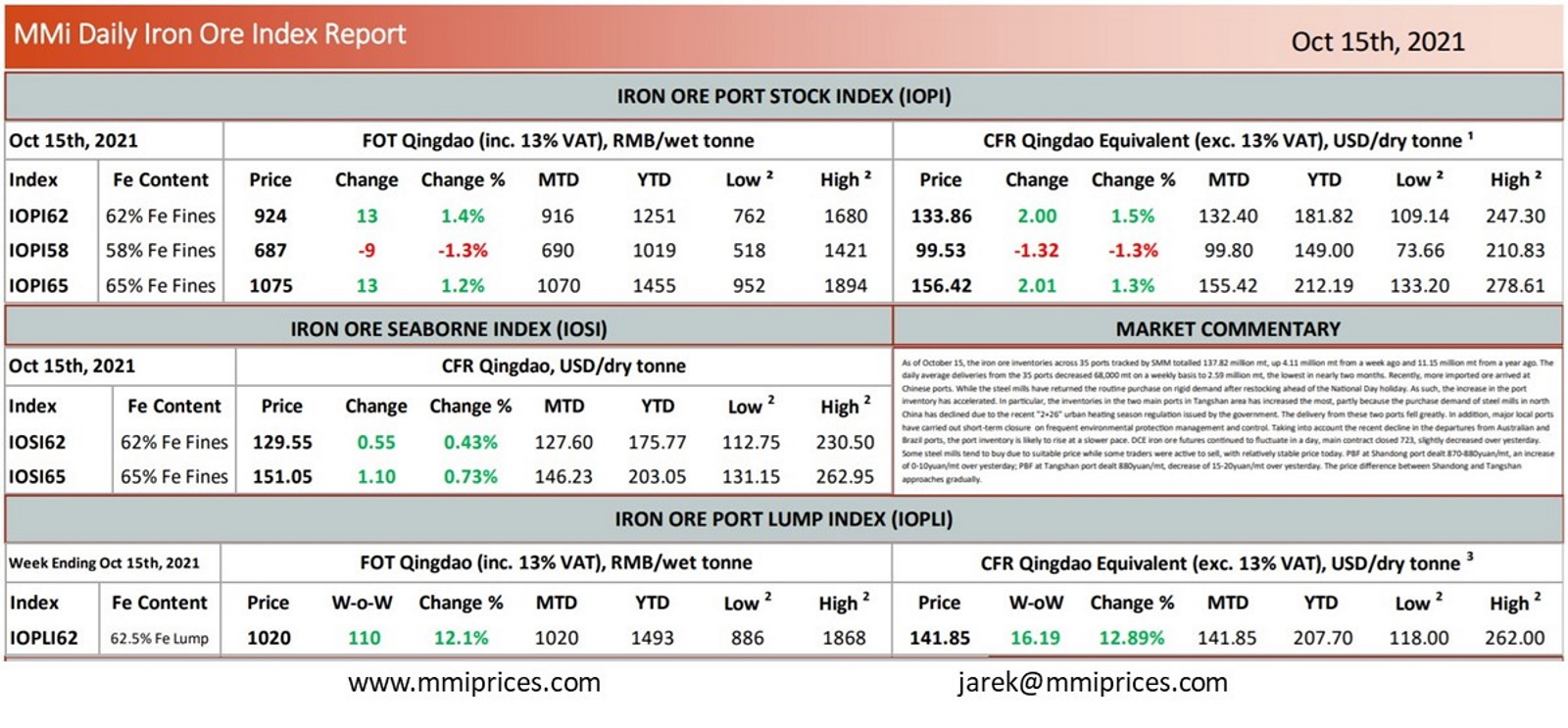

As of October 15, the iron ore inventories across 35 ports tracked by SMM totalled 137.82 million mt, up 4.11 million mt from a week ago and 11.15 million mt from a year ago. The daily average deliveries from the 35 ports decreased 68,000 mt on a weekly basis to 2.59 million mt, the lowest in nearly two months. Recently, more imported ore arrived at Chinese ports. While the steel mills have returned the routine purchase on rigid demand after restocking ahead of the National Day holiday. As such, the increase in the port inventory has accelerated. In particular, the inventories in the two main ports in Tangshan area has increased the most, partly because the purchase demand of steel mills in north China has declined due to the recent “2+26” urban heating season regulation issued by the government. The delivery from these two ports fell greatly. In addition, major local ports have carried out short-term closure on frequent environmental protection management and control. Taking into account the recent decline in the departures from Australian and Brazil ports, the port inventory is likely to rise at a slower pace. DCE iron ore futures continued to fluctuate in a day, main contract closed 723, slightly decreased over yesterday. Some steel mills tend to buy due to suitable price while some traders were active to sell, with relatively stable price today. PBF at Shandong port dealt 870-880yuan/mt, an increase of 0-10yuan/mt over yesterday; PBF at Tangshan port dealt 880yuan/mt, decrease of 15-20yuan/mt over yesterday. The price difference between Shandong and Tangshan approaches gradually.

Source: Metals Market Index (MMi)