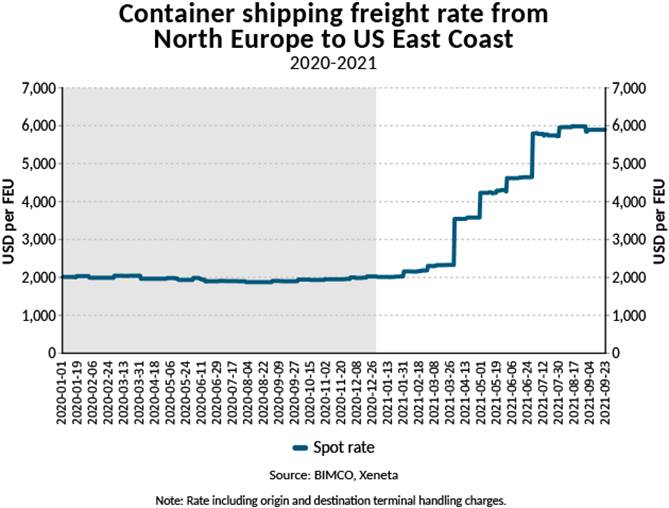

For almost three months now, the spot freight rate for containerised goods shipped by sea from North Europe to the US East Coast has been 210% higher than last year (1 July – 23 Sept).

It wasn’t until 1 April 2021 that we saw the ripple effects from the globally stretched supply chains impacting front-haul freight rates on the Transatlantic container shipping trade lane. At that time, spot freight rates for a 40-foot container jumped 52% from USD 2,329 to USD 3,544 on average for the trade lane. The Transatlantic average spot rates continued to climb, reaching USD 5,798 per FEU on 1 July before flatlining just south of USD 6,000 reaching USD 5,893 per FEU on 23 September 2021.

Description automatically generated“In addition to the ripple effects from stretched global supply chains, strong demand from US consumers also contributed to the hike in spot rates on this trade,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

“Imports to North America from Europe have increased by little more than 500,000 TEU from last year and liner operators have responded by deploying significantly more capacity on that trade,” Sand says.

Demand and deployed capacity sharply up

During the first seven months of 2021, 3,292,000 loaded TEUs were moved from Europe to North America (source: CTS). That’s 500,000 TEU more than the same period last year, representing a growth rate of 18.5%. Comparing 2021 to the pre-pandemic year of 2019, growth is up by 14.5% as demand only fell 7.5% from 2019 to 2020.

In a bid to match container shipping capacity to the higher demand, liner companies added 21.4% of cargo carrying capacity in the 12 months from 1 July 2020 to 1 July 2021.

Source: BIMCO, By Peter Sand, BIMCO’s Chief Shipping Analyst