Jet fuel hedging is making a sustained comeback for the first time since Q2 2020, with activities seen gaining momentum in the futures exchange. But Asia’s jet fuel market — the most severely affected oil product by the coronavirus pandemic — was still far from being back to normal, middle distillate traders said. The aviation industry remains plagued by uncertainties, complexities and volatilities.

The rise in jet fuel hedging activities could be partly due to an increasing number of airlines returning to hedge fuel positions in the derivatives market, industry participants told S&P Global Platts.

Aviation fuel is one of the largest expenses for an airline, accounting for up to 30%-35% of total operating costs.

Pre-pandemic, airlines would typically hedge a portion of their fuel purchases, based on travel seasonality. This has changed mainly due to shorter fuel purchasing cycles and demand uncertainty over the past year.

“Airlines are in a unique position where they have roughly nine months of visibility over their revenue and therefore do not hedge their fuel before generating the associated revenue,” said an industry participant.

Another market participant from a major Asia-based airline told Platts that they typically hedge up to 12 months ahead pre-pandemic, and build their hedging position ahead of the next quarter up to around 60%-70% of their fuel requirements. However, since March 2020 the airline has stopped all hedging activities due to COVID-19.

A second source of an Asia-based airline told Platts they used to actively hedge against their fuel purchasing, usually at no more than 50% of their jet demand. With international travel restrictions decimating demand, they now procure only a fraction of their pre-pandemic fuel consumption 2 billion gallons/year of jet fuel.

Preference for crude-linked instruments

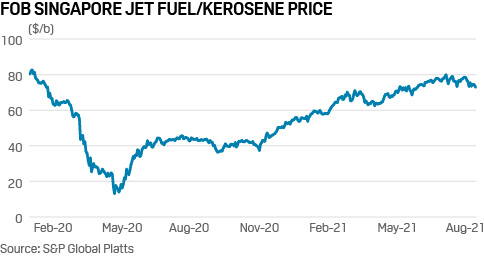

Liquidity in the FOB Singapore jet fuel/kerosene swaps market has been thin and highly volatile since mid-2020. This prompted several industry participants to optimize fuel hedging against crude-linked instruments, where liquidity is higher.

“It makes sense as the volatility in the outright [FOB] Singapore [jet fuel/kerosene] prices have largely tracked the price movements in the upstream crude market since March 2020,” said a third airline source based in Asia. “For the purpose of hedging, we monitor the price spread between [FOB] Singapore jet fuel/kerosene paper and ICE Brent futures, but mainly hedge against crude due to the much higher liquidity and price visibility in Brent futures contracts.”

The source added that the hedged volume depends on the outright price of crude futures and the periodical volatility.

“For example, if Brent futures stays relatively stable at $60/b we might hedge less. However, below $40/b or above $80/b, we might hedge a bigger percentage share of our jet [fuel] purchasing”.

It was not surprising to observe an initial uptick in activity in the Singapore jet fuel/kerosene swaps in Q2 last year, when global jet fuel prices tanked to historic lows during the peak of the pandemic. The huge downswing in FOB Singapore jet fuel/kerosene outright price encouraged more end-users to lock in their position in the derivatives market, participants said. The liquidity in Singapore jet fuel/kerosene swaps subsequently tapered off when the outright price rebounded to above $40/b in early June 2020.

“When the prices did crater, the forwards did not follow suit,” a trader said. “It would have been extremely expensive [for airlines] to hedge. Furthermore, the typical summer seasonality pull on jet demand was completely absent last year.”

“This year it’s a very different situation, with the resumption in air travel in Europe and the US drawing Asian barrels westwards, a significant improvement in Singapore jet regrade spread compared to year-ago levels, and a forward market that is backwardated.”

Supply shortages coupled with firm demand from the US West Coast lifted market sentiment, boosting the FOB Singapore jet fuel/kerosene cash differential to a premium to the Mean of Platts Singapore jet fuel/kerosene assessment over May 3-17.

The strength fizzled out when the cash differential flipped to a discount as a spike in coronavirus cases in major demand centers including China and Japan sapped the market’s short-term optimism.

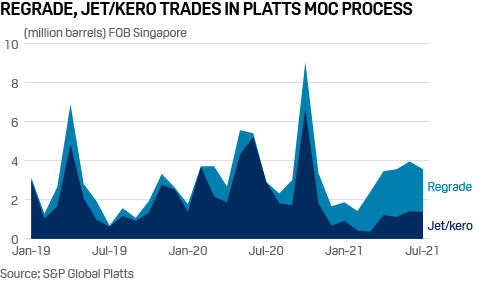

With the recovery of the Singapore regrade – the spread which jet fuel commands over gasoil – total volumes traded during the Platts Market on Close assessment process rose to 7.25 million barrels in Q2, up 81.3% from 4 million barrels traded in Q1.

Cargo outshines commercial

Domestic travel around continues to improve ahead of international travel, S&P Global Platts Analytics said in a recent report. Once the current wave of coronavirus recedes, Platts Analytics expects the next big uplift should be in international traffic.

“Our July air traffic came in ahead of expectations. Total global commercial traffic was expected to be impaired by 29% versus pre-pandemic norms, but was down only 20%,” Platts Analytics said. In the same month, global domestic travel fell 11%, beating expectations of a 22% decline, and international travel was down 44% against expectations of a 48% drop.

An airline representative from South Korea said they are seeing strong demand in cargo and domestic flights, adding that domestic flight capacity has recovered to approximately 80%-90% in July.

Air cargo markets remained resilient in June, supported by improved business confidence in the advanced economies such as the US and Europe, the Association of Asia Pacific Airline said in a recent report.

“Air cargo traffic growth, supported by strong demand for both intermediate and consumer goods from the major advanced economies, remains the saving grace,” said AAPA Director General Subhas Menon. “Many Asian economies are facing renewed challenges in bringing the pandemic under control and in progressing vaccination rollouts. Prospects for an early recovery for Asian airlines are dim unless cohesive action is taken by governments to accelerate vaccination rollouts and reopen borders safely.”

To cater to growing cargo demand against a backdrop of limited passenger flights, regional airlines were prompted to beef up air cargo business and boost “belly belt” capacity by converting a proportion of its passenger fleet to freight planes.

One regional carrier said that it was converting large aircraft including Airbus A380s and Boeing-777s, with cargo now accounting for almost 85% of its total demand. Boeing said in May that the company was adding two production lines to convert old 737-800s passenger planes into freights.

Rising infections cloud outlook

Despite firmer demand, the recovery outlook on the aviation front remains dim as the wave of delta variant infections has resulted in more flight cancellations and increased travel restrictions, industry sources said.

“Recent COVID cases and lockdown measures in northeastern Queensland have led to 60% cancellation rate for flights out of Sydney up to the Sunshine Coast, Cairns and Townsville. That’s a major impact on the business,” a source from an Australian airline said.

Singapore has been tightening its grip on border security amid the rise in cases in the region. The country will be tightening border measures in Australia and Jiangsu province, China.

Thai AirAsia suspended all its August flights and will defer paying its staff wholly or partially until September, local media reported.

Indigo, one of India’s biggest budget airlines, reported a larger-than-expected loss in the quarter ending March of around 11.5 billion rupees ($155 million) due to tepid passenger traffic.

“I think domestic airline capacity is around 70%, but international flights are still sharply curtailed. We expect global airline capacity to fully recover [to pre-COVID-19 levels] by 2023, in line with IATA’s baseline forecast,” a source with an Indian airline said.

The recovery and outlook of global aviation is highly reliant on the rate of COVID-19 infections and the measure that local authorities take to curb the spread of the virus.

Looking back to the earlier part of the year, there has been an evident uptrend in liquidity of Singapore jet fuel derivatives instruments since Q1. Total volume of Singapore kerosene paper traded during the Platts Market on Close process month-to-date in August has already surpassed that of July by 28.6% at 1.8 million barrels. There were, on average, 1.23 million barrels traded per month in Q2, compared to an average of only 0.55 million barrels traded per month in Q1.

Having said that, with rising infections in many parts of Asia stalling the pace of aviation recovery, it remains to be seen whether the same uptrend can be sustained going into Q4.

Source: Platts