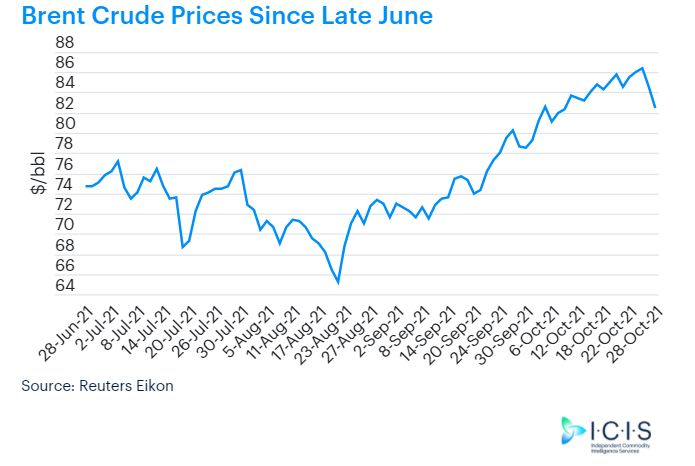

Oil prices fell by more than $2/bbl on Thursday, with Brent crude dropping to its lowest in two weeks after official data showed an unexpected rise in US crude inventories.

At 02:45 GMT, Brent crude was down $2.11/bbl at $82.47/bbl, after touching a session low of $82.32/bbl.

US WTI fell by $1.84/bbl to $80.82/bbl after dropping to a session low of $80.58/bbl, down $2.08/bbl.

Weekly supply statistics from the Energy Information Administration (EIA) showed a much greater-than-forecast build in US crude oil inventories.

Crude stocks rose by 4.3m barrels in the week to 22 October.

Gasoline stocks in the US, however, fell by 2m barrels to the lowest in nearly four years last week, according to the EIA.

Inventories at the Cushing, Oklahoma NYMEX delivery point are being depleted, reflecting rising domestic demand for gasoline and diesel, but also a widening backwardation market structure that discourages building inventories.

“Crude holdings at Cushing Oklahoma fell by the most since January (2021) to about 27.3m barrels, the lowest level since Oct 2018,” UOB Global Economics & Markets Research said in a note.

“The second stab at lower oil prices came via the news that Iran will return to nuclear talks next month, and that sparked concerns that this may pave the way for a substantial return of Iran crude supply to the market,” it said.

Source: icis by Nurluqman Suratman https://www.icis.com/explore/resources/news/2021/10/28/10699257/crude-slumps-by-2-bbl-on-sharp-increase-in-us-inventories