1. Introduction

The aim of this Report is to provide the technical perspective on the ways of reducing Greenhouse Gas (GHG) emissions from the maritime transport in line with the initiatives of the “Fit for 55” package. This Report intends to inform discussions regarding the reduction of the GHG emissions from the maritime transport sector and offer policy suggestions stemming from the technical analysis.

The Report is structured as follows: Section 2 provides a brief background on issues concerning the ambition to decarbonise the maritime sector and presents the relevant EU-wide (the “Fit for 55”package) and global policies to decarbonise the sector. Section 3 provides a short overview of the various options to decarbonise shipping (e.g., alternative fuels, propulsion technologies and emerging technologies). Section 4 discusses the uncertainties regarding the transition of the maritime transport sector towards decarbonisation. Finally, the Conclusions section summarizes the key insights of the Report.

2. Issues concerning the ambition to decarbonise the maritime sector

a. Decarbonisation does not follow a linear trajectory

Setting a framework to achieve the decarbonisation goals and a carbon-neutral economy, can only be successful with regard to shipping if the technology and the carbon-neutral fuels become available. This will happen through investment in innovation, building the necessary infrastructure and development of solutions that can meet the set goals in a cost-effective and sustainable manner suitable for ships competing internationally. It may be easier to model the reduction of emissions as a linear trajectory. In practice, however, that is not the case. With new technologies and fuels, experience has shown that initial uptake is slow. After experience is gained, the related costs and technology risks will be reduced, and the new technologies will become more accessible to a bigger part of the shipping community. This would result in an increase in the uptake and investment (a reinforcing cycle). Therefore, an exponential curve instead of a linear trajectory should be expected.

On one hand, the trajectory of emissions towards full decarbonisation hinges on the introduction and market uptake of economically viable and safe low and zero emission fuels and technologies. Implementing the new technologies requires sufficient time and a joint effort from all stakeholders in the maritime value chain e.g., shipbuilders, engine manufacturers, the fuel producers and energy providers in the fuel supply chain, port infrastructure and port operators. On the other hand, in the course of meeting the decarbonisation goals, the ships will need to increase their efficiency. Increasing ship efficiency is a combination of multiple factors. Ship design and the operational measures/choices, such as improved voyage planning, regular cleaning and maintenance of the propeller and the hull, and installation of energy-efficient waste heat recovery systems, etc. are a few of the factors to be considered. Various technologies and methods of operation have been developed so as to achieve increased efficiency of existing and future vessels.

b. Brief overview of EU ambition for the maritime transport sector

The recently announced “Fit for 55” policy package involves a number of individual initiatives which put forward policies and measures aiming to lead to the reduction of the GHG emissions from the maritime sector for 2030 and beyond.

The EU Emissions Trading System (EU ETS) Directive is considering the extension of the EU ETS to the maritime transport sector, from 2023 (with a progressive phase-out of free allowances). The measure shall apply to vessels of more than 5,000 GT (100% implementation to intra-EU voyages and 50% implementation to extra-EU voyages). This initiative is aligned with the Monitoring, Reporting and Verification (MRV) scope.

The FuelEU Maritime Regulation proposes the reduction of the GHG intensity of energy used by the vessels by 6%, 26% and 75% in 2030, 2040 and 2050, respectively, compared to 2020. This initiative is also aligned with the MRV scope. In parallel, the Renewable Energy Directive suggests fuel subtargets to be applied horizontally to the overall transport sector (including maritime). The sub-targets cover biofuels and hydrogen provided that these are produced from renewable electricity.

The FuelEU Maritime also envisages the use of electricity when vessels are at berth (using Onshore Power Supply – OPS). The measure is foreseen to apply to containers and passenger ships in 2030. The Alternative Fuel Infrastructure Directive requires the development of the OPS in the majority of the EU ports by 2030 and the supply of Liquefied Natural Gas (LNG) in terminals in 2025.

c. Brief overview of global policies in place

The global shipping industry is fully committed to reducing shipping’s carbon intensity per tonne/mile by at least 40% by 2030, pursuing efforts towards 70% by 2050, compared to 2008, and to reduce total annual GHG emissions by at least 50% by 2050, compared to 2008, in conformity with the Paris agreement goals. The International Maritime Organisation (IMO) adopted an Initial Strategy in April 2018, due to be revised in 2023, which provides the framework for the development and adoption of concrete short-term CO2 reduction measures as well as candidate mid- to long-term measures for achieving appropriately reduced emissions within agreed timelines and implementation schedules, consistent with the IMO agreed roadmap for decarbonisation from now until 2050.

Pending the development and commercialisation of marine alternative fuels, the long-term goals of the agreed IMO Initial Strategy for decarbonisation and the ambitious objectives of the European “Green Deal” and “Fit for 55” Package are challenging. This is why the industry, along with several Member States with substantial maritime interests, made the proposal at the IMO to set up a Research and Development (R&D) Board and Fund (the IMRB/ IMRF proposal1) to be funded initially by a mandatory contribution from each ship over 5,000 gt per ton of fuel consumed. The purpose of this initiative is to expedite the development of alternative fuels that the shipping industry needs but which it cannot develop. It is the urgency of the situation that has prompted this initiative and the shipping industry’s willingness to contribute.

The IMO member governments also agreed to start discussing mid- and long-term measures, including Market-based Measures (MBMs), as soon as October 2021, according to the agreed IMO work plan for medium- and long-term measures.

The related IMO work stream that still needs to be completed concerns the development of Life Cycle Assessment (LCA) GHG / carbon intensity guidelines for all types of fuels. In this framework of ongoing discussions within IMO on LCA guidelines, the 27 EU Member States and the European Commission proposed in September 2021 a Well-to-Wake (WtW) certification scheme to be developed and validated by the IMO. Allocation of Fuel Lifecycle Label with default GHG emission factors, based on feedstock and production pathways, will enable categorisation of low carbon and zero carbon alternative fuels, including sustainable biofuels, and the quantitative calculation of their WtT (Well-to-Tank) emissions.

The IMO Decarbonisation Strategy has identified a list of candidate short-, medium- and long-term measures for CO2 emission reduction. Taking a major step forward for the energy transition of the maritime sector, the ΙΜΟ member governments, including all EU Member States, at the 76th session of the IMO Marine Environment Protection Committee (MEPC), held from 10-17 June 2021, adopted a comprehensive package of legally binding technical and operational short-term measures to reduce CO2 emissions from ships, which will enter into force on 1 November 2022.

More specifically, the measures adopted at MEPC 76 require ships of 400 gt and above to calculate their Energy Efficiency Existing Ship Index (EEXI) following technical means to improve their energy efficiency, and all ships above 5,000 gt to establish their annual operational Carbon Intensity Indicator (CII) and CII rating. Carbon intensity links the GHG emissions to the amount of cargo carried over the distance travelled. The IMO will review the effectiveness of the implementation of the CII and EEXI requirements by 1 January 2026 to determine if any further amendments are necessary.

3. Overview of key alternative fuel and vessel technology options to decarbonise shipping

a. The different levels of technical and regulatory maturity of alternative fuels (Input from UGS study)

Liquefied Natural Gas (LNG) is mostly composed of Methane (CH4). LNG can have 20-25% less tank-to-wake CO2 emissions and it is sulphur-free producing no SOx emissions. Methane has a comparative impact of CH4 on climate change (more than 30 times greater than CO2 over a 100-year period) when unburnt methane is released in the atmosphere (methane slip) 2. Since methane is the main component of LNG, liquefied methane produced from biomass (LBG) could easily blend with LNG.

“Green” LNG production and the liquefaction of natural gas to -173°C requires substantial energy input and storage capacity. Lack of LNG bunkering infrastructure for LNG-fuelled ships in major ports of call worldwide is a market-barrier to further widespread use of LNG as marine fuel.

Using LNG as fuel is more viable for tankers than for bulk carriers and general dry cargo ships. For container vessels, LNG could be viable on certain routes. The energy density of LNG is 40-45% lower than that of Heavy Fuel Oil (HFO). Hence, there is a high Capital Expenditures (CAPEX) cost of fuel storage and containment systems in non-LNG carriers.

Biofuels as a partial solution to international shipping

A substantial and sustained supply of efficient biofuels from renewable sources with worldwide availability for ocean-going shipping may not be feasible. Most renewable resources that can be used as biomass, such as fields, forests and crops, are needed to meet other, more basic human needs. Ethically, allocating resources is non-negotiable when planning biofuel supply chains and production. For these reasons, second and third generation biofuels show the most promise for marine propulsion.

Hydrotreated Vegetable Oil (HVO), a promising candidate as a “drop-in fuel” in most cases can be distributed using the existing Marine Gas Oil (MGO) and HFO distribution systems, although modifications are sometimes required. Using existing distribution systems for the type of biofuel classed as Fatty Acid Methyl Ester (FAME) is more challenging.

Second generation biofuels such as HVO do not compete with food crops and are produced from lignocellulosic biomass, such as corn stalks or from food residues. A large variety of processes exist for the production of conventional (first-generation) and advanced (second and third generation) biofuels, involving a variety of feedstocks and conversions. Another 2nd generation biofuel-used cooking oil (UCOME oil) produced from waste sources is being used in pilot projects for shipping.

The biomass used to make biofuels must itself be produced sustainably, as the first step in the biofuel supply chain. The use of renewable energy can further reduce the carbon footprint of such fuels during production. This technology is based on the premise that all biomass-origin energy can be classified as carbon neutral. For calculating the well-to-tank emissions the default values for cultivation, processing, transport and distribution should be taken into consideration. However, there is currently no globally accepted ISO standard or certification available to verify the green production of biofuels from end to end.

Biofuels can be mixed with fossil fuels (the “drop-in” fuel option), enabling ships to start limiting their emissions. Biofuels are compatible with modern ship engines (all vessel types – large or small, deep-sea or short-sea trading vessels – can burn biofuels without requiring technical, safety or design adjustments) provided these mixes – blends are safe and fit for purpose.

There is a clear gap between the cost of biofuels and fossil fuels, both for aviation and marine applications. In the first instance, technology evolution will be needed to bring costs down and derisking investments will be crucial to deploy these technologies; it will also be important to evolve towards bio refinery approaches, delivering a range of outputs. In that sense, marine biofuels and bio jet fuels are complementary as they are at different ends of the fuel spectrum (high vis-à-vis low specifications). Marine fuels are generally of low quality and marine engines can accept different fuel grades, while aviation fuels need to fulfil high quality standards. There is competition for biofuel feedstock. Currently, bio jet fuels are made from HVOs, leading to direct competition for oleo chemical feedstocks. The ongoing electrification of road transport, however, will at some point beyond the year 2025 reduce the demand for oleo chemical biofuels for the road transport sector, and more biofuels will be available for the marine and aviation sectors.

Currently, however, there are no marine biofuel production pathways approved for blending with fossil fuels nor GHG factor default values established for biofuels destined for marine applications.For calculating the well-to-tank emissions for biofuels, the GHG factor default values related to cultivation, processing, transport and distribution will need to be taken into consideration.

Several studies predict that at most biofuels could supply fuel for 30% of the global fleet. Biofuels as “drop-in” fuels can be used primarily for containerships and for ships operating near densely populated areas, e.g., cruise ships and ferries. Depending on their price and provided it is the responsibility of fuel suppliers to make sure that when mixed with fossil fuels the blends are safe and fit for purpose, they can provide a partial solution for meeting sustainable decarbonisation targets for bulk/tramp shipping.

Synthetic fuels (ammonia, methanol, and hydrogen)

Ammonia

Availability in adequate quantities and at viable cost, development of suitable marine engines and of new bunkering infrastructure worldwide, lack of predictability of the regulatory framework and safety issues related to the exposure of crew to toxic ammonia vapours during storage and handling need to be addressed.

“Green” ammonia is zero-carbon ammonia, produced using renewable electricity, water and air. Potential high cost of the production of the green ammonia is a major consideration. The method for producing ammonia with no carbon footprint has not yet been developed, neither for industrial use nor for shipborne application.

Ammonia Internal Combustion Engines (ICE) are still at the development stage with MAN Energy Solutions leading the way to developing a commercial, ammonia-fuelled, two-stroke engine. The first engine tests are expected within 2021 for delivering a complete engine shipboard installation by 2024.

Due to low energy density, storage tank requirements will be almost three times larger than traditional conventional fuels. However, ammonia has higher energy density compared with liquified hydrogen (LH) (see relevant section below).

Methanol

Notwithstanding the absence of bunkering infrastructure and the lack of information regarding the future cost of carbon-neutral methanol, dual-fuel methanol engine and fuel-supply systems (DF methanol ICE) are an option being examined primarily as a future marine fuel for a certain segment of short sea shipping with a very limited number of vessels (approximately 10) running on methanol globally (DNV GL, 2020). Methanol can be a stable and safe hydrogen carrier since it is the simplest alcohol with the lowest carbon content and highest hydrogen content of any other liquid fuel. It can be used to produce hydrogen for fuel cells and the methanol industry is currently working on technologies that would allow methanol to be produced from hydrogen for such purpose.

Safety concerns, lower energy density and increased costs of the fuel storage system continue to make this fuel less suitable for the oceangoing bulk fleet.

Hydrogen

The low volumetric energy density of liquefied hydrogen (LH) and the high cost of the fuel storage system make the use of LH in deep-sea shipping very difficult. The situation is different for LH in short-sea shipping on fixed routes covering limited distances with frequent port calls, which due to their relatively low energy demand, are more likely candidates. DNV is working with the Norwegian Government on putting a new hydrogen-powered ferry into service by 2021.

If a renewable source of electricity is used, electrolysis is an almost carbon-free process for hydrogen production. Potentially, using green hydrogen to make green ammonia, has the advantage of making another fuel which can be either combusted or used in fuel cells.

On safety considerations, ships burning synthetic fuels (ammonia, methanol and hydrogen) will require specially trained crews.

Fuel cells

In the future, a ship running on fuel cell technology will not necessarily require an internal combustion engine. Recognizing that fuel cell technology for ships is still in its infancy, making predictions on the future development of fuel cells is challenging. The technology is not mature enough and it cannot provide a solution for large ocean-going ships in the foreseeable future. In addition, a significant cost reduction and size up-scaling is needed for fuel cells to become commercially viable. Specialised crew will also be required.

Electrofuels

Electrofuels based on “green” hydrogen – from water electrolysis using renewable electricity – can be synthesized with nitrogen or non-fossil carbon dioxide. No information on the cost of these electrofuels as “drop-in” fuels is readily available. Electrofuels, are at a very early stage of development.

b.Propulsion Technologies

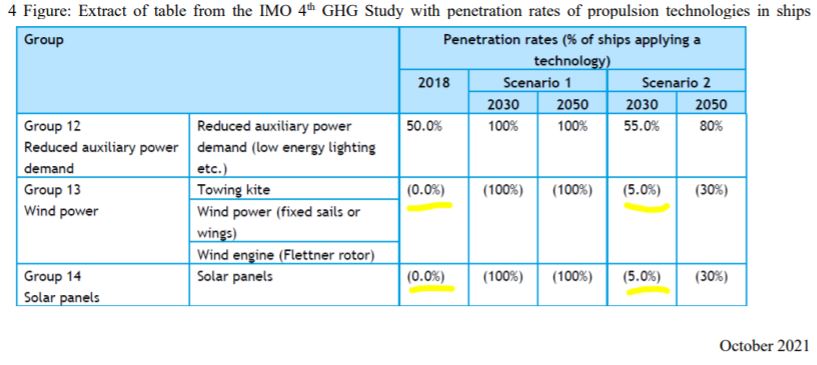

All available alternative propulsion technologies other than the conventional ones using incorporating shaft and/or propeller for the main and auxiliary engines, or those being developed at the moment, can offer improvements in fuel consumption but cannot replace conventional internal combustion engines. Currently, the only available auxiliary propulsion method is wind-assisted propulsion (WASP) and its main forms are: Fixed Sails or Wings, Kites and Flettner rotors. Based on the findings of the IMO 4th GHG study4, the immaturity of these technologies is confirmed by the negligible penetration rate they have in shipping.

c.Emerging Technologies (e.g., using on board capture and storage technology)

R&D for developing propulsion system(s) using onboard pre-combustion or post-combustion Carbon Capture and Storage (CCS) technologies is an ongoing process.

A proposed method under testing is reforming methanol to hydrogen, which is then burned in a reciprocating engine that has been upgraded to burn multiple fuel types and is specifically optimised for hydrogen use. The new concept allows for a closed CO2 loop ship propulsion system while maintaining the reliability of well-established marine engine technology. Another proposed method being tested by Mitsubishi Heavy Industries (MHI) is using amine solvent to absorb CO2 from flue gases, which is a proven technology for use onshore. The CAPEX and OPEX (operational costs) of the commercial application of those projects, such as the HyMethShip project 20205, are so far unknown. Table 1 summarizes the main limitations of onboard CCS considering main features of ships.

For onboard application, captured CO2 stored in tanks as a cryogenic liquid will occupy considerable space and will have to be unloaded when ships reach a port. Another considerable limitation is that the equipment size of CCS systems should be minimized covering less space and less weight. Special consideration should be given to the height of the absorber and the stripper, which are the two main components for the carbon capture process. Studies showed that the total height of the columns for CCS onshore applications could be around 50 meters, which makes such a packing height unrealistic even for larger vessels.

Technologies such as CCS onshore would possibly allow bridging the current technological gap between fossil fuels and the zero-emission fuels needed to decarbonise shipping. However, this technology (CCS) has yet not been fully developed, neither for industrial use, nor for shipborne application.

4.Journey of shipping towards decarbonisation is uncertain and a complex task: Main considerations

The maritime transport sector involves several actors who are not necessarily all affected to the same extent by the policies proposed by the “Fit for 55” package and the overall ambition to decarbonise the sector in the longer term. Different decision makers exist with their own aspirations, which may not always be mutually compatible.

In particular, shipowners take the decision to purchase vessels, while charterers hire the vessels and determine the transportation of the cargoes. Yet, shipowners are responsible for compliance with the FuelEU and the EU ETS proposals. In addition, shipyards and marine equipment manufacturers supply vessels which can incorporate different levels of technological progress resulting in different energy efficiency possibilities for the vessels. Shipbuilders play an important role in delivering technological options to the market which can comply with the increasing ambition to decarbonise the maritime transport sector. Similarly, energy producers and fuel suppliers should provide the necessary fuel options to the maritime sector. The latter will need to provide fuel options which allow shipowners to achieve the reductions in the GHG intensity of their vessels in line with the increased ambition of the FuelEU maritime and IMO targets. Problematically, the FuelEU maritime initiative does not apply to the fuel suppliers, whereas the Renewable Energy Directive appropriately sets overall transport (including maritime) GHG intensity reduction targets on fuel suppliers.

The above considerations indicate the complexity of the effort to decarbonise the maritime transport sector and raise a market coordination problem which requires careful actions from policy makers and market stakeholders.

a.Technical information about vessels (different lifetime, purchasing costs of newbuilds or used, other)

Newbuildings vessels need capital-intensive long-term investments for a lifespan of 25-30 years and regulatory certainty in terms of applicable global regulations in order to remain sustainable internationally. Depending on ship type/size, and type of trade, and given the need to comply with the applicable international requirements for the specific ship type and category, any business decisions taken for fitting additional equipment so as to achieve a better energy efficiency, such as the installation of energy-efficient waste heat recovery systems, etc. are factors that affect the total cost.

Changes in the regulatory framework in view of the remaining lifespan of the vessel, the type of trade that the ship serves, are factors affecting decisions for vessels retrofits. Retrofitting vessels can have an important role to play in transitioning the shipping industry into decarbonisation. However, a cost- benefit analysis will be required on vessel by vessel case as the investment payback period may vary significantly.

b.Avoiding stranded investments in shipping / Need for preserving the bulk/tramp shipping

modus operandi

As the shipping industry embarks on a long and uncertain period of transition into a multi-fuel low and zero carbon future, shipowners are facing the difficult task of deciding which fuel and marine propulsion technology to opt for or how to “future-proof” their fleets and assets.

Nowhere is the uncertainty greater than in the bulk/tramp shipping segment. Bulk/tramp shipping due to the service it provides and the cargoes it carries, is itinerant by nature and does not operate on the basis of a schedule or published ports of call. Thus, its modus operandi is inextricably linked to and heavily relies on a universal fuel being available globally, allowing ships to call at any port. A proliferation of new zero carbon fuels bodes ill for their global availability, which in turn casts doubts over the viability of the bulk/tramp shipping modus operandi and its ability to continue to operate as it has been operating for a century or so serving seaborne trade and supporting world economic growth in an incomparably cost-effective manner.

c.Importance of energy density, safe storage and use of alternative fuels for shipping

Decarbonisation requires a new generation of zero-carbon fuels and propulsion technologies that do not yet exist. The investments in fuel production and in supply infrastructure represent by far the major share of the total cost of decarbonisation for the shipping sector. Consequently, the greening of fuels and ships is the responsibility and area of expertise of out of sector stakeholders, who must provide the international shipping industry with safe and fit for purpose propulsion technologies and maritime fuels available worldwide.

In general, the alternative energy source to be selected and carried on board must have a sufficiently high energy density, compared to the energy density of VLSFO6 and MDO/MGO7 to maximize the available cargo space, but crucially without compromising safety. These efforts require the active contribution of all actors in the maritime value chain, especially the fuel supply chain, shipyards, engine manufacturers, but also classification societies, ports and charterers.

It is noteworthy that due to the current regulatory uncertainty, orders for newly built vessels with delivery dates in 2023/2024 are mainly comprised of “dual-fuel (DF) ready” and NOx Tier III compliant ocean-going vessels although they are no doubt more expensive.

d.R&D and innovation are critical for “future-proof” fleets and assets

The first priority must be a massive effort in R&D and a shift of technological paradigm towards safe and future-proof alternative fuels. Once new and economically viable fuels are developed, fuel and energy suppliers will have to start producing them and ports will need to have the right infrastructure in place.

e.Studying the macroeconomic implications of shifting (from fossil-fuels to alternative low- carbon and zero-carbon fuels) for shipping

In the coming decades, fossil fuels will likely remain much cheaper than zero-carbon alternatives, unless the former are heavily taxed or the latter heavily subsidized (or both). In general, the question of the macroeconomic implications of fuels for ships which become more and more expensive is a major one. The disruption and economic implications of the departure from fossil fuels, the universal fuel for shipping, over the last 70-80 years and the introduction of a number of new carbon neutral fuels and technologies creates a totally new situation. It seems prima facie that technologies that capture most or all of the CO2 from fossil fuels will cause less disruption and should be investigated further.

5.Concluding remarks

The present Report offers the technical perspective on the potential alternative fuel and vessel technology options to enable the decarbonisation of the maritime transport sector. It presents, to some extent, the complexity surrounding the sector resulting from the multiple market actors involved. It is evident, that decarbonising the maritime transport sector is not a straightforward task and, certainly, not a task for a single market actor. Shipowners, charterers, shipbuilders, engine builders, fuel producers and distributors, infrastructure providers, ports and policy-makers will all need to coordinate actions to deliver the ambition of the “Fit for 55” package and its maritime initiatives.

There can be no doubt that significantly more research is required to develop cost-effective low- carbon and zero-carbon fuel options, which can be produced to scale. At the same time, investments in infrastructure will also be required (including OPS for ports and biofuel production) already in the coming years. Alternative fuels such as ammonia, methanol or hydrogen need a new generation of internal combustion engine and advancements in technology not yet developed for ocean-going ships which will need to be developed by out of sector stakeholders-energy providers, engine-builders and shipyards. This requires the development of regulations and technical rules for safe design and use onboard ships in parallel with the technological progress needed for their uptake.

Depending on the fragmentation of the future fuel landscape and the length of the transitional period towards a new era, the shift to a multi-fuel future may in fact herald the end of low-cost seaborne trade and its mainstay, the international bulk/tramp shipping model which is responsible for over 84% of global seaborne tonne-miles.

Source: Union Of Greek Shipowners