Investment outlook is strong

Quite a lot of US numbers have come through today. They broadly show ongoing strong economic activity, but they also hint at problems in the supply capacity of the economy that could limit both the growth potential of the US while allowing inflation rates to stay higher for longer.

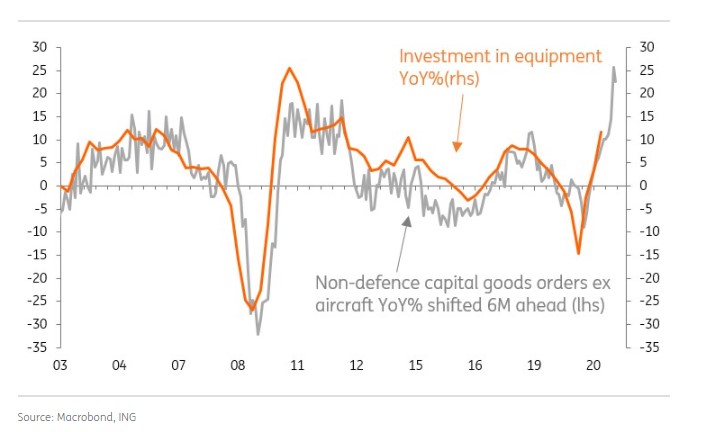

Durable goods were a little softer than hoped, but upward revisions mean that in $ terms it is broadly in line with expectations. New orders rose 2.3% month-on-month, led by a 27.4% increase in civilian aircraft orders after Boeing had a decent month. Non-defence capital goods order excluding aircraft – the so-called core measure of manufacturing orders that the Federal Reserve follows closely due to its good lead for capital expenditure – fell 0.1% versus expectations of a 0.6% gain. However there were some upward revisions and the annual growth remains very strong at 23.5%. The chart below shows that we should still be looking for a sharp acceleration in investment spending within the 2Q GDP report.

US durable goods orders points to a jump in investment spending

But demand is outstripping supply

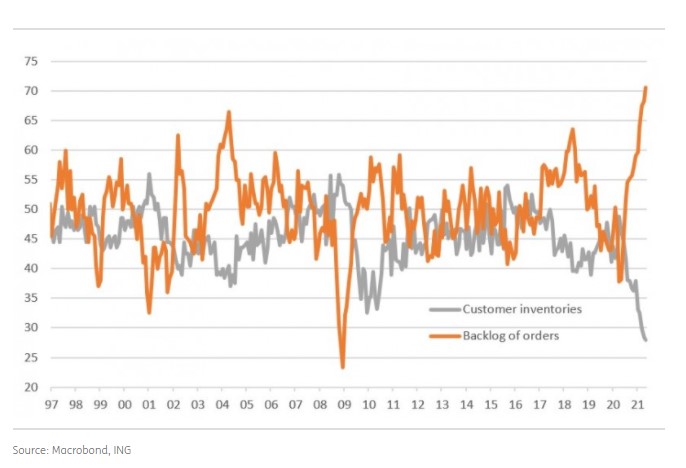

Today’s report also supports the numbers within the ISM release showing new orders are strong. The problem is actually fulfilling those orders with the ISM reporting that the backlog of orders at US manufacturers are at all-time highs with supplier delivery times the worst since 1974. At the same time, manufacturers know that their customer inventory levels are at all-time lows and this implies that companies have the sort of pricing power not experienced for many years. With costs rising across the board they know they can pass these on and there is little their customers can do given their desperate search for inventory.

Manufacturers have full order books, when their customers are desperate for inventory

Retail is feeling the strain too

This is now spreading to the retail sector with inventories having fallen sharply for the third straight month (-1.4% in March, followed by a -1.6% in April and a -0.8% in May). The chart below shows retail trade inventories to sales and underscores the point about supply chain strains and bottlenecks leading to a lack of stock to sell.

Retail inventories to sales (months) show strains are spreading throughout the economy

It all adds up to more price pressures

Given the strong economic momentum and excellent consumer fundamentals we expect the vibrant demand environment to hold for several more quarters, but unless the re-opening frictions ease soon we are going to end up seeing more prolonged and significant price pressures. Such an environment could easily push more Federal Reserve officials in the direction of opting for a 2022 start point for the lift off in interest rates.

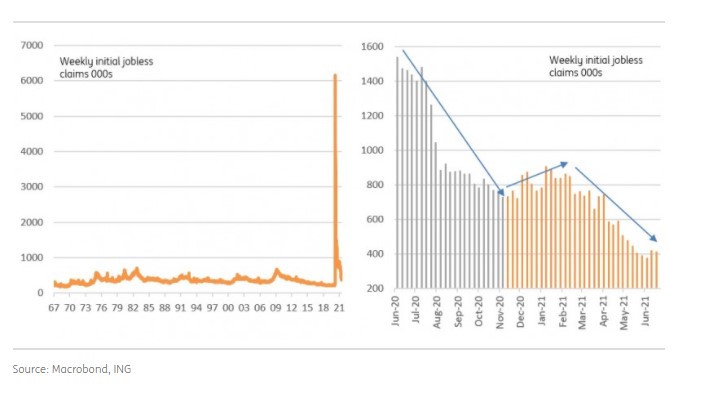

Unemployment issues may be a temporary distortion

Just to mention that we have had disappointment in the labour figures. Initial jobless claims surprisingly rose last week and they have been revised up even more. More concerningly though is the fact that we didn’t see much of a correction lower this week. We had assumed we would be back well below 400,000 given the clear appetite for companies to hire workers and not fire them. We are somewhat at a loss to explain what is going on here.

The non-seasonally adjusted data showed a bigger fall (14k versus the seasonally adjust 7k fall), but that is only modest noise. The details show Pennsylvania reported a second consecutive sizeable increases of 14.5k while Michigan was in a distant second place, showing a 1,678 increase on the previous week. The majority of other states reported falls, so there could be localised issues while it could be that reported upgrades to the Pennsylvania government computer systems means that there is some transitioning that could be having an influence.

Downward trend in jobless claims has temporarily stalled

Either way, the strong growth environment and clear excess demand for labour in virtually all labour market surveys suggests the overall downward trend in jobless claims should soon return.

Either way, the strong growth environment and clear excess demand for labour in virtually all labour market surveys suggests the overall downward trend in jobless claims should soon return.

Source: ING