[ad_1]

The container and dry bulk shipping industries are breaking new records left, right and centre it appears, resulting in dry bulk owners enjoying unseasonably high profits, and container shipping carriers and tonnage providers delivering record high profits.

The container and dry bulk shipping industries are breaking new records left, right and centre it appears, resulting in dry bulk owners enjoying unseasonably high profits, and container shipping carriers and tonnage providers delivering record high profits.

In this piece, BIMCO will take a look at some of the current records broken in the shipping industry world-wide.

Pandemic fallout has strengthened Asian dominance

The swift recovery from the pandemic in China has seen its dry bulk imports rise to their highest levels ever, boosted by infrastructure heavy stimulus and high grains demand, causing a spike in the appetite for many dry bulk imports which have reached their highest levels ever.

This is certainly true for iron ore, of which 471.8m tonnes (source: GACC) have been imported in the first five months of the year, a 26.5m tonne increase from the start of 2020. It is also 24.4m tonnes higher than the previous record for the first five months of the year which was set in 2019 when imports totaled 447.4m tonnes.

China’s record high demand for iron ore is fuelled by the country’s record high steel output and prices, which reached 97.9m tonnes in April (source: NBS China). In the first four months of the year, Chinese steel mills have pumped out 374.6m tonnes of steel, a 15.8% increase from the same period in 2020, despite talk from the government about curbing annual production with the aim of reducing pollution.

High steel production in China is part of the wider picture with industrial production and manufacturing performing strongly at the start of the year, boosting exports as goods hungry consumers in the developed world, and especially in the US, are buying Chinese produced goods.

Getting to Europe is more expensive and unreliable than ever before

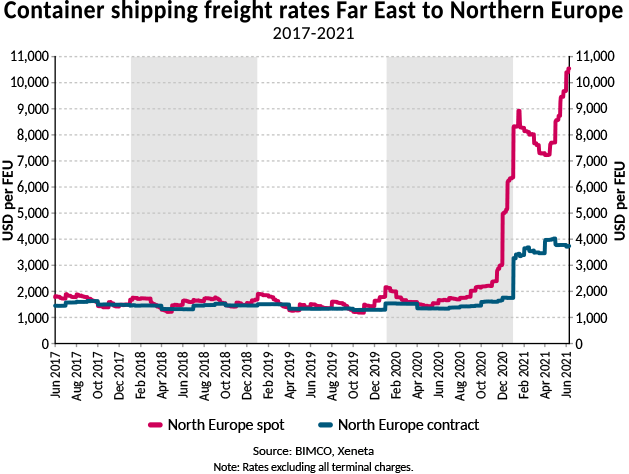

Although the strongest growth in exports from Asia derives from trades to North America, the Far East to North Europe trade has also experienced higher volumes. However, even more impressive are the freight rates on this route which have breached the USD 10,000 per FEU mark for the first time ever. In fact, they stand at USD 10,544 per FEU on 8 June 2021 (source: Xeneta) and are expected to rise even further when mid-month General Rate Increases (GRIs) are announced next week.

So far this year, average Far East to North Europe freight rates have averaged USD 8,224 per FEU, towering above the USD 1,489 – USD 2,187 per FEU that spot rates averaged on an annual basis between 2017 and 2020.

This is despite volumes on this trade being up by only 1.0% in the first four months of 2021 compared to pre-pandemic 2019, an increase of just under 60,000 TEU. The wider supply chain crunch as well as the global pressure on container shipping, equipment shortages and disruptions such as the blockage of the Suez Canal and COVID-19 disruption at major Chinese ports are behind the moderate increase.

Long term contract rates have also risen to record high levels, with carriers locking in long term contracts at USD 3,836 per FEU.

Despite having to pay record high freight rates for some shippers, the bigger worry is reliability. The high demand for container shipping this year has meant more cargoes being rolled over and shippers finding it harder than ever to secure a spot for their box(es) on the desired sailing. While the shippers that are most valuable to carriers are escaping from these record high freight rates, others are paying thousands of dollars in surcharges, and even this is often not enough to secure space on already fully booked ships.

Growth slowing, but bauxite exports still record high in Africa

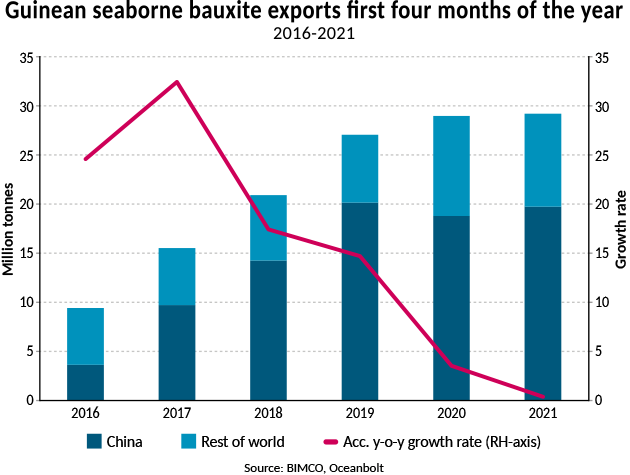

Moving south and back into dry bulk, one of Africa’s largest exports is bauxite, with Guinea alone accounting for more than half of global seaborne bauxite exports in 2020. These too have been record-high since the start of the year, reaching 29.2m tonnes in the first four months of the year, slightly up from the previous record set in the first four months of 2020 of 29.0m tonnes. So far this year, 258 journeys have been started in Guinea carrying bauxite, 141 of which are Capesize ships.

The largest buyer of Guinean bauxite is China, which has taken 19.7m tonnes, and although this is an increase from 2020, it is not record high as Guinean bauxite exports to China in the first four months of 2019 reached 20.2m tonnes.

Despite the record high volume, the growth rate so far this year is in fact the lowest it has been since this trade was established, coming in at just 0.8%. The growth rate has tapered off markedly since it peaked in 2017 when it grew by 64.8% in the first four months of that year compared with the same period in 2016.

However, the wider dry bulk industry is relatively isolated from both positive and negative developments on the dominant Guinea to China trade as the majority of the volumes are carried on purposed-built and long-term leased ships.

After a slow start; South America is exporting soya beans like never before

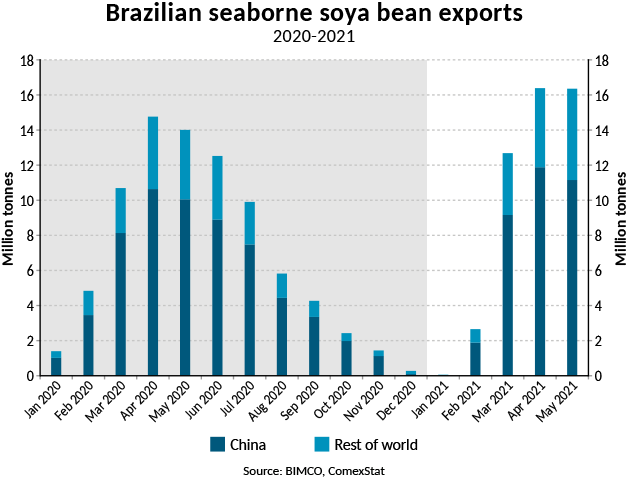

Across the South Atlantic, after a slow start to the year, Brazilian soya bean exports during April and May were the two strongest months on record. In both months, seaborne exports came in above 16.3m tonnes, compared to the previous record of 14.8m tonnes set in April 2020.

The slow start to the year means that the two months of record high imports has brought accumulated year-on-year growth in the first five months of the year up to “only” 5.3%, although at 48.1m tonnes, this is still the highest start to the year on record. Of these total exports, around 70% are sent to China, equivalent to 455 Panamax loads of 75,000 tonnes.

Many records to be found in North America, but one stands out

A record high soya bean export season can also be found in the US. When looking at this continent, one record cannot be ignored, as it is the primary driver behind the current highs of the container market.

North American container imports are up by 33.6% in the first four months of the year, reaching 10.9m TEU. This is the first time they have exceeded 10m TEU in the first third of the year. Accounting for almost 70% of total North American imports, imports from the Far East have grown by 45.0% from last year as consumer demand for goods made in the Far East has reached record highs, thanks to stay-at-home orders and government stimulus checks burning holes in consumers’ pockets.

Even adjusting for the pandemic, volumes on the Far East to North America trade are up by an impressive 31.4% from the first four months of 2019, an increase of 1.8m TEU. This means an extra 120 fully loaded 15,000 TEU ships were needed during the first four months of this year compared to demand in 2019 on this trade alone, a task not only for carriers to meet, but also for ports and hinterland connections. The latter two have proved particularly problematic in the US.

Almost 60% of the extra TEUs transported globally in the first four months of 2021 compared to the same period in 2019 have been imported by the US. The latter has seen total imports rise by 2.1m TEU, compared to the 3.6m TEU that global volumes have increased by. If you remove US imports from the picture, global growth in container volumes from 2019 falls from 6.7% to 3.3% in the first four months of the year.

Completing the round trip, record amounts of air

The combination of record high container imports and US exports still struggling to reach pre-pandemic levels, the number of empty containers being sent on the backhaul transpacific trade is growing even faster than the already impressive growth in loaded imports.

Compared to the first four months of 2019, the US West Coast has exported 62.5% more empty containers than it did last year, with 2.9m boxes being loaded onto ships, the highest ever four-month period. This is 1.8 times more than the number of loaded containers being exported. These empty boxes are being returned to Asia as fast as they can, as Asian exporters wait for them to return so that the cycle can start again.

Back to Asia to find one of the few tanker shipping records around

Unlike dry bulk and container shipping, tanker shipping made its money last year, and is still suffering the consequences of lower global oil demand. However, no trip around the shipping world is complete without tankers, and few and far between, some records can be found. In fact, back in China (the world’s largest crude oil importer) 2021 has been the strongest year for crude oil imports ever. In the first five months of this year, China imported 220.5m tonnes of crude oil (source: GACC), compared to 215.6m tonnes imported in 2020.

Although a record, the growth rate has slowed markedly from previous years when it was close to 10%. Instead, compared to the first five months of 2020, Chinese crude oil imports are up 2.3%, and as the year progresses, it is unlikely volumes will keep posting growth compared to 2020, due to the oil price war. Chinese imports of crude oil peaked in June and July 2020 above 50m tonnes per month, but volumes this year are unlikely to reach those levels.

Source: BIMCO, By Peter Sand, Chief Shipping Analyst

[ad_2]

This article has been posted as is from Source