Despite the recent downturns in the sub-continent markets, which have seen prices correct by as much as USD 25/Ton of late, levels still remain at historically impressive highs across the sub-continent markets.

Not since the glory days of 2008 have we seen prices so high (when the USD 800/LDT mark was breached). Notwithstanding, levels in the mid USD 600s/LDT are still very impressive and are certainly the highest we have seen for nearly 12 years now. Yet, despite the pessimism from End Buyers, there is a permeating impression from some of the industry players that levels are here to stay through Q4!

Meanwhile, steel plate prices across the sub-continent remain volatile and have depreciated across the board. In India, plate prices fell mid-week, only to recover a little by the time the week ended. The Pakistani market also played itself out like India, with steel dipping momentarily through the week.

In Bangladesh however, the story was different as levels declined and stayed down throughout the week. On the contrary in the West, the Turkish market remained steady, with local steel plate prices firming marginally, and interest on units persevering.

As the end of the year dawns and despite the jerky movement in plate prices, there seems little to suggest that the market would see an imminent collapse in price, despite End Buyers generally being more tentative with their offers of late. Yet, no one really knows.

Covid-19 of course remains an ever-present concern, and particularly for the Far Eastern market, where deliveries are being thwarted by the ongoing spread of the Delta variant.

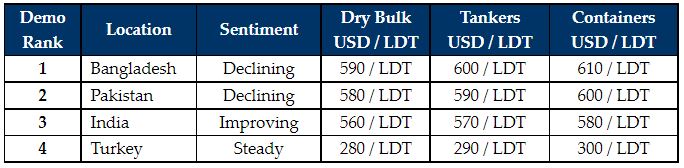

For week 38 of 2021, GMS demo rankings / pricing for the week are as below.

Source: GMS,Inc.