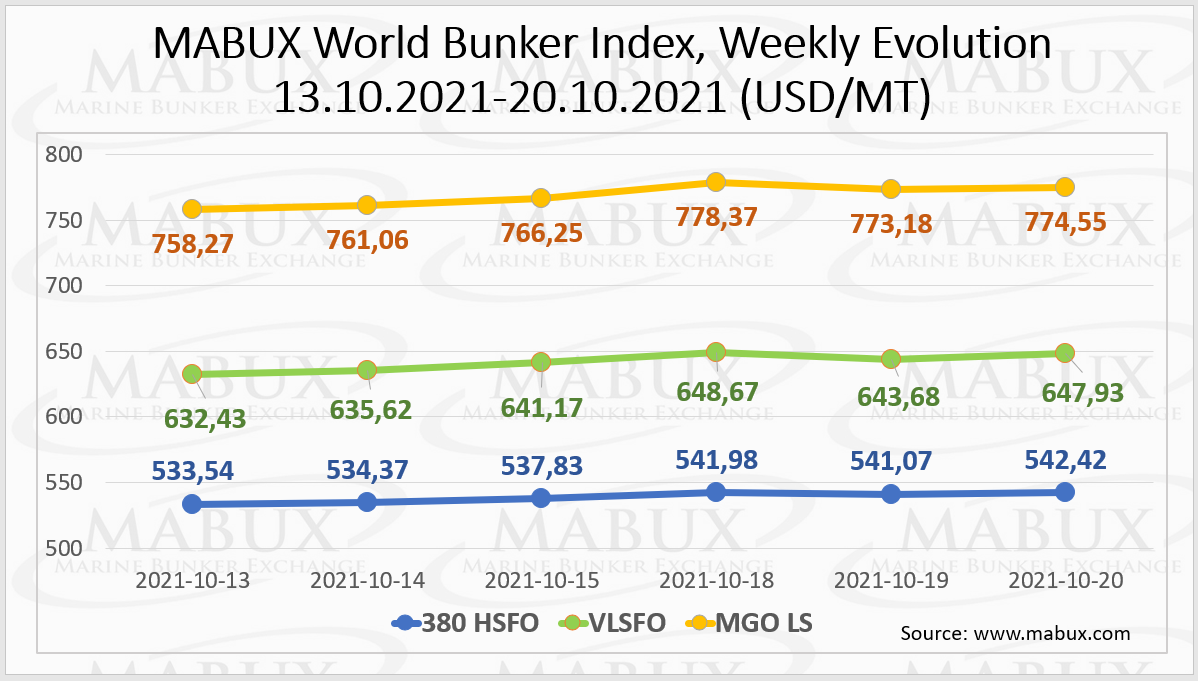

On a Week 42, the MABUX World Bunker Index continued its firm upward trend. The 380 HSFO index rose by 8.88 USD : from 533.54 USD / MT to 542.42 USD / MT. The VLSFO index increased by 15.50 USD: from 632.43 USD / MT to 647.93 USD / MT, while the MGO index added 16.28 USD (the rise from 758.27 USD / MT to 774.55 USD / MT).

MABUX temporarily suspends publication of the MABUX ARA LNG Bunker Index as the LNG bunkering market has practically stalled due to falling demand caused by a sharp increase in gas prices in Europe. We believe the gas crisis is temporary and expect LNG bunkering operations to resume by the end of this year. The publication of the MABUX ARA LNG Bunker Index will resume as soon as the LNG bunker market recovers.

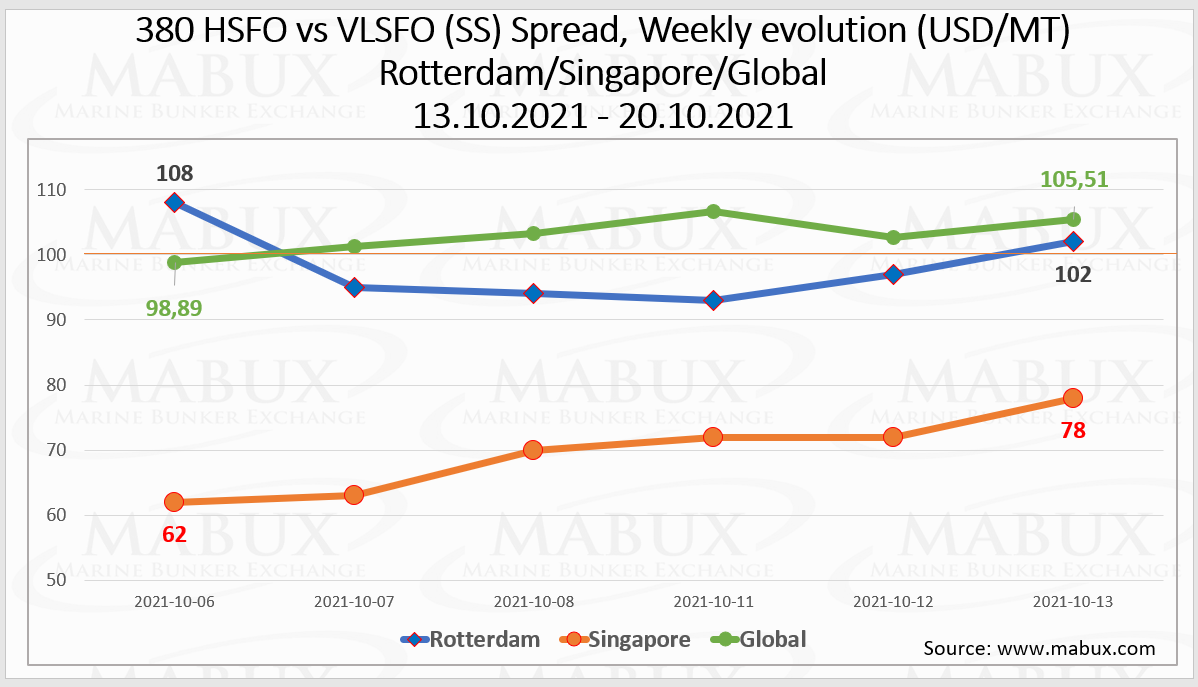

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – increased during the week and amounted to $ 103.05 (versus $ 92.65 last week). Meantime and reached $100 mark. The average weekly SS Spread in Rotterdam also increased and now is above the $ 100 mark: $ 109.33 (against $ 98.17 last week, plus $ 11.16). The average SS Spread in Singapore, also rose but still remains a little below the psychological mark of $ 100: $ 96.00 versus $ 69.50 last week ( $ 26.50). More information is available in the Differentials section of www.mabux.com.

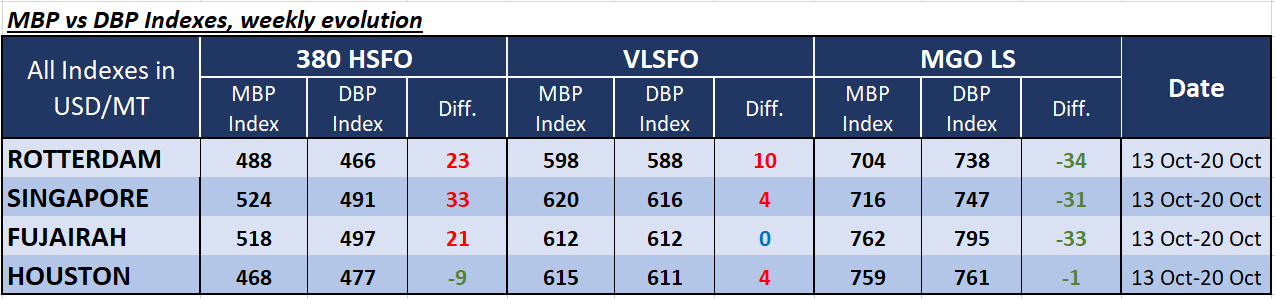

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was overvalued in all selected ports (except of Houston), where the Index recorded an underpricing of $ 9 (vs. minus $ 14 a week earlier). In other ports, 380 HSFO was overcharged: in Rotterdam – plus $ 23, in Singapore – plus $ 33 and in Fujairah – plus $ 21.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, was in the overvaluation zone in three of four selected ports: In Rotterdam by plus $10, in Singapore by plus $ 4, in Houston by plus $ 4. In Fujairah MABUX MBP Index for this fuel grade 100% correlates to DBP Index.

The MABUX MBP / DBP Index also recorded an undercharge of MGO LS fuel in all selected ports: minimum value in Houston (minus $ 1), maximum value in Rotterdam (minus $ 34).

Data from China’s General Administration of Customs, as reported by Reuters, shows show that China’s very low sulphur fuel oil (VLSFO) exports totalled 1.45 million tonnes in September, a 16% increase on the same period in 2020. September volumes were also up on the 1.59 million tonnes registered in August this year, while exports for the period January to September rose 39% on the year before to reach 14.66 million tonnes. The Customs data released today (20 October) also indicated that fuel oil imports under general trade were 515,165 tonnes. These volumes were supported by demand from some independent refiners for use as a feedstock to process into fuels due to stricter crude oil import quotas. Imports into bonded storage, which includes high and low sulphur fuel oil, totalled 611,495 tonnes in September.

Source: www.mabux.com