Container xChange, one of the world’s fastest growing tech companies and the market leaders for trading and leasing of containers, have published container prices data trends and insights soon after the Golden Week concludes in China and as the world prepares for Christmas holidays shopping season. The data indicates that the average standard container prices in China have plunged both for trading and leasing.

“We are experiencing improvement in market situation as the one-way leasing charges, spot rates and other freight costs are starting to stabilize and average standard container prices are witnessing a drop for the first time in many weeks. Though we are still yet to see how the market responds further to inventory stocking by the US importers in the coming months, these are good signs of market correction. The drop in prices could also possibly be only a temporary decline because of the Golden week in China if the prices do not decline further.” comments Christian Roeloffs, founder and CEO, Container xChange

“The easing prices show temporary consolation in the global container shortage crisis. There are possibilities that the trend continues because we are half way through the busiest time for the shipping industry. Retailers are looking to pile up stock ahead of the Christmas holidays and the falling prices could well become the new normal from hereon. This could probably be a very early sign of stabilization of the market. We will continue to monitor the prices and availability but for the time being, this is good news for the industry.” said Dr. Johannes Schlingemeier, founder and CEO, Container xChange.

Average trading prices in China fall by 22%

The average trading price of 40 high cube containers is falling in China since week 39 just ahead of the Golden week. From $8516 in week 39, the average prices have plunged to $6598 in week 42, a 22.5% decline which is the biggest decline witnessed this year in China. The peak has already been touched at $8576 which was a 52% jump from week 27 (first week of July).

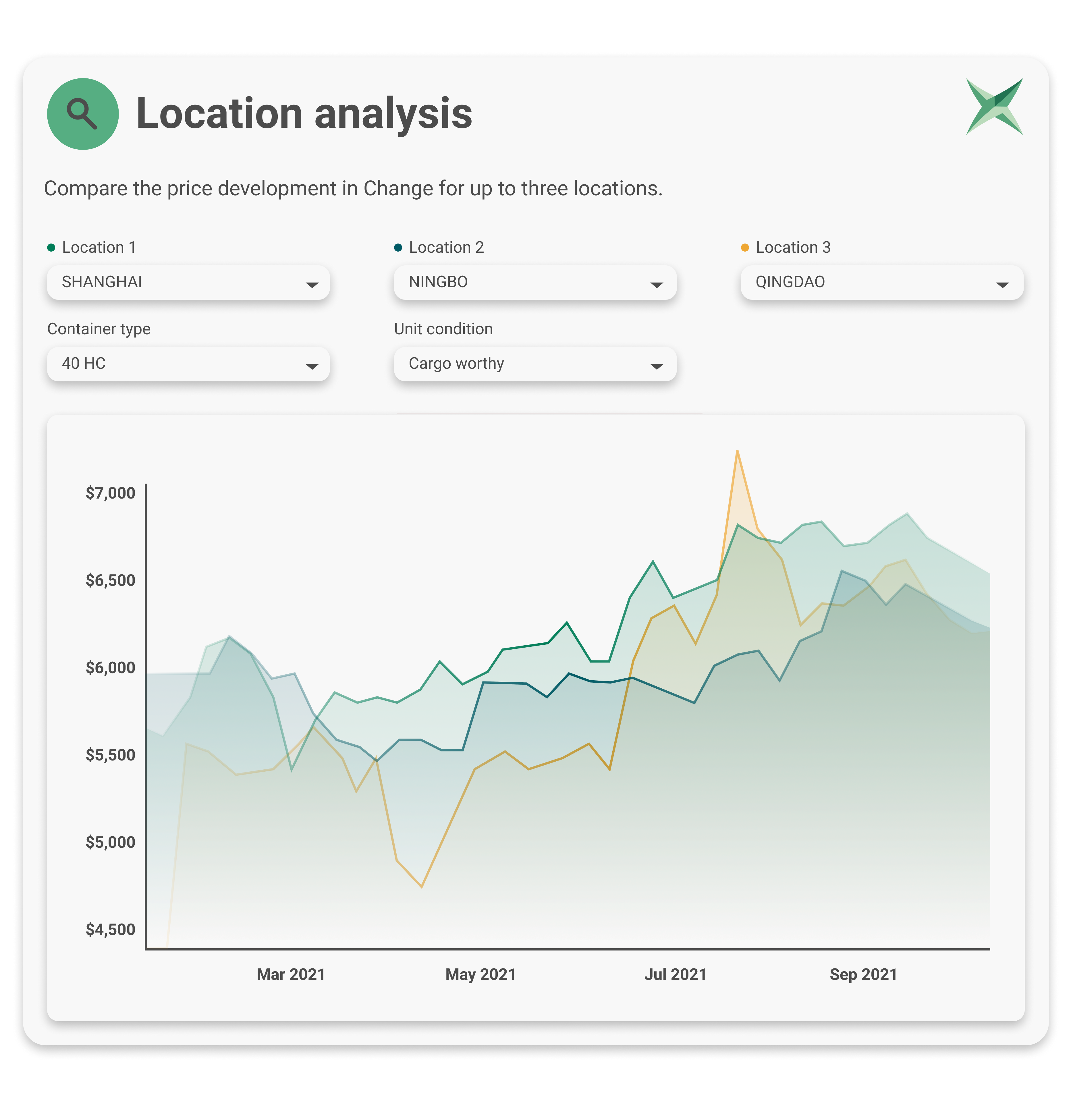

At different ports in China, the average trading prices have declined ranging from 1 % TO 11% for 40 high cube containers at different ports in China, Qingdao recording the highest 11% plunge from last month, Ningbo 2%, Shanghai 3.4%, Shenzhen 1.7% and Tianjin 0.5%.

In Ningbo, for instance, average prices for 40 high cube containers peaked in the week 38 (20-26 September) at $7184 and have been falling every week since and now stands corrected at $6803 in the week 41 (decline of 5.6%). Further market price correction is most likely expected as this rate is still far from $5580 in the week of 27 (first week of July).

A 20 ft dry container now costs on an average $3000 which is plateaued since the beginning of September from $3017. The average prices of a 20 ft dry container have reduced from the last week at Shanghai port (from $3359 – $2847), Qingdao port (from $2982 – $2794) and at the Ningbo port (from $ 4300 to $3940).

As per the platform data, 46 ports globally experienced a moderate pullback in average container prices. The hotspots include China, Vietnam, and United states. All these price falls indicate improvement in congestion which caused sky rocketing freight costs all over the world.

Leasing rates in China down 35%

The average one-way leasing pickup charges for the China-US stretch are down to $1800 from $2767 in one week (from week 39 to week 40), a 35% plunge, the highest recorded this year on this stretch. Similarly, these rates have also reduced for stretches Ex China to few ports in Europe (Hungary, Netherlands, Slovakia) and Russian Federation.

The average one-way leasing pickup charges have slumped from $3931 to $3621, a decline of 8% on the China to UK stretch from week 39 to week 40. Similarly, a 5.4% decline from $3646 to $3450 on the China to Belgium stretch during the same period.

While the demand will continue to stay strong as the retailers aim to fill the stock ahead of the Christmas holidays, the all-in rates are expected to stay strong too. The situation is more likely to improve by early November and further after the Chinese New Year in February 2022.

Source: Container xChange