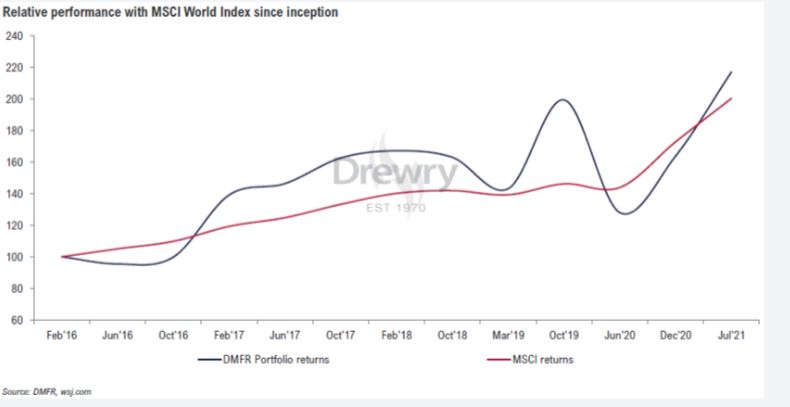

Back in 2016, Drewry Maritime Financial Research (DMFR) launched a model portfolio – selecting stocks within the global maritime space to ensure a balanced approach to managing risk in a low return environment.

Recommended stocks are hand-picked based on the fundamentals of each entity, coupled with near-term triggers. The objective of the model portfolio is to generate optimum returns in conjunction with moderate risk.

August 2021

• The boom in the container market is continuing with no sign of abatement in the near term. Container freight rates on some routes are close to USD 13,000 per 40-foot container, which almost guarantees record profitability for carriers this year. Rising freight rates have ensured that stock markets remain strong, with more room for further upside. The recent disruption at Yantian Port, port congestions, logjams and a higher freight as an outcome could be a recurring theme until 1H22. While the blockage of a key shipping artery such as the Suez Canal is a rare likelihood, the risk that further outbreaks of Covid close to major hub ports remain ever-present, particularly given the prevalence of new viral variants.

• Drewry’s Port sector index continued to surge, gaining strength from global vaccination drives and rebound in trade. The index in 2Q21 grew by 9.6% QoQ (vs 1Q21: 8.9% and 4Q20: 16.4%) on the back of higher returns posted by global/international terminal operators vis-à-vis their more geographically constrained regional terminal peers. Drewry’s current forecast is for a 10.2% increase in global port handling in 2021. This equates to a more than 80 mteu uplift in port volumes over the course of the year, compared to the 9.5 mteu reduction recorded in 2020. The recovery is expected to be sustained into 2022, after which annual growth will normalise to 3.0-3.5%. Despite the near-term optimism, there remains a high degree of uncertainty attached with the spread of new variants of the virus (Delta and Lambda) and a sooner-than-expected interest rate hike – both of which can take a toll on economic growth prospects.

• Dry bulk shipping has revved up in the past year. A market reminiscent of the bull run seen in 2005-2008 has prompted existing operators to expand their fleet and new operators to step in. London saw its first shipping IPO in May 2021 in Taylor Maritime. The main driving force behind the rally has been China. The country’s robust demand for commodities has boosted the global dry bulk trade. Meanwhile, we remain upbeat about the EU’s and Asia’s coal imports. The commencement of grain season in Europe and Russia is likely to aid the demand for Panamaxes and Supramaxes in the continent and the Black Sea.

• For 2021, we expect LNG trade to improve by 5.9% to reach 377 million tonnes, aided by lower gas storage in Europe and high Asian demand for gas power generation. Additionally, South America and the Middle East are also expected to witness an uptick in seasonal LNG demand due to higher temperatures. LNG spot prices are expected to remain high over 2H21 due to the strong demand in all regions with sudden surges expected in 4Q21 from Europe. Strengthening oil prices will also raise the cost of oil-linked contracted LNG in 2H21, which is likely to ease in 2022.

• We expect LPG shipping rates to consolidate further over the next month. Low fixtures and narrow US-Asia propane price arbitrage have contributed towards a lower tonne-mile demand. Subsequently, there is a long list of open vessels along with possibilities of relets that is likely to keep shipping rates under pressure in the short term. On the other hand, new orders continue to pour in, causing concerns over long-term earnings for vessels. So far, 72 vessels have been ordered in 2021, compared to just 13 in the entire 2020.

• Crude oil consumption and trade is on the rise over the past six months; additionally, crude oil inventory has dropped below the five-year average. implying limited inventory drawdown in future. The tanker market bottomed out in late 2020, and we now expect an increase in crude oil trade with a recovery in oil demand and rising OPEC+ output. Demand optimism amid rapid vaccination drives in major economies; easing restrictions in the US, Europe and India; resumption of economic activities; and a decline in inventories will also support the recovery in crude oil consumption and tanker demand in 2H21.

Archive of Model Portfolio Updates

December 2020

• During the period (30 June 2020 to 4 December 2020), our portfolio gained about 28.5% in value while Dow Jones Global Shipping Index (DJSGH) gained over 52%. In comparison, the benchmark MSCI index gained about 20%. Shipping equities were hit hard in 1H20 largely due to demand-side constraints, but increasing stimulus packages and vaccine hopes have revived the industry.

July 2020

• During the period (28 October 2019 to 30 June 2020), our portfolio lost about ~36% in value while Dow Jones Global Shipping Index (DJSGH) lost ~29%. The benchmark MSCI index slid about 1.3%, and shipping equities in this period were hit hard in 1H20 largely due to demand-side constraints. Meanwhile, key geopolitical risks continue, including the worsening ties between the US and China.

October 2019

• During the period (13 March 2019 to 28 October 2019), our portfolio gained a substantial ~39% in value while Dow Jones Global Shipping Index (DJSGH) gained ~14%.

• The benchmark MSCI index rose by a mere 5.5%. Shipping equities in the period have seen a rally in the last couple of months largely due to supply-side discipline.

• Key geopolitical risks remain including, US-China trade negotiations, ‘no deal’ Brexit and US sanctions on Iran and Venezuela.

March 2019

• During the period (4 October 2018 to 15 March 2019), our portfolio lost 12.2% in value and the Dow Jones Global Shipping Index (DJGSH) lost 14.7% in value.

• Shipping equities have retracted sharply owing to the seasonal weakness in the bulk and container trades, and the persisting uncertainty in the macro business environment. As a result, the portfolio lagged behind the benchmark index MSCI, which declined 1.8% during the same period.

• Weakness in stock performance also attributed to the sell-side pressure created during December 2018.

• The portfolio modestly outperformed the sectoral benchmark the DJGSH by 2.6% during the period. On an annualised basis, the DMFR portfolio has returned 12.7% since its inception (February 2016) compared with 11.7% generated by the MSCI and -5.6% by the DJGSH.

October 2018

• Our model portfolio is down 2.5% in the period starting 1 March 2018 to 4 October 2018, but continues to negotiate headwinds – as evident by the 6.3% outperformance against Bloomberg’s BI SHIP.

• In this same period, however, the portfolio lagged behind the global benchmark – the MSCI World Index (up 1.2%) – as shipping stocks across the board, with the exception of the tanker sector, weakened. The allocation to stocks of large dry bulk carriers and tanker operators helped minimise losses.

• We have modified our strategy to increase exposure to the tanker shipping sector to 47% from 11% earlier as we believe the tanker shipping market has bottomed out.

• In terms of portfolio concentration, we have increased the number of stocks in our portfolio from 10 to 13 as we now include more stocks, especially in the tanker and LNG sectors.

March 2018

• Our model portfolio gained 2.8% between November 2017 and February 2018, outperforming its sector-specific benchmark – Bloomberg’s BI SHIP (down 4.5%) – as a result of the rebound in the dry bulk and LPG shipping stocks. Meanwhile, the performance of the DMFR model portfolio lagged behind that of the global benchmark – the MSCI World Index (up 5.2%) – as we witnessed a disproportionate correction in global shipping stocks since the start of 2018. Our timely increase in allocation to gas shipping stocks benefited the portfolio as value-buying emerged, particularly in the LPG shipping space.

• In November 2017, we increased our allocation of LPG shipping stocks from 7% to 16% on the back of improving demand-supply fundamentals.

• The overall LPG vessel fleet is likely to expand 5% in 2018, compared with the average annual growth of 16% in the last two years. We had been confident on the coaster segment since the middle of last year, and our view is substantiated by the increased rates for smaller vessels. Download March 2018 Report

October 2017

• Our model portfolio gained 11.1% between July and October 2017, outperforming its sector-specific benchmark – Bloomberg’s BI SHIP (up 5.2%), and also MSCI – the global benchmark index (up 6.8%).

• This out-performance was a result of the continued recovery in the dry bulk and liner shipping sectors. We have maintained our exposure to liner stocks although we have reshuffled the allocation based on valuations.

• Our increased allocation to gas shipping stocks benefited the portfolio as value-buying emerged, particularly in the LPG shipping space. Meanwhile, crude tanker operators continued to reel under pressure and the stocks under our coverage declined since our last update in July. Download October Report

June 2017

• Our model portfolio gained 3.2% from March 2017 to June 2017, clearly outperforming its sector-specific benchmark, Bloomberg’s BI SHIP (down 2.5%), while being lower than MSCI, the global benchmark index (up 4.6%).

• This outperformance was a result of our larger allocation to container shipping companies and port operators. However, at average P/B valuations of 2x for liner companies, most of the positive developments are in the price, and hence we believe it is time to book profit in names such as Maersk and OOIL, which have led the rally in the liner space.

• We also trimmed our exposure to port operators in view of the surge in share prices especially ICTSI, which we downgraded to Neutral in May 2017.

February 2017

• First year’s performance, Model Portfolio returns 38%. Download full report

• In 2Q16, we made a tactical shift to increase allocation to the dry bulk sector as we upgraded it to Neutral, backing our conviction of the bottom in the dry bulk market. We downgraded the tanker segment considering its large orderbook, significant dividend cuts ahead and were also discouraged by stagnant asset prices despite healthy freight rates. Our conviction call for 2016, “Long dry bulk, short tankers” generated the highest alpha.

• In 3Q16, our portfolio construct was geared for higher risk and we increased our allocation to the dry bulk sector to 42% as we expected the upward trend in stock prices to resume after a period of consolidation in 2Q16. The trade played out handsomely as our portfolio generated a return of 40% between October 2016 and February 2017.

• Our portfolio defied a terrible year for the industry to produce a 38% return in our first year out. The model portfolio markedly outperformed the benchmark indices, BISHIPGP Index (Bloomberg Intelligence Marine Shipping Index, 14%) and MSCI World Index(19%) by a big margin.

• For 2017, lowering allocation to dry bulk stocks; increasing weightage on container trade. We have reduced our allocation to the dry bulk segment to 31% from 42%. The value play is over in our view and we believe stocks could be at the risk of “too soon too fast” in the near term. Conversely, we believe that the worst is over for the container shipping and we see higher returns for the sector in 2017-18. We have increased the allocation to the sector from 8% to 27%. The port sector is another major constituent of our model portfolio for 2017 as world trade recovery gathers steam and earnings remain resilient for our portfolio constituents.

• We are Neutral on gas shipping as we believe the stocks are trading in a fair territory, while we maintain our Unattractive stance on tankers.

October 2016

• Our model portfolio outperformed key benchmark indices from June to October, although it is still down 6% from February 2016. The portfolio generated annualized returns of 15.7% during the four-month period starting from 16 June 2016.

• We continue to stick to our thesis that dry bulk names will be the outperformers in 2017, and have added Star Bulk Carriers because of its high spot exposure and large Capesize fleet.

• We have increased allocation to the Port sector as the global throughput growth is stabilising and hence earnings will remain resilient in our view; we have included China-COSCO Ports and ICTSI.

June 2016

• We made a tactical shift to increase allocation to the Dry Bulk sector in June 2016 as we believed the bottom had been reached early in the year. Meanwhile, we downgraded the Tanker segment to Neutral on increasing vessel supply.

• We reshuffled our portfolio to play the recovery in the Dry Bulk shipping sector albeit from a very low base, and believed that the beaten-down Dry Bulk names could provide superior risk-adjusted returns.

About our Model Portfolio

In 2016, Drewry Maritime Financial Research (DMFR) launched a model portfolio – selecting stocks within the global maritime space to ensure a balanced approach to managing risk in a low return environment.

Recommended stocks are hand-picked based on the fundamentals of each entity, coupled with near-term triggers. The objective of the model portfolio is to generate optimum returns in conjunction with moderate risk.

It is important to note that shipping is a high-beta sector; it is therefore not uncommon for shipping stocks to under-perform or out-perform the financial markets by a wide alpha.

Source: Drewry