Global active equity funds have seen higher inflows this year, bolstered by a surge in equities and higher participation of retail investors, who aim for higher returns than the benchmark indexes.

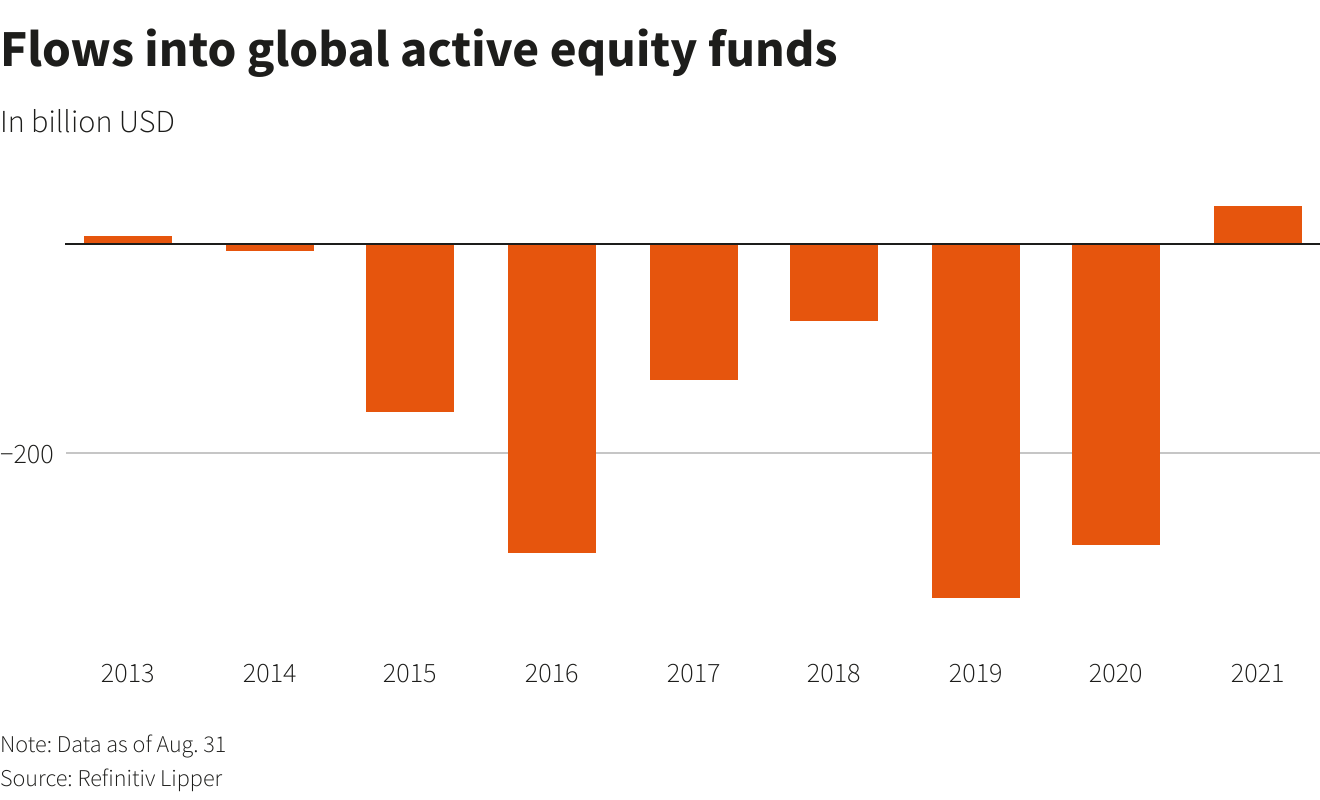

According to Refinitiv data, global active equity funds have attracted a total $36.6 billion in the first eight months of this year, after seeing outflows in the previous seven years.

Graphic: Flows into global active equity funds:

European active equity funds led the inflows, obtaining $155.1 billion, while Asian funds saw $41.7 billion.

U.S. active equity funds witnessed outflows of $191 billion, however, the outflow was 32% less than in 2020.

“The inflows broadly appear to be related to portfolio rebalancing and investors’ seeking active managers who can dynamically adjust to an ever shifting environment,” said Russ Ivinjack, senior partner at investment consultant Aon.

“We expect flows to active strategies to continue to be strong as most investors have a full allotment to indexing and require the additional return potential that active management offers in less efficient markets.”

Flows into active funds have lagged in the past few years due to their higher fees and a lacklustre performance over passively managed funds.

Active equity funds have delivered a return of 13.8% this year, lower than the passive equity funds’ gain of 14%.

“The market is rife with alpha opportunity where the dispersion between the best and worst performing stock quintiles has trended well above average for over a year,” said BofA in a note this month.

Retail trading levels have increased since the beginning of the year, helped by the frenzy of buying in stocks such as GameStop Corp.

However, their inclusion in indexes happens much later and hence investors in passive funds have to forego those initial gains, analysts said.

GameStop Corp has risen 988% this year, against the S&P 500 index’s gain of 18%.

“GameStop was a part of the S&P SmallCap 600, but it was after the stock gained some 10-fold in 2021 that it was added to the S&P MidCap 400 index,” said Kunal Sawhney, chief executive officer at independent research firm Kalkine.

“The point is indices rely on how any particular stock is trading in the market, and any addition or replacement in the index is based on stock performance.”

Source: Reuters (Reporting by Patturaja Murugaboopathy; Additional Reporting by Gaurav Dogra in Bengaluru; Editing by Alison Williams)