[ad_1]

The Biden administration may have a carbon emissions conundrum as it seeks to resolve an outstanding dispute with the European Union over steel and aluminum tariffs inherited from former President Donald Trump.

U.S. and EU officials will work toward resolving “existing differences” surrounding steel and aluminum tariffs instituted under the previous U.S. administration before the end of the year, according to a June 15 statement. However, the Biden administration is facing pressure from steel producers and labor to keep measures in place to stem global excess steel capacity and resolve alleged market inequities.

The steel industry’s stated goal of curbing production overcapacity will conflict with President Joe Biden’s ambition to confront global planet-warming carbon emissions, according to Thomas Koch Blank, a senior principal official for breakthrough technologies at the Rocky Mountain Institute think tank. As steel producers bemoan a lack of government incentives for transitioning existing assets, they are trying to innovate and build new assets that produce low- or zero-carbon steel.

Therefore, as it stands, the industry trend toward green technology will abut any desire voiced by U.S. steel producers to stop new capacity from coming online abroad, Blank asserted.

“You have a political priority to resolve overcapacity. When you start decarbonizing the sector, that’s going to be increasingly important. You’re going to end up with more overcapacity you’re going to manage. It’s going to go from important to crucial,” Blank said in an interview. “Managing overcapacity is something that capitalism has done for hundreds of years.”

“You know, companies go bankrupt. That is not what the steel industry is lobbying for though, obviously,” Blank added.

The Trump administration applied a 25% tariff on steel imports and a 10% tariff on aluminum imports under a national security justification. Resolving the steel tariff dispute by the end of 2021 will be a “tall order,” American Iron and Steel Institute President and CEO Kevin Dempsey said in an interview. The trade group is “skeptical” that a different trade measure sufficiently addressing overcapacity could be drafted by that deadline.

“Most reporters have reported starting last week … the EU demands as facts,” Dempsey said. “There’s going to be a real effort from the U.S. administration to work something out with the EU [but] I just want to caution that this is not an easy thing to accomplish.”

Carbon-colored tariffs

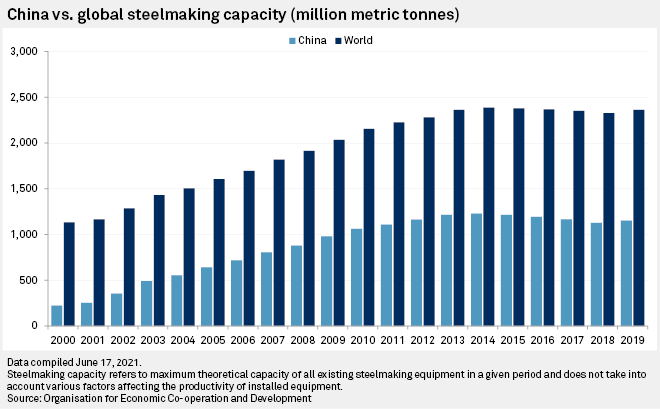

Steel producers, manufacturers and steelworkers have urged the Biden administration to keep the tariffs and argued the measures succeeded in confronting alleged global excess production capacity driven by competing markets such as China. This coalition may benefit from the blue-collar political brand of Biden, which has included reshoring jobs from overseas and supporting the industry-heavy U.S. Midwest.

The steel tariffs specifically have also accomplished another Biden priority, which is confronting planet-warming carbon dioxide emissions. Steel production in China is more carbon-intensive than U.S. output. Left-leaning academics, including a member of the Biden transition team, have said the administration should replace the Trump tariffs with policies that promote domestic steel while confronting potentially dirtier steel markets.

“Ironically, that made U.S. steel more competitive and U.S. steel has a lower CO2 footprint than the Chinese,” Blank said.

Some observers are bullish on the odds of trade talks resolving by year-end. D.C.-based trade lawyer Daniel Cannistra said in an interview that the administration’s approach to trade talks with Europe has given the impression that they will likely reach a successful conclusion in 2021. Such a resolution could include replacing the tariffs with new measures that target steel specifically from China.

“To the extent they are worried about some future [import] surge, that’s when a quota could be put in place. And that’s worked effectively,” Cannistra said. “What is Biden saying that he wants? He wants an exit strategy. He wants the smoothest, least controversial exit strategy that he can come up with.”

Source: Platts

[ad_2]

This article has been posted as is from Source