[ad_1]

Ten years after we launched our online Maritime asset valuations and market information services, we’ve now expanded coverage into commercial passenger aircraft.

“Similar to what we did in Shipping ten years ago, we are the first to bring a daily updated, truly automated valuation model (AVM) to the Aviation market.”

– Richard Rivlin, Founder and CEO

Image Credits: VesselsValue.com

Increasing Volatility

Recently, we have seen increasing demand for real-time and transparent information for aircraft since the outbreak of Covid-19. The Aviation market, after two years of stability, has started to experience significant disruptions to aircraft demand, earnings, and values. Due to Covid-19, the volatility and uncertainty of the Aviation market has led to the need for more detailed, frequent, and objective data.

Ships vs Planes

Numerous parallels exist between planes and ships. Vessels and aircraft are both high value, depreciating, globally movable and volatile assets. Most vessels and aircraft have values between USD 10-200 million, a lifespan of circa 25 years, and experience cyclical markets.

The similarities between the asset types allows learnings from the Maritime space to be implemented into the Aviation market and vice versa, resulting in better valuations and market intelligence for both sectors.

The Opaqueness of Aircraft Transactions

The Maritime market is opaque, but aircraft markets are even less transparent than Maritime. Most aircraft transactions go unreported. Transactions that are reported either have no price or unusable prices for valuation purposes, as they’re reflective of other conditions such as lease or finance with varying and unreported terms.

We have invested significant resources and leveraged our transaction investigative techniques from Shipping to expertly break the aircraft transaction secrecy to accurately report transactions used in valuations.

Ship vs Aircraft Value Changes over Covid-19

Aircraft and Vessels

The volatility and values of the aircraft market have generally fallen over the Covid-19 period. Other appraisers however have typically reduced their values in hindsight several months or even quarters later. Our values track the market each day and accurately reflect even the most minor changes. Other appraisers have recently reported larger declines since January 2020, but this can be attributed to their values starting at optimistic pre Covid-19 rates.

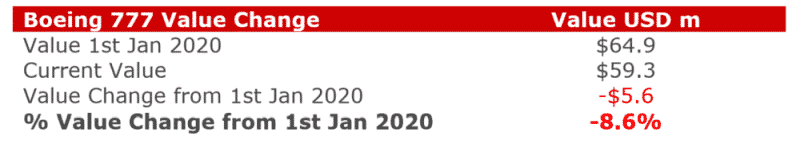

The below table shows aircraft value changes over Covid-19 for some of the most common aircraft types in comparison with popular ship types. Boeing 777 is a large Widebody aircraft that typically flies intercontinentally, so is compared to a Capesize. Airbus A320 is a Narrowbody that flies within continents and is compared to a Handy Containership.

Boeing 777 vs Capesize

Since January 2020, a generic five year old Boeing 777 has decreased by USD 5.6 mil, from USD 64.9 mil to USD 59.3 mil, representing a decrease of 8.6%.

Image Credits: VesselsValue.com

In comparison, a generic five-year-old Capesize Bulker has increased by USD 15.4 mil, from USD 33.9 mil to USD 49.4 mil, representing an increase of 45.5% since the start of 2020.

Image Credits: VesselsValue.com

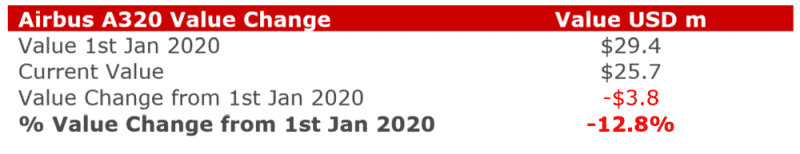

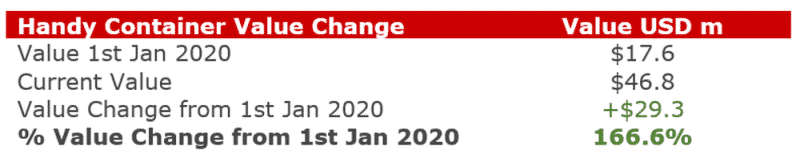

Airbus A320 vs Handy Containership

Since January 2020, a generic five-year-old Airbus A320 has decreased by USD 3.8 mil, from USD 29.4 mil to USD 25.7 mil, representing a decrease of 12.8%.

Image Credits: VesselsValue.com

In comparison, a generic five-year-old Handy Container has increased by USD 29.3 mil, from USD 17.6 mil to USD 46.8 mil, representing an increase of 166.6% since the start of 2020.

The above comparative data highlights how the Aviation sector, despite the long boom, is now suffering. In stark contrast with this, the Shipping industry is now booming.

Image Credits: VesselsValue.com

“This data clearly confirms what most of us know, that after many boom years for the Aviation sector, it is now suffering. Contrastingly, after a mostly bear market in Shipping since 2008, most of the Shipping markets are now booming”.

– Darren Biddlecombe, Senior Aviation Analyst

Fleet Values

Fleet values across Shipping and Aviation also share similarities. The below data shows the relative values of different segments of the aircraft and vessel fleets. This includes values of all live and ordered (newbuild or backlog) vessels and aircraft.

The Big Ones

Aircraft

The total value of the Widebody commercial passenger live fleet and backlog (newbuilds) = USD $469 billion as of 21st October 2021.

Ships

The total value of the Capesize, VLCC, Suezmax & Aframax, ULCV, New Panamax Container, Large LNG & VLGC live fleet and newbuilds = USD $481 billion as of 21st October 2021.

The Workhorses

Aircraft

The total value of the Narrowbody commercial passenger live fleet and backlog (newbuilds) = USD $899 billion as of 21st October 2021.

Ships

The rest of the live and newbuild Shipping fleet (bulkers up to Post Panamax, Tankers up to Panamax/LR1, Containers up to Post Panamax, LNG & LPG’s below LLNG &VLGC, Small Dry, Vehicle Carrier, Reefer, RORO & Cruise) = USD 879 billion as of 21st October 2021.

Total Fleets

Aircraft

The Commercial passenger, Widebody and Narrowbody, live fleet and backlog (newbuilds) = USD 1.37 trillion as of 21st October 2021.

Ships

The live and newbuild fleet of Bulkers, Tankers, Containers, LNG Carriers, LPG Carriers, Small Dry, Vehicle Carrier, Reefer, RORO and Cruise live fleet and newbuilds = USD 1.36 trillion as of 21st October 2021.

VesselsValue data as of 21st October 2021

Press Release | VesselsValue

Vessels Vs Aircraft: Similarities And Differences As A Value Analysis appeared first on Marine Insight – The Maritime Industry Guide

[ad_2]

This article has been posted as is from Source