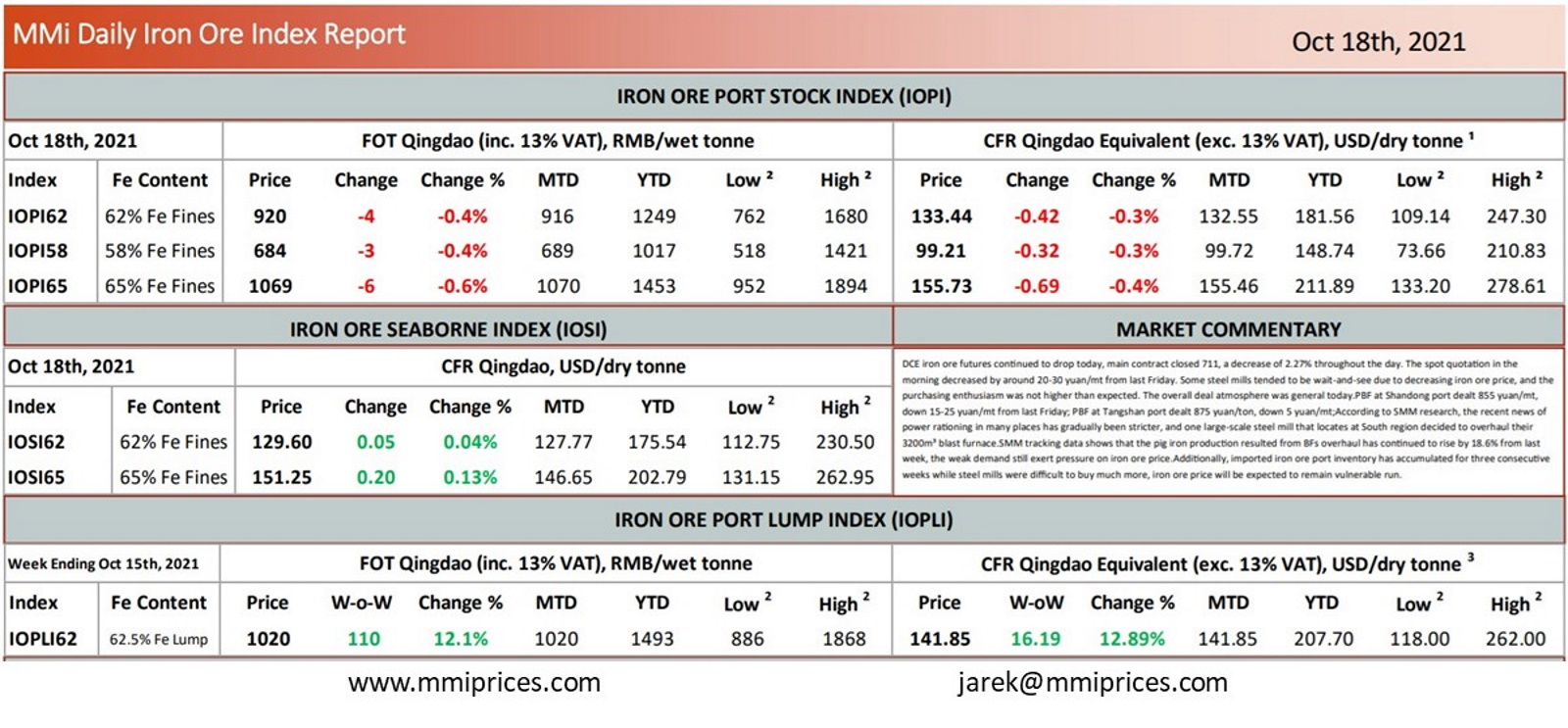

DCE iron ore futures continued to drop today, main contract closed 711, a decrease of 2.27% throughout the day. The spot quotation in the morning decreased by around 20-30 yuan/mt from last Friday. Some steel mills tended to be wait-and-see due to decreasing iron ore price, and the purchasing enthusiasm was not higher than expected. The overall deal atmosphere was general today.PBF at Shandong port dealt 855 yuan/mt, down 15-25 yuan/mt from last Friday; PBF at Tangshan port dealt 875 yuan/ton, down 5 yuan/mt;According to SMM research, the recent news of power rationing in many places has gradually been stricter, and one large-scale steel mill that locates at South region decided to overhaul their 3200m³ blast furnace.SMM tracking data shows that the pig iron production resulted from BFs overhaul has continued to rise by 18.6% from last week, the weak demand still exert pressure on iron ore price.Additionally, imported iron ore port inventory has accumulated for three consecutive weeks while steel mills were difficult to buy much more, iron ore price will be expected to remain vulnerable run.

Source: Metals Market Index (MMi)