[ad_1]

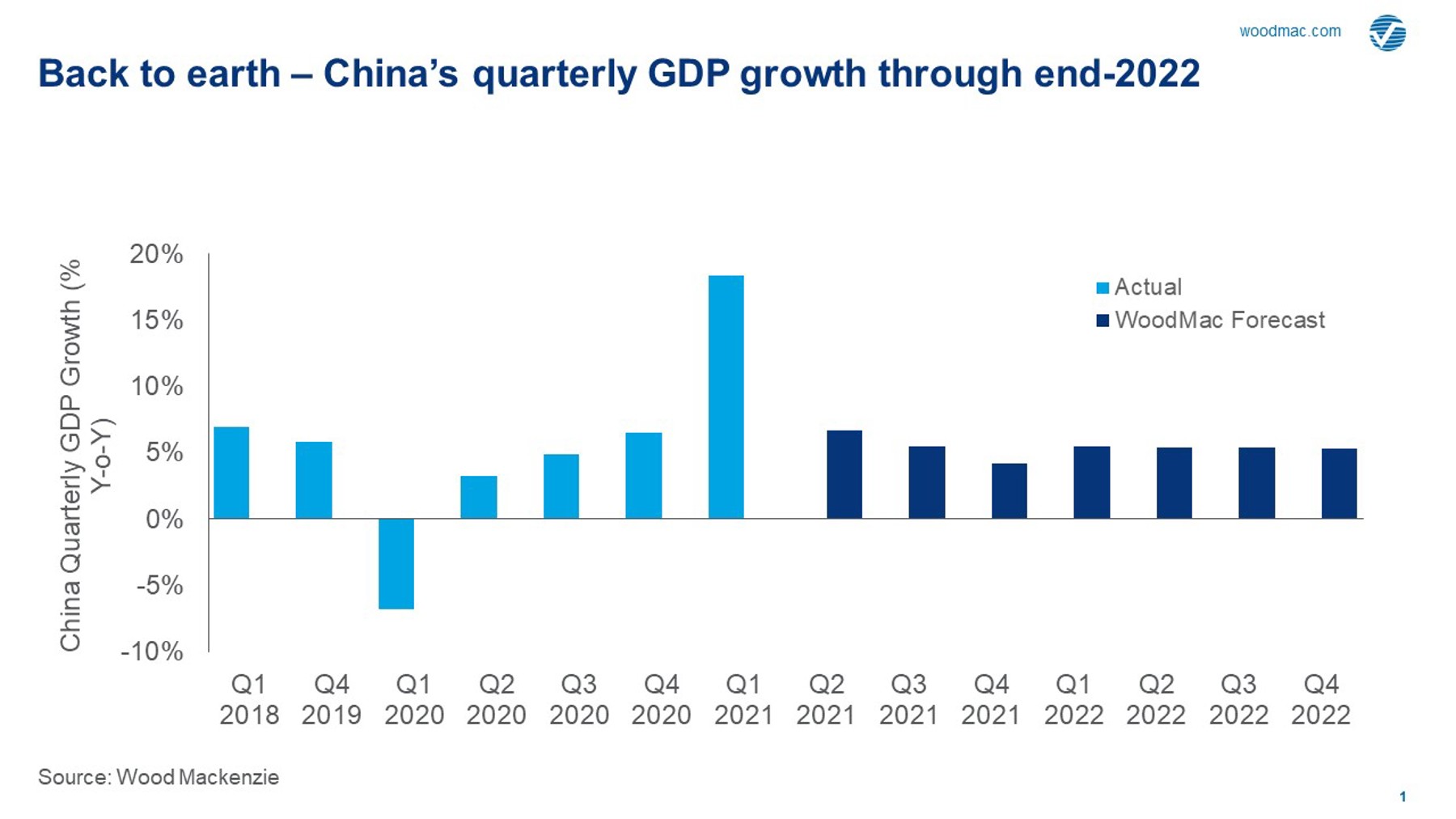

China’s National Bureau of Statistics could never be accused of hyperbole. With its recent data release showing China achieved record Q1 economic growth of just over 18% year-on-year, the bureau announced that “the national economy made a good start” to 2021. And while this rebound came off the back of a terrible Q1 last year as Covid-19 tore through China’s economy, official first quarter growth in 2021 nonetheless represented the biggest jump in Chinese GDP since the reporting of quarterly data began almost 30 years ago.

This pace of recovery is being felt across global energy markets. Growth in China’s demand for oil is supporting the recovery in crude prices, while an almost insatiable appetite for LNG has helped push Asian spot prices to an eight-year seasonal high in recent days. But the impact of the recovery is also being felt in provincial energy markets within China, particularly in the coal and power sectors as rapid economic growth combines with a spike in early summer temperatures. To understand more I spoke to our senior economist for APAC, Yanting Zhou, about how runaway growth doesn’t come without consequences.

Can China continue its blistering Q1 growth?

The pace of year-on-year growth in Q1 is primarily about what happened in the same quarter last year as the coronavirus lockdown put the brakes on the economy. China’s successful containment of the virus domestically and stimulus-led recovery did the rest. Looking forward, we see the Chinese government continuing to exercise macro and micro economic control over the economy to manage growth at more sustainable levels. While the current quarter will also be strong based on a weaker Q2 2020, we anticipate quarterly growth from Q3 this year through to the end of 2022 to average around 5.2%.

How is the rapid pace of growth impacting China’s energy markets?

The pace of growth has seen macro-economic pressure building as high commodity prices stoke inflation and electricity supply struggles to keep up with soaring demand. Power shortages in Guangdong and Yunnan provinces worsened in May, due in part to strong manufacturing output in Guangdong and the start-up of several energy intensive projects in Yunnan. High coal prices and weaker than expected rainfall have also limited power supply.

These power shortages are starting to slow industrial output. Guangdong is China’s biggest manufacturing hub and with power shortages leading to electricity rationing and reduced operations for industrial users there’s a lot at stake, particularly for wider supply chains.

What’s behind China’s growth in power demand?

Recovery – both at home and overseas. Power demand grew by almost 30% in Guangdong in the first four months of 2021, compared to a 13.2% increase nationwide. Domestic consumption is a big part of this, but it’s also about export growth: exports already accounted for about 40% of Guangdong’s GDP in 2020 and rose by 30% year-on-year in the first five months of 2021 alone.

Weather has also played its part, with above-average temperatures in southern China leading residents to crank up air conditioning. Regional grid operator China Southern Power Grid reports that the spike in temperatures since May has seen current peak load demand already exceeding the 2020 high, and the mercury is still rising as we move further into summer.

How are power generators responding?

More than a third of Guangdong’s power demand is met by local coal-fired plants, but high coal prices and limited coal supply are restricting power generators’ willingness and ability to increase output. Domestic coal supply has been constrained by production restrictions in many of China’s key coal-producing areas. Meanwhile, thermal coal imports also dropped by almost a quarter year-on-year in the first four months of 2021.

Around another 30% of Guangdong’s power demand is satisfied by imports from Yunnan and other provinces. Yunnan adjusted down its power export quota to Guangdong in 2021 to meet its rising local power demand. This has been compounded by lower-than-expected rainfall in May, resulting in Yunnan further reducing its scheduled power exports to Guangdong by almost 29% from January to May.

What is the impact on the wider economy?

Guangdong’s manufacturing sector has been impacted since May. Many sectors there reduced operations to as little as three days a week in May due to electricity rationing, while others have switched production to non-peak hours or are relying on higher cost self-generated power.

It’s worth pointing out that industrial sectors using natural gas and other energy sources have not been impacted. Fuel costs have of course risen considerably but supply availability has remained steady.

Perhaps more concerning for the central government is evidence of accelerating inflation. Soaring energy prices, power shortages and production constraints are starting to push up costs and prices. Given Guangdong’s significant share of intermediate goods and its role in both domestic and global supply chains, delays and rising costs for orders will stoke price inflation beyond the province itself: in May, China’s producer price index (PPI) jumped by 9% from a year ago, the biggest increase since July 2008.

Are you expecting power shortages to appear in other provinces?

Looking across China, with industrial production remaining robust throughout the country, we expect steady growth in power demand. With higher temperatures also driving increased electricity consumption, the provinces of Hunan, Shandong and Zhejiang are all facing potential power shortages this summer.

This is good news for gas-fired generators, but the situation for coal-fired power is unlikely to improve significantly. The government’s efforts to control commodity prices have had little impact on coal prices to date, and producers are going all out to prioritise safety over output ahead of the 100th anniversary of the CCP on 1 July. As such, we see little respite from high coal prices in the near-term. And with high coal prices leading to power shortages, the pace of China’s economic recovery could look increasingly uneven as we go through the summer.

Source: Wood Mackenzie

[ad_2]

This article has been posted as is from Source