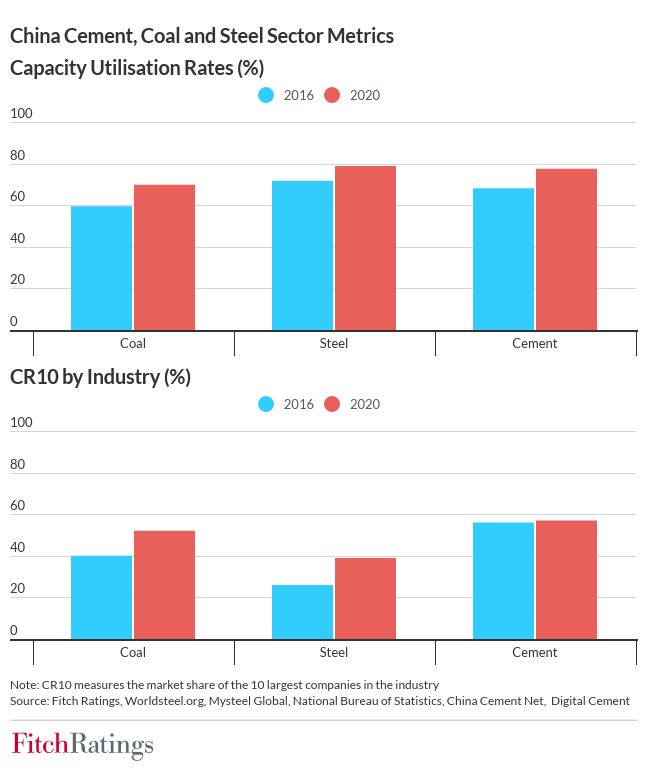

Credit polarisation among China’s coal, steel and cement firms is set to intensify amid peaking demand, ongoing consolidation and increasingly differentiated local-government support for state-owned enterprises, says Fitch Ratings.

We expect China’s policymakers to focus on eliminating uncompetitive capacity and financially unviable producers in the three industries. Meanwhile, we believe policymakers will encourage production capacity to move towards resource-rich areas with low operational costs or to regions that exhibit strong market demand.

Further sector consolidation is likely to see weaker producers exiting the market or being acquired by large, competitive industry leaders. We believe acquirers will be selective in choosing targets and will favour those with product leadership or cost advantages in order to create synergies.

We expect continued capacity cuts to support strong coal and steel prices over the medium term, although the record-high levels seen in 2021 will not be sustainable once production picks up. In addition, long-term demand upside for steel, coal and cement is likely to be limited due to China’s push for carbon neutrality in light of the sectors’ carbon-intensive nature

Note: CR10 measures the market share of the 10 largest companies in the industry Source: Fitch Ratings, Worldsteel.org, Mysteel Global, National Bureau of Statistics, China Cement Net, Digital Cement

The supportive price environment provides an opportunity for sector de-leveraging, but the impact on individual companies and their ratings is likely to be uneven. Producers that manage to reduce debt and optimise their capital structure will help preserve financial flexibility against the next cyclical downturn. However, many coal and steel companies have continued to increase their debt stock in recent years, with high interest costs and capex eating up earnings accretion.

Companies with unviable capital structures and large exposure to short-term debt capital market financing may face heightened default risk should liquidity tighten and investor sentiment weaken.

Source: Fitch Ratings