[ad_1]

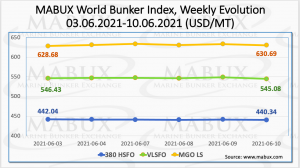

During Week 23, MABUX World Bunker Index showed moderate irregular fluctuations. The 380 HSFO index has decreased by 1.70 USD: from 442.04 USD/MT to 440.34 USD/MT, the VLSFO index has fallen by 1.35 USD: from 546.43 USD/MT to 545.08 USD/MT, while the MGO index added 2.01 USD (from 628.68 USD/MT to 630.69 USD/MT).

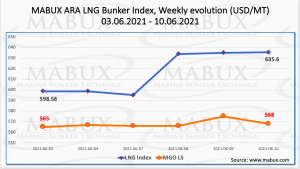

MABUX ARA LNG Bunker Index – the average price of LNG as a marine fuel in the ARA region, has risen sharply during the week by 37.02 USD from 598.58 USD/MT to 635.60 USD/MT. At the same time, the average value of LNG Bunker Index also increased by 17.03 USD. The average price for MGO LS for the same period has increased by 13.66 USD/MT. Accordingly, the average price difference between bunker LNG and MGO LS in Rotterdam has increased significantly and is at 48.30 USD (versus 33.58 USD last week). LNG bunker price indices, TTF, NBP and Henry Hub gas futures, LNG bunker market news and more are available in the new LNG Bunkering section at www.mabux.com.

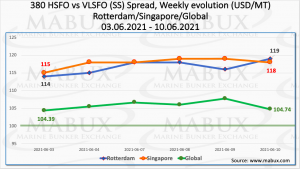

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – has risen by $ 3.59 during the week and is above the psychological mark of $ 100: $ 105.87 (versus $ 102.28 last week). At the same time, the average value of SS Spread in Rotterdam also has increased by $ 6.84 and reached $ 116.67 ($ 109.83 last week). In Singapore, the average SS Spread also has risen by $ 4.33 to 117.83 USD ($ 113.50 last week). Thus, the values of the SS Spread index in both ports are almost equal and are well above the $ 100 mark, which makes the installation of scrubbers even more cost-effective. More information is available in the Differentials section of www.mabux.com.

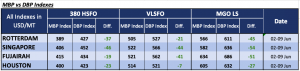

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO fuel remained undervalued in all four selected ports ranging from average minus $ 23 in Houston (versus minus $ 15 last week) and minus $ 19 in Fujairah (vs. minus $ 18) to minus $ 37 in Rotterdam (vs. minus $ 34) and minus $ 46 in Singapore (vs. minus $ 52). The most significant changes in underestimation ratio were recorded in Houston (up $ 8) and Singapore (down $ 6).

VLSFO fuel, according to MABUX DBP Index, was also underpriced in all four selected ports: in Houston the average underestimation was minus $ 7 (minus $ 3 last week), in Rotterdam – minus $ 21 (unchanged), in Fujairah – minus $ 41 (versus minus $ 40), in Singapore – minus $ 44 (versus minus $ 47). Undervalue margins in all ports have changed slightly.

As for MGO LS, MABUX DBP Index has registered an undercharge of this grade at all selected ports ranging from minus $ 27 (unchanged from last week) in Houston to minus $ 45 (unchanged) in Rotterdam, minus $ 54 (vs. minus $ 49) in Singapore and minus $ 51 USD (versus minus $ 53) in Fujairah. Here, no significant changes in the underestimation ratio were registered either.

Maersk has proposed a carbon tax on ship fuel of $450 per ton of fuel – equating to $150 a ton of CO2 – as a ‘levy to bridge the gap between the fossil fuels consumed by vessels today and greener alternatives that are currently more expensive’. As per Maersk, ‘Fossil fuels cannot keep being cheaper than green fuels. Action is required now. It is vital to consider all greenhouse gases, not just CO2, on a full life cycle analysis, otherwise we will not be able to truly decarbonize shipping by 2050 in line with the Paris Agreement’. The proposal sparked mostly positive reactions but one theme running through some of the responses was that such a tax could place a heavy burden on smaller players, and others said they prefer to see carbon trading rather than a carbon tax.

Source: MABUX

[ad_2]

This article has been posted as is from Source