Chinese imports of U.S. LNG have surged in recent months, helping to keep U.S. export facilities running close to full bore. But the purchases are short of the levels called for under the truce that ended a year-long freeze in the LNG trade between the two countries.

The Biden administration said it is conducting a comprehensive review of U.S. trade policy toward China, and top U.S. and Chinese trade officials are preparing to assess the two nations’ “phase one” trade deal under which China committed to purchasing U.S. energy goods.

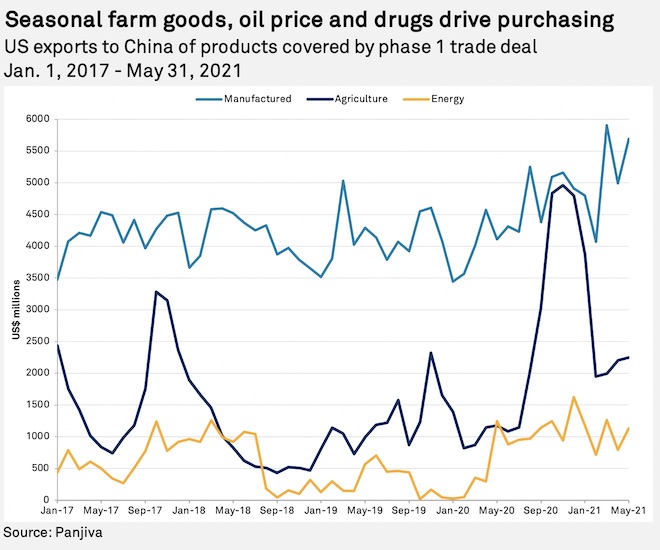

Chinese imports of U.S. LNG totaled about $2.2 billion from the time the deal was signed in January 2020 through May, according to recent data from Panjiva, a business line of S&P Global Market Intelligence that provides news and analysis about global supply chains.

In terms of volume, more than 100 tankers delivered around 350 Bcf of U.S. gas to China over that time period, according to S&P Global Platts vessel-tracking software cFlow. Over 40% of that total was in 2021 through May, with the number of shipments picking up in May and June. The volume of exports was not far behind shipments to South Korea or Japan, which are the first- and second-biggest importers, respectively, of U.S. LNG since exports from the Lower 48 began in February 2016. In April, China overtook Mexico as the third largest importer, according to the U.S. Energy Department.

As with other Chinese purchases of U.S. energy goods, the amount of LNG may be too little, too late to put China within reach of meeting its commitments under the deal. China fell another $25.4 billion behind its overall purchase commitments for the first five months of 2021, on top of an aggregate gap of $53.1 billion in 2020.

With the trade deal set to expire at the end of 2021, it remains to be seen whether Chinese commitments to buy U.S. energy goods will play a role in upcoming deal talks.

Some market observers have pointed to a tense relationship and rising trade risk heading into those talks, but a number of analysts said increasing U.S. gas flows to China may continue so long as frictions between the countries do not translate into tariffs that would make LNG deliveries to China uneconomic again.

“It’s mostly an economic story rather than a political story as to why U.S. exports to China are rising so much,” Jason Feer, head of business intelligence at Poten & Partners, said in an interview. “If the Chinese government didn’t want U.S. LNG imports, then, of course, there wouldn’t be any. But the fact is China’s economic rebound is pretty strong, and the other factor is the world drained inventories last winter. There is a real need.”

A bright spot in a faltering trade pact

Chinese gas demand is poised for a record annual increase in 2021, which is setting up its largest increase in LNG imports, according to Platts Analytics. Platts expects Chinese LNG imports to rise by 21 billion cubic meters in 2021, or about 23% year on year.

U.S. exporters, meanwhile, benefited from tightening global supplies and strong LNG prices in Asia and Europe compared to cheap U.S. gas costs. Feedgas deliveries to the six major U.S. LNG terminals have been trending close to 11 Bcf/d.

China agreed under the trade deal to more than double its imports of a basket of 548 U.S. products that would amount to an extra $200 billion in purchases through 2020 and 2021 compared to 2017 levels. It called for energy products — which include LNG, oil, refined petroleum products and coal — to account for $52.4 billion worth of China’s purchases over 2017 levels across the next two years, although product-specific details about the goals were not released.

Exports of energy products have remained a bright spot, climbing 80.3% during the first five months of 2021 compared with 2017 levels, according to Panjiva. LNG played a large part in driving that uptick, but experts have been skeptical from the time the trade deal was signed that China would meet its commitment to buy energy products and about how much U.S. LNG it could import, citing market constraints.

Before the deal, trade tensions prompted a 13-month halt in U.S. LNG deliveries to China, including spot and contracted volumes. After signing, China allowed exemptions to a 25% tariff on LNG that enabled Chinese buyers to resume purchasing the fuel in March. Deliveries began arriving the next month.

A coveted market

China is vying to become the world’s biggest importer of LNG in the coming years, making the country a coveted market for U.S. LNG exporters. The Trump-era trade war between the U.S. and China also took a severe toll on negotiations for long-term supply deals between U.S. LNG exports and Chinese buyers, and it remains unclear whether the upcoming trade talks could lead to an agreement that supports such deals.

“It is hard for me to imagine that any Chinese company is going to be willing to sign the kind of contract that you have to sign without some sort of guidance from the Chinese government that would likely take the form of some sort of trade agreement,” Feer said. “The Chinese importers didn’t have too much trouble working around tariffs and the restrictions on imports, and they could do it again if they had to, but it costs money, and it was disruptive.”

The only U.S. LNG producer that has a direct long-term supply agreement with a Chinese counterparty is Cheniere Energy Inc. Cheniere has announced some shorter-term commercial progress in China since the phase-one deal was signed. Just three days after the 2020 election, China’s Foran Energy Group Co. Ltd. and Cheniere confirmed signing an agreement that called for negotiating a five-year supply deal by the end of the year that would likely include 26 shipments of LNG starting in 2021.

“We have a great commercial engagement with our Chinese counterparties,” Cheniere Executive Vice President and Chief Commercial Officer Anatol Feygin told investors during the company’s most recent earnings call in May. “We fully expect to have more commercial success there.”

High-level negotiations between the two nations may impact LNG exporters. During those discussions, the Biden administration may prioritize issues such as intellectual property protection and market access, according to a recent analysis by ClearView Energy Partners. A more hawkish stance by the U.S. on issues, including alleged forced labor practices and Taiwan, could reduce the likelihood of new agreements being reached, according to Panjiva. China previously denied that it is committing human rights abuses in Xinjiang.

A review of the U.S.-China phase one trade deal was due in February but has yet to take place apart from some initial talks between U.S. Trade Representative Katherine Tai and China’s Vice Premier Liu He.

The main incentive the U.S. may be able to offer China to improve relations may be cutting tariffs, according to Panjiva. China could offer the stick of reining in its increased purchases from the U.S. of goods covered under the trade deal.

“China’s purchases of U.S. energy goods stipulated by the phase one trade deal continue to taper off, and Beijing’s limited compliance seems increasingly to be more incidental than intentional,” ClearView analysts said. “Despite the continuing purchasing shortfalls, we still do not expect U.S. Trade Representative Katherine Tai to commit significant political capital to defending (or extending) the purchase obligations when she engages with her Chinese counterpart, Vice Premier Liu He.”

Source: Platts