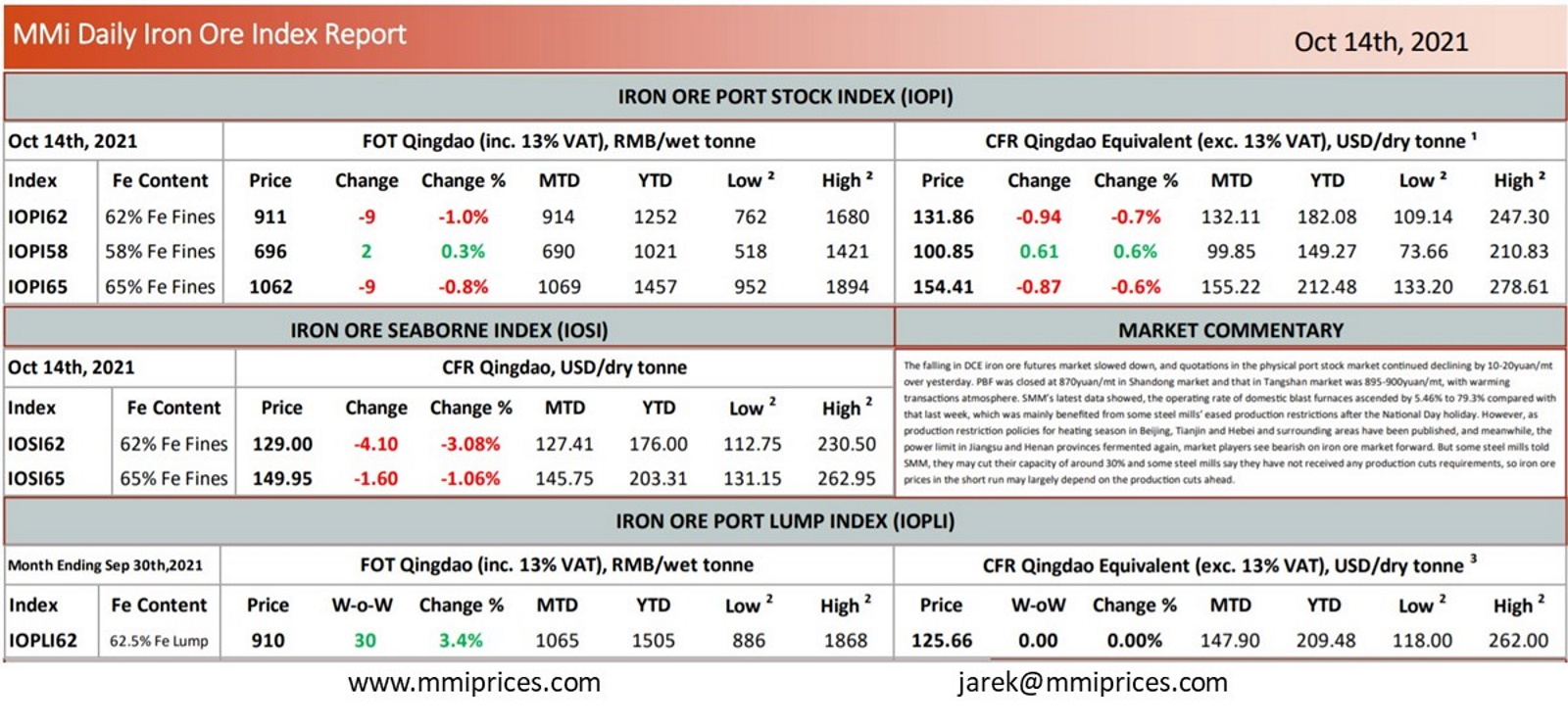

The falling in DCE iron ore futures market slowed down, and quotations in the physical port stock market continued declining by 1

0-20yuan/mt over yesterday. PBF was closed at 870yuan/mt in Shandong market and that in Tangshan market was 895-900yuan/mt, with warming transactions atmosphere. SMM’s latest data showed, the operating rate of domestic blast furnaces ascended by 5.46% to 79.3% compared with that last week, which was mainly benefited from some steel mills’ eased production restrictions after the National Day holiday. However, as production restriction policies for heating season in Beijing, Tianjin and Hebei and surrounding areas have been published, and meanwhile, the power limit in Jiangsu and Henan provinces fermented again, market players see bearish on iron ore market forward. But some steel mills told SMM, they may cut their capacity of around 30% and some steel mills say they have not received any production cuts requirements, so iron ore prices in the short run may largely depend on the production cuts ahead.

Source: Metals Market Index (MMi)