In the late 17th Century, the English philosopher John Locke wrote one of the earliest descriptions of the economic principle that supposedly still drives commodity markets today. According to Locke, the law of supply and demand defines the relationship between the price of a given product and the willingness of people to either buy or sell it. Generally, as the price of a commodity increases, supply will rise and demand will decline. The equilibrium price at which supply and demand are in balance is driven by the cost of marginal supply. Put another way, the cure for high commodity prices is high commodity prices.

However, an assessment of the fundamentals of many mined commodity markets today could challenge this thesis.

Are transient or structural factors driving mined commodity prices upwards?

Much has been written about the coming commodities supercycle, which many believe has already started. Adherents cite strong market demand and stratospheric prices as evidence of this. However, the key question is whether transient or structural factors are at play.

If the factors are transient, once these ‘here today, gone tomorrow’ drivers are removed, surely fundamentals will be reflected in prices? This would inevitably mean a downward correction which could exacerbate the issue of limited supply development. If that happens, when the energy transition takes off supply will be unable to keep up.

If, on the other hand, long-term structural forces are driving commodity markets then we have already experienced lift off. Even if transient drivers are removed, prices will shoot for the stars as supply growth inevitably lags demand. The structural factors influencing markets are focused on the lack of projects under development and the transformational demand arising from the energy transition. Currently, despite high price levels too few projects are being greenlighted; planned development isn’t even enough to meet the needs of a slow-paced energy transition, let alone the transformational demand from an accelerated one.

So, it appears Mr Locke’s theory that high prices incentivise sufficient supply development doesn’t seem to hold. This may be partly because investors are looking for prices to remain higher for longer before committing capital to expansions. Miners are likely to be wary of repeating the sins of the past by going for growth too soon, or indeed by investing in capex just as demand wanes. They are also feeling the pressure to prove they can manage their balance sheets effectively and distribute dividends consistently.

Why mined commodity markets aren’t as tight as prices suggest

That supply is struggling to keep up with strong demand in many markets is unquestionable. Pent-up consumer demand, restocking along the value chain and green-tinged stimuli are all contributing to an undeniable post-lockdown commodity demand bounce. Put this together with exploding energy markets struggling to meet needs and the universe of natural resource commodities might seem to be on a one-way ticket to Mars.

So, how strong are current fundamentals and what is the outlook for the next two-to-three years?

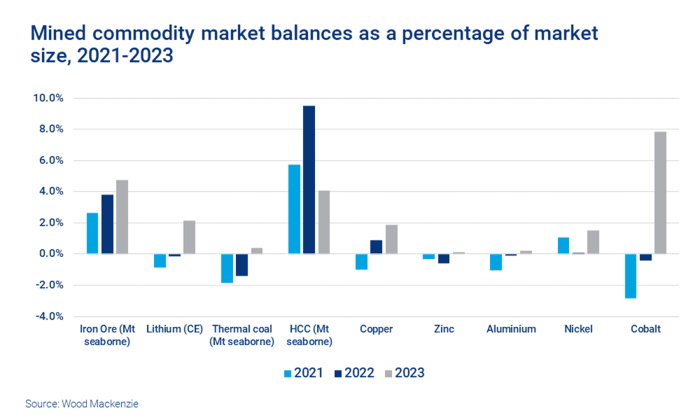

While most markets are in deficit in 2021 the majority are not markedly so, with most having adequate stock levels. Looking forward, our analysis shows that (absent major supply disruptions) markets are set to tip into surplus, some substantially so. This should inevitably feed into price dynamics.

Heady margins make a return to earth likely before demand explodes

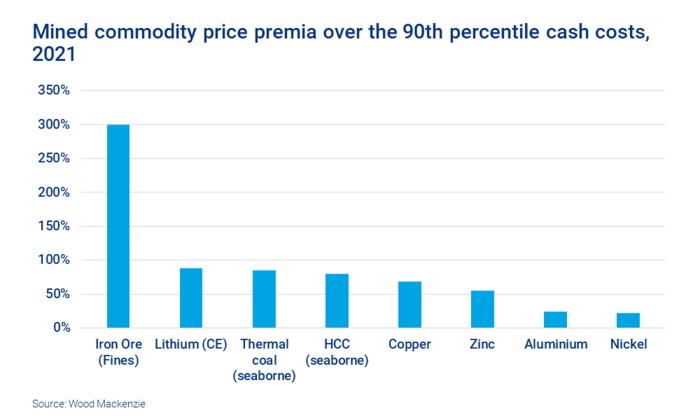

Price premia over the 90th percentile marginal cost level are at moon-shot extremes for several mined commodities. This highlights the downside potential should prices fall back down to earth to more closely reflect market fundamentals.

Several factors could prove to be the catalyst for the end of the post-lockdown bounce. Energy market shortages will inevitably lead to lower output across the value chain. Then there is the likelihood of a rising interest rate cycle to stave off the very inflation that high commodity prices are fuelling. Finally, we have the spectre of tax increases and the unwinding of quantitative easing, both of which point to subdued demand growth.

Of course, demand from metals-intensive electric vehicles and renewable energy will help offset lower growth elsewhere, but that won’t be enough to prevent medium-term demand slowing considerably.

Many observers appear to be looking down the wrong end of the telescope and seeing what is happening now as what will happen in future. The thinking is that if current markets are in deficit and the energy transition can only accelerate demand, then structural, multi-year stock drawdowns and even higher prices will surely follow. This may be true for a few commodities, but not for most.

I would argue that gravity is going to start dragging the supercycle rocket back down to earth very quickly – at least for long enough to refuel for the multi-decade stellar journey that will be the energy transition. A period of small but significant increases in stocks and slower price growth is therefore likely in the near future. Lower prices will precede the real start of the supercycle from mid-decade onwards.

Finally, to dispel any misconception that I don’t believe the energy transition will lead to a multi-decade supercycle in many mined commodities, it would be apt to paraphrase Winston Churchill: “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning of the next supercycle.”

Get unique metals and mining insight in your inbox

This article is part of a series exploring opportunities and challenges in the world of metals and mining. Fill in the form at the top of the page to be alerted to new articles as they are published.

Source: Wood Mackenzie