The seaborne coal trade has been one of the few “dark horses” of the dry bulk market over the past couple of years. In a recent analysis, shipbroker Banchero Costa commented that “2020 proved to be a truly terrible year for global seaborne coal trade. Total global loadings in the 12 months of 2020 were down -12.7% year-on-year to 1130 million tonnes, according to vessels tracking data from Refinitiv. Despite all the global talk about “going green” and “fight on carbon”, coal trade was still growing strongly until 2019. It expanded by +2.5% in 2019 and by 3.2% in 2018. However, Covid-19 and its associated lockdowns proved a body blow”.

Meanwhile, according to the shipbroker “in 2021 things are still very bad, but we are seeing some modest signs of recovery, or at least stabilisation. In the first 5 months of 2021, global seaborne coal trade declined by -1.9% y-o-y to 476.8 mln tonnes. However, the worst was in the first quarter, as 1Q 2021 recorded a -8.4% y-o-y decline to 279.3 mln t. Instead, in April 2021 trade rebounded to 96.4 mln tonnes, which was +6.3% up y-o-y compared to the same month last year, although it was still -10.5% down from April 2019. In May 2021 global coal trade increased further to 101.1 mln tonnes, which was +12.0% y-o-y compared to May 2020, and the highest monthly figure since March 2020. However, this was still down -10.9% from May 2019”.

According to Banchero Costa “mainland China’s seaborne coal imports in the 12 months of 2020 declined by -8.2% y-o-y to 242.0 mln tonnes. However, this was very uneven, with the year starting strongly and things really deteriorating towards the end. In 1Q 2020, China imported 69.4 mln tonnes of coal, which was a positive +14.8% y-o-y increase, in a quarter normally affected by the CNY. In 2Q 2020, imports stayed at around 70.4 mln tonnes, which was still +1.8% y-o-y. In 3Q 2020, imports to China declined to 58.1 mln tonnes, down -20.6% y-o-y. In 4Q 2020, imports declined further to 44.1 mln tonnes, -27.5% y-o-y. In the first quarter of 2021, China imported 61.0 mln tonnes, which represents an improvement compared to the second half of last year, but is still down -12.1% from the first quarter of 2020. April 2021 and May 2021 were no better, with -27.2% and -13.4% y-o-y respectively”.

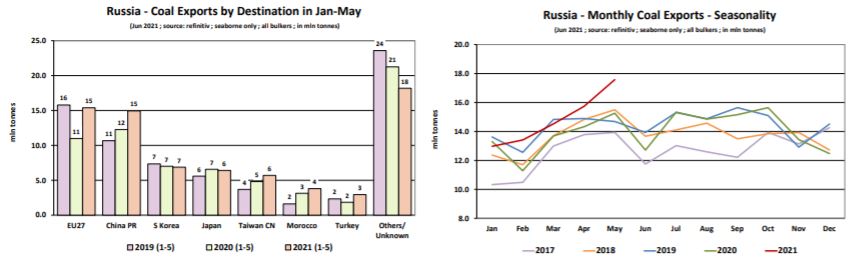

“Overall in the first 5 months of 2021, Mainland China imported 97.0 mln tonnes of coal, which represents a -15.3% y-o-y decline from the same 5 month period last year. In terms of sources of the shipments, things are changing quite a bit. Indonesia is by far the top supplier of coal to China, accounting for 59% of China’s imports so far in 2021. Arrivals from Indonesia increased by +8.7% y-o-y to 56.9 mln t in the first 5 months of 2021. The second largest supplier is now Russia, accounting for a 16% share. Shipments from Russia to China increased by +29.8% y-o-y to 15.4 mln tonnes in the first 5 months of 2021, from 11.9 mln tonnes in the same period of 2020. Volumes from South Africa surged by +307.7% y-o-y to 5.2 mln tonnes so far this year, from just 1.3 mln tonnes in the same period last year. South Africa now accounts for 5.3% of China’s total seaborne imports. Perhaps surprisingly, shipments from the USA to China also surged, by +328.3% y-o-y to 5.1 mln t in the first 5 months of 2021, from 1.2 mln tonnes in the same period last year. The USA now account for 5.3% of China’s seaborne coal imports. Shipments from Ukraine also increased by +39.8% y-o-y to 3.6 mln tonnes. From Canada volumes increased by +19.7% y-o-y to 3.3 mln tonnes. From Australia, shipments are down -94.4% y-o-y to just 2.5 mln tonnes in the first 5 months of 2021, down from 37.0 mln tonnes in the same period last year. Australia’s share of the Chinese market is now just 2%, from 32% in this period last year”. Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide