Platts AGS (AGSAA00) was launched on June 26, 2020 aiming to provide the US crude export community with a benchmark that considered the growing Midland supply along with the logistics costs interplay between Houston and Corpus Christi, the two key export locations along the USGC.

A version of this Spotlight from S&P Global Platts Analytics was first published June 23.

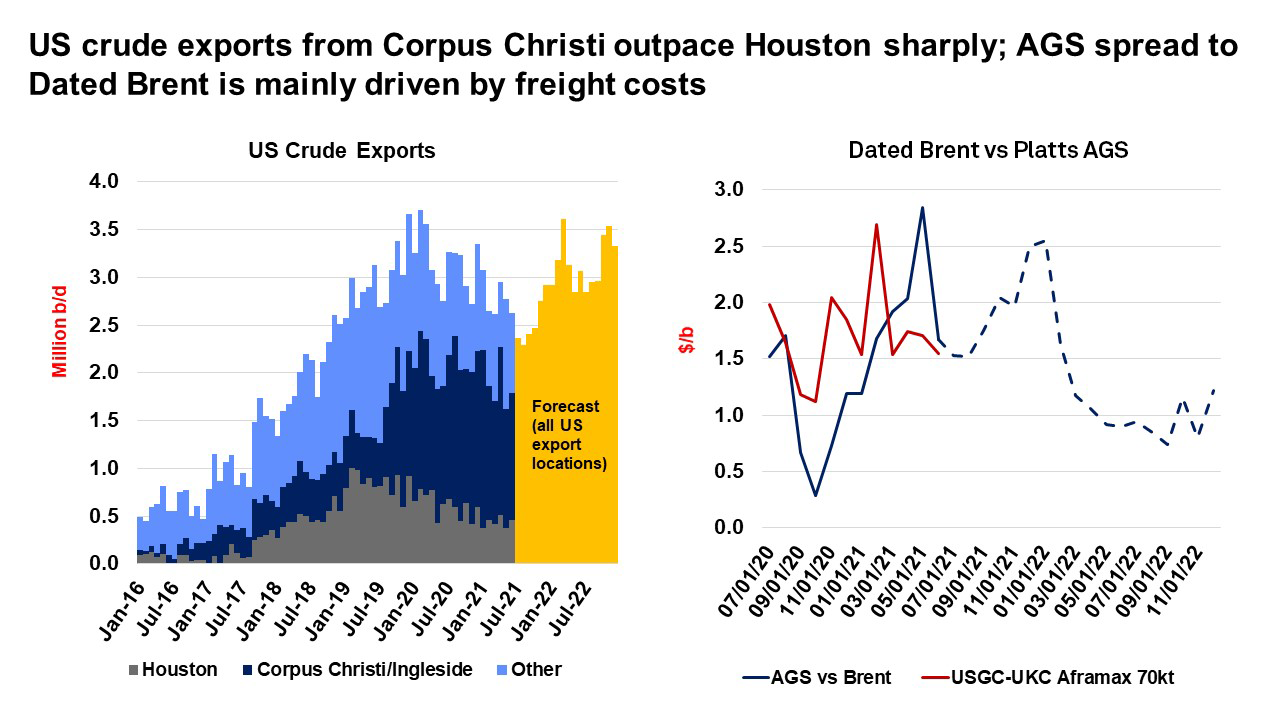

Over the first six months from its introduction, Platts AGS was assessed, on average, at around $1/b under Dated Brent. The spread widened to around $1.90/b over the following six months with freight costs acting as the key driver of the spread, followed by regional supply/demand dynamics.

For 2021, Platts Analytics forecasts the Platts AGS/Dated Brent average spread will stay around $1.90/b but then narrow next year to about $1.15/b as refinery crude runs/refined product demand in the Atlantic Basin recover more dynamically.

US crude oil exports are expected to continue rising near term as local shale production ramps up following the COVID slump.

Notably, Corpus Christi/Ingleside, with its deeper draft and ability to load larger vessels (VLCCs can load a bit over 1 million barrels at the port, then sail out to sea and perform a single STS transfer with a Suezmax), has overtaken Houston as the busiest crude export location on the USGC. It went from average outflows of 770,000 b/d in 2019 to 1.50 million b/d in 2020 and has climbed slightly to 1.58 million b/d so far this year.

Source: Platts