Quality comes with a cost, and for Asian refiners aspiring to make low-carbon crude a bigger part of their procurement baskets it’s going to be no different.

In a region where energy import costs have a big influence on overall financial strength of most developing economies, the common view is that Asia will be moving towards embracing low-carbon crudes at a much slower pace, compared to Europe or the Americas.

Still, delegates at the 37th S&P Global Platts Asia Pacific Petroleum Conference, or Platts APPEC, were of the view that the ambition of Asian refiners looking to cut carbon footprint will only get stronger by the day. But at the same time, they had one key question in mind: How will Asian refiners strike a balance between earning robust margins, while paying higher prices for low-carbon crudes?

“In times of weak refining margins, many Asian refiners would be more concerned about staying afloat by seeking the cheapest crude they can process,” said Lim Jit Yang, advisor for Asian oil markets at S&P Global Platts Analytics. “However, the demand for low-carbon crude is expected to increase over time as companies seek to reduce their carbon footprint, which will likely to be a norm in the future.”

Price factor

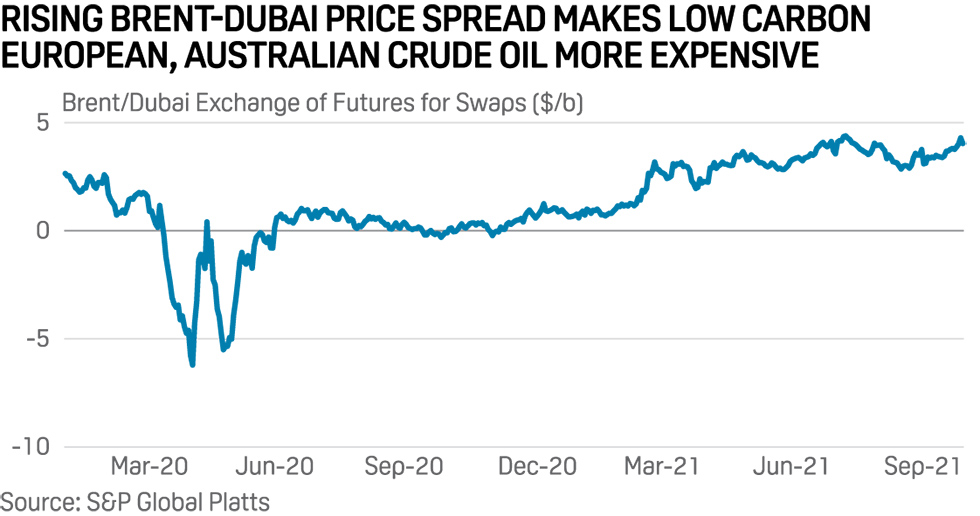

Asian refiners’ appetite for non-Middle Eastern crude grades are often determined by benchmark price spreads and related arbitrage trading margins. The Brent-Dubai price spread plays is a key arbitrage feasibility indicator for many refinery feedstock trading managers in Asia looking to buy crude from west of the Suez or low-sulfur grades from other regions.

The Brent-Dubai spread averaged $2.93/b to date in 2021, a sharp jump from the 4 cents/b average in 2020. This means various crude grades produced in the North Sea, West Africa, and Oceania that are linked to the European benchmark are less economical than Dubai-linked high sulfur Persian Gulf grades.

In addition, Australia’s low carbon Ichthys condensate cargoes have consistently commanded premium in the Asian spot market so far this year.

Among the most recent spot deals, TotalEnergies sold a 650,000-barrel cargo of low-carbon intensity Australian ultra-light crude for loading in Nov. 30-Dec. 4 to Thailand’s PTT at a premium of $2.50/b to Dated Brent.

Some Asian refiners seem to be more keen than others to regularly buy carbon neutral or low-carbon intensity European and Australian crude oil regardless of arbitrage economics or additional premium attached, to fill a certain portion of their monthly feedstock baskets.

Subdued start of trade flows

Carbon-neutral cargoes of oil imply the purchase of carbon offsets to cover the life cycle emissions of the fuel.

In January, Oxy Low Carbon Ventures—a subsidiary of Occidental Petroleum, said it delivered 2 million barrels of carbon-neutral oil to Reliance Industries. OLCV said it was the energy industry’s first major petroleum shipment in which greenhouse gas emissions associated with the entire crude lifecycle, from wellhead to combustion, were offset.

Various Japanese energy and power companies have also been active in picking up low-carbon Australian Ichthys LNG and LPG cargoes.

GS Caltex, South Korea’s second-largest refiner, purchased 2 million barrels of Norway’s Johan Sverdrup crude certified as carbon neutral at the point of production for delivery in September. Thailand’s PTT has been regularly picking up low-carbon Australian Ichthys condensate in recent trading cycles.

Simon James, vice president of crude trading and refinery optimization at Equinor, said during APPEC that with one of the world’s lowest carbon emissions from production, Johan Sverdrup would become one of the important oil fields for securing enough energy for all regions, especially Asia.

CO2 emissions from the field are extremely low, with estimates for the full field life below 0.7 kg of CO2 per produced barrel. James said this is sharply below the global field average. Sweden’s Lundin Energy, a partner in the Johan Sverdrup oil field, said June 16 all future net production from Johan Sverdrup will be certified as carbon neutral produced by Intertek, under its CarbonZero standard.

The Johan Sverdrup field runs on power-from-shore solution, allowing it to be operated without the use of fossil fuels. This means it has the lowest CO2 emissions from production of any other oil and gas field in the world, according to Equinor.

Adding the ESG feather to the cap

Apart from Equinor, Colombia’s state-run Ecopetrol is also accelerating its heavy crude marketing efforts in Far East Asia, while aiming to apply carbon offsets to its crude cargoes.

With more than 60% of Colombia’s total crude exports flowing to Asian markets, Ecopetrol President Felipe Bayon said this would provide opportunities to many Asian refiners to pick up low-carbon crudes.

For the sale and export of flagship Castilla Blend crude, Ecopetrol is initiating a pilot program for offsetting carbon emissions for heavy crude production and shipments. Bayon added that the company will work with Asian end-users to find ways to offset CO2 emissions of Castilla Blend cargoes.

Ecopetrol’s commitment to minimizing GHG emissions in the life cycle of its crude production and shipments will likely pay off as many Asian refiners and end-users are looking to enhance their ESG profiles on the feedstock procurement front.

Japanese, South Korean, Thai and Taiwanese refinery feedstock managers said on the sidelines of the APPEC conference that processing crude oil with a very low carbon intensity, such as Johan Sverdrup, would be an effective way to promote Asian refiners’ green business practice.

But for Asian refiners looking to cut their carbon footprint, the cheaper-or-cleaner feedstock debate will only intensify in the foreseeable future.

Source: Platts