma.

“We’re due for a correction,” he said. “It’s like the market is addicted to buying the dip. Every time it goes down 5% or 6%, all this liquidity jumps in to prop us back up.”

Wednesday will bring the results of the Fed’s policy meeting, where the central bank is expected to lay the groundwork for a tapering, although the consensus is for an actual announcement to be delayed until the November or December meetings.

The Dow Jones Industrial Average fell 900.25 points, or 2.6%, to 33,684.63, the S&P 500 lost 117.85 points, or 2.66%, to 4,315.14 and the Nasdaq Composite dropped 477.75 points, or 3.18%, to 14,566.22.

As of Monday afternoon, just over half of the stocks in the S&P 500 were down 10% or more from their 52-week highs, including 93 stocks down more than 20%, according to Refinitiv data.

Strategists at Morgan Stanley said they expected a 10% correction in the S&P 500 as the Fed starts to unwind its monetary support, adding that signs of stalling economic growth could deepen it to 20%.

The CBOE volatility index, known as Wall Street’s fear gauge, hit its highest level in over four months.

Most airline carriers were down just slightly after the United States announced it will relax travel restrictions in November on passengers from China, India, Britain and many other European countries who have received COVID-19 vaccines.

Declining issues outnumbered advancing ones on the NYSE by a 8.68-to-1 ratio; on Nasdaq, a 6.04-to-1 ratio favored decliners.

The S&P 500 posted no new 52-week highs and three new lows; the Nasdaq Composite recorded 20 new highs and 178 new lows.

Source: Reuters (Reporting by Caroline Valetkevitch in New York and Devik Jain and Sagarika Jaisinghani in Bengaluru; additional reporting by Noel Randewich in San Francisco; Editing by Sriraj Kalluvila and Lisa Shumaker)