Revamped demand for commodities from grains to coal powered a surprisingly strong recovery in the dry bulk shipping market for the first six months of 2021. Both freight levels and earnings reached multi-year highs. Supramaxes have now taken the lead as the highest-earning bulker size, as the geared ships continue to outperform larger vessels and benefit from the resurgence in economic activity around the world.

Although uncertainties still loom large due to the global pandemic, many countries are recovering economically and actively rebuilding commodity stockpiles, and expectations are that shipments will increase further in Q3, while freight rates will remain steady. Grain shipments and ballooning minor bulk demand, along with an imbalance in fleet positioning, firmed the dry freight market in Q1 and supramax freight rates recorded significant rebound stemmed from sharp year-on-year growth in cargo flows.

High market rates experienced in the first quarter extended in the following months and, before the end of June, the supramax freight index rose 48 points to 2,802 on Friday June 18, its highest level over the last ten years. Average time charter earnings surpassed the barrier of $30,000/d to close at $30,819, recording a 332% y-o-y increase, triggering shipping investor interest and resulting in more second hand bulker purchases at higher values. On June 23, the index moved up to 2,840 points, and supply fundamentals indicate that the rebound is here to stay as we move towards the third quarter of this year.

The freight market is now characterized by a steady and substantial growth due to lower figures in the availability of supply tonnage and firmness in cargo demand. The main driver of rebound is the Atlantic basin that continues to outperform by the strong East Coast South America and Gulf of Mexico soybean and corn export season. The Med and Continent markets appear with the same upward trend as other Atlantic areas and Pacific have also shown more resistance with prompt tonnage being cleared out.

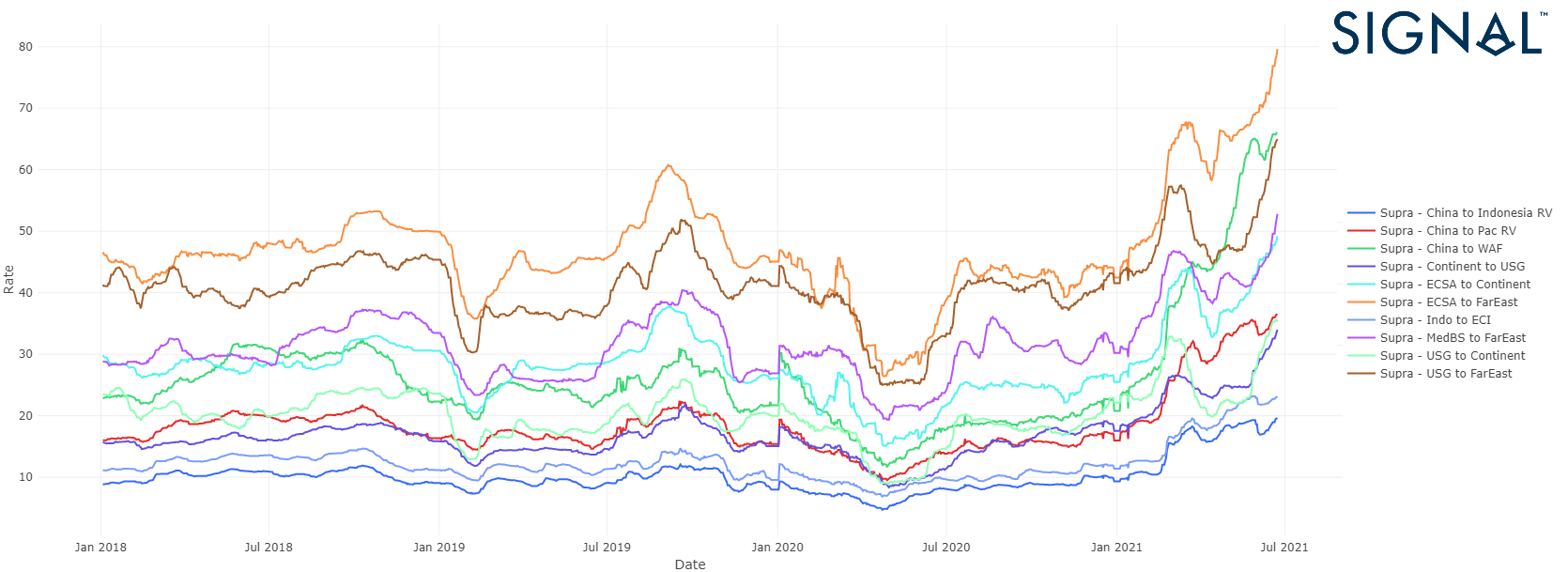

The below extract from the “Market Rates” Reports in the Signal Ocean Platform, illustrates the increase in spot market rates in $/ton terms, where we can see freight rate developments for various dry routes in the Atlantic & Pacific since the beginning of 2021.

Chart 1: Market Rates Report, summarizes the evolution of spot freight rates from January 2018 up to year to date for all major supramax trading routes for a round and trip voyage in Pacific and Atlantic areas.Signal Ocean Platform data. Signal Ocean Platform data.

The chart above reveals the surprising rebound in dry market rates $/ton in ECSA to the Far East, where rates have jumped above $70/t in June and are nearing close to $80/t, compared to $42.5/t at the end of December 2020. Significant magnitude of increase is also viewed from USG to the Far East, where rates are above $60/t, from $41.6/t at the end of December 2020.

To understand further the current freight market dynamics of supramax bulkers, we will use AIS derived supply and demand data from the Signal Ocean Platform.

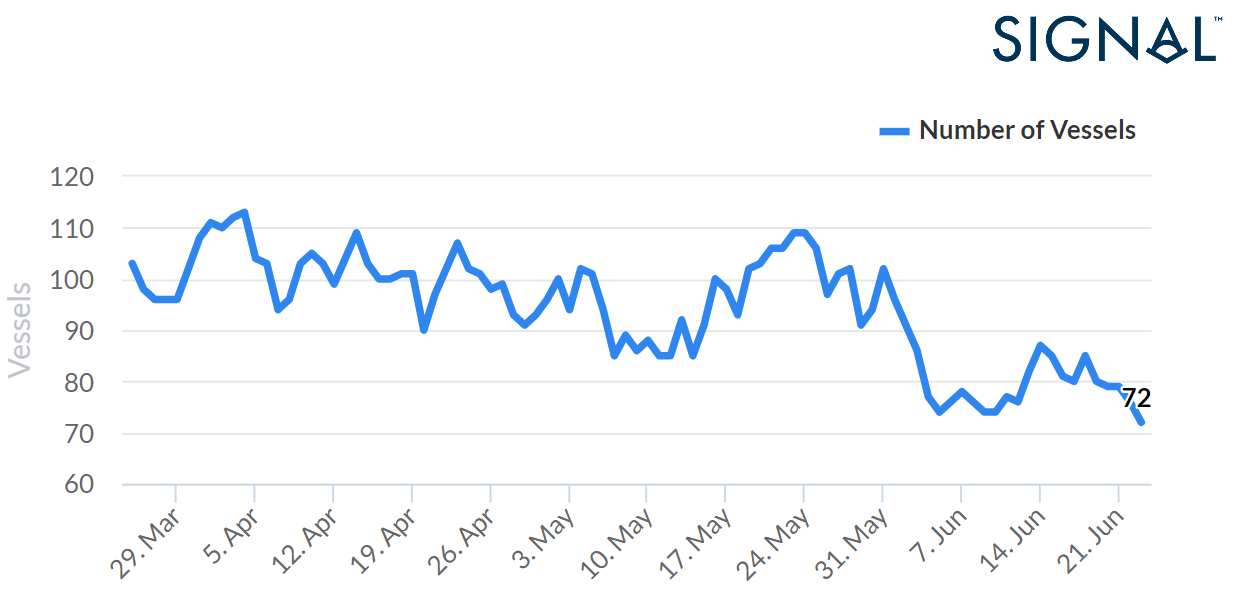

Chart 2: Ballasters View Report, summarizes the trend of ballast supramax bulkers sailing from West Atlantic (Canada Atlantic Coast, US Atlantic Coast, Caribs, US Gulf, East Coast Central America, East Coast Mexico, Argentina & Uruguay & Brazil). Signal Ocean Platform data.

Vessel Supply – Ballasters View

The below extract from the Ballasters View Signal Ocean report, illustrates a progressive shortage of ballasters sailing from Atlantic West. The chart signals the trend of clearing out of tonnage that supports the current boost of the freight market sentiment from ECSA and USG to the Far East. The number of supramax bulkers sailing empty from Atlantic West has now decreased to less than 80 ships compared to more than 100 ships in mid-May.

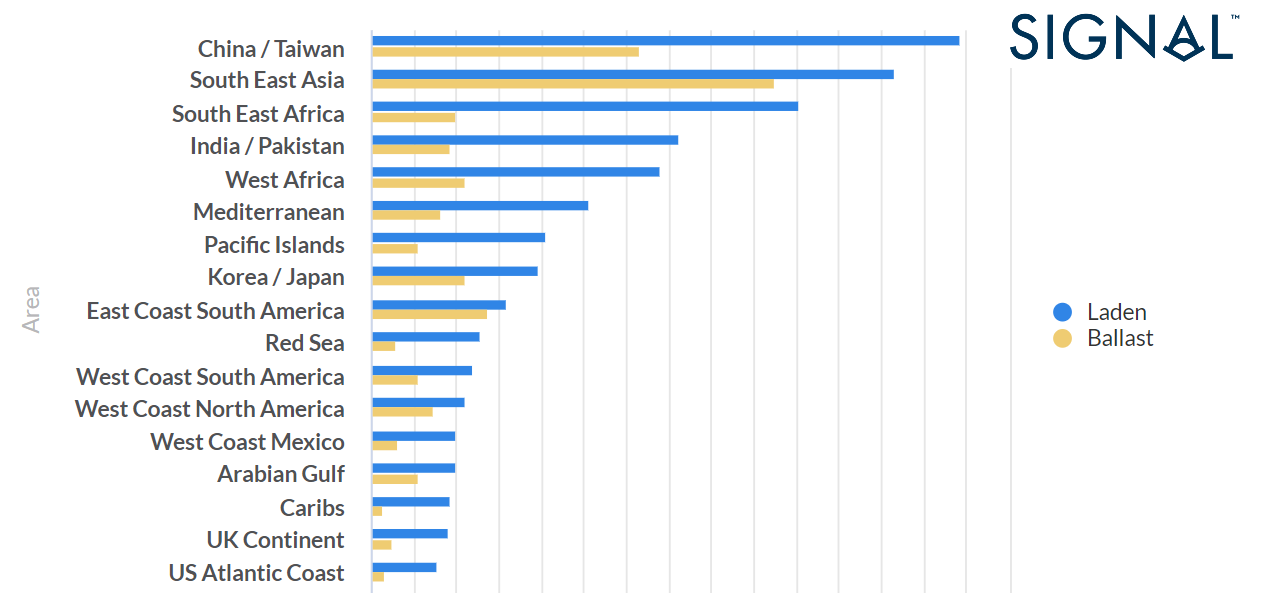

To illustrate further the trends of ballast supramax bulkers from Atlantic and laden to Pacifc Asia, chart 3 is an extract from Fleet Current Area Signal Ocean report.

Chart 3:Current Fleet Allocation Report, demonstrates the current position of the global fleet based on AIS destination and last movement date time UTC referring to the latest AIS of the vessel. Signal Ocean Platform data.

Demand Trends – Cargo Flows

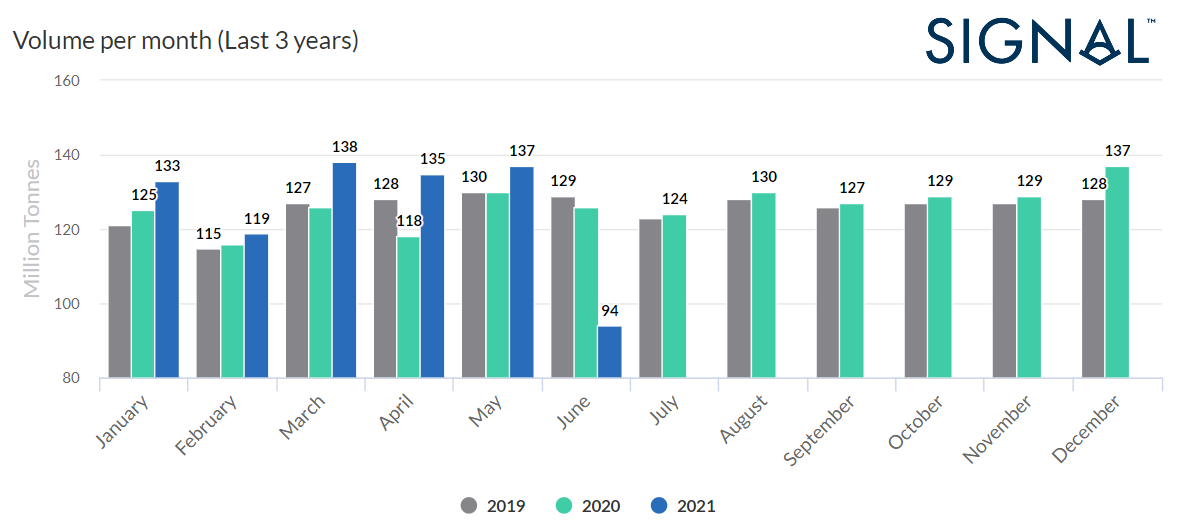

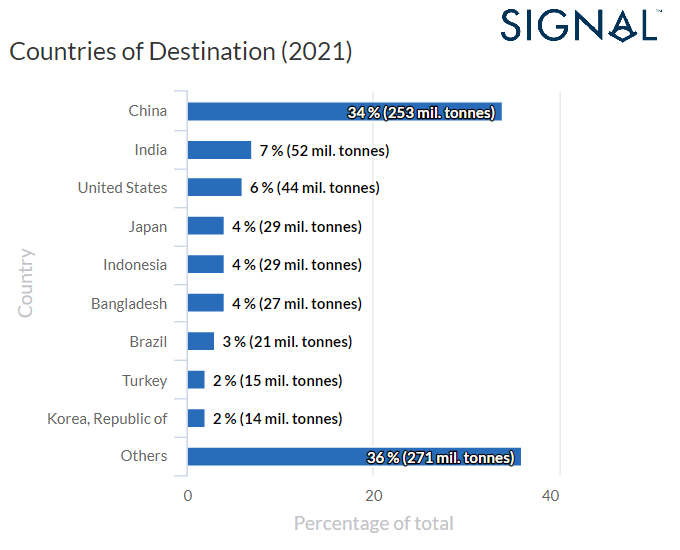

The below extract (chart 4) from the Cargo Flows Signal Ocean report reveals the increasing trend in monthly volumes for the year 2021 compared to 2019 & 2020. In March, April and May, the monthly volume of cargo flows surpassed 130 Mil tons. In chart 5, we see the ranking of the countries of destination for 2021 with China holding the top position throughout the year (34% of cargo volumes are destined to China, 253 Mil tons).

Chart 4: Cargo flows Report, demonstrates the evolution of cargo volume per month over the last three years. Signal Ocean Platform data.

Chart 5: Cargo flows Report, demonstrates the cargo volumes to countries of destination as percentage to total volume of cargo flows.Signal Ocean Platform data.

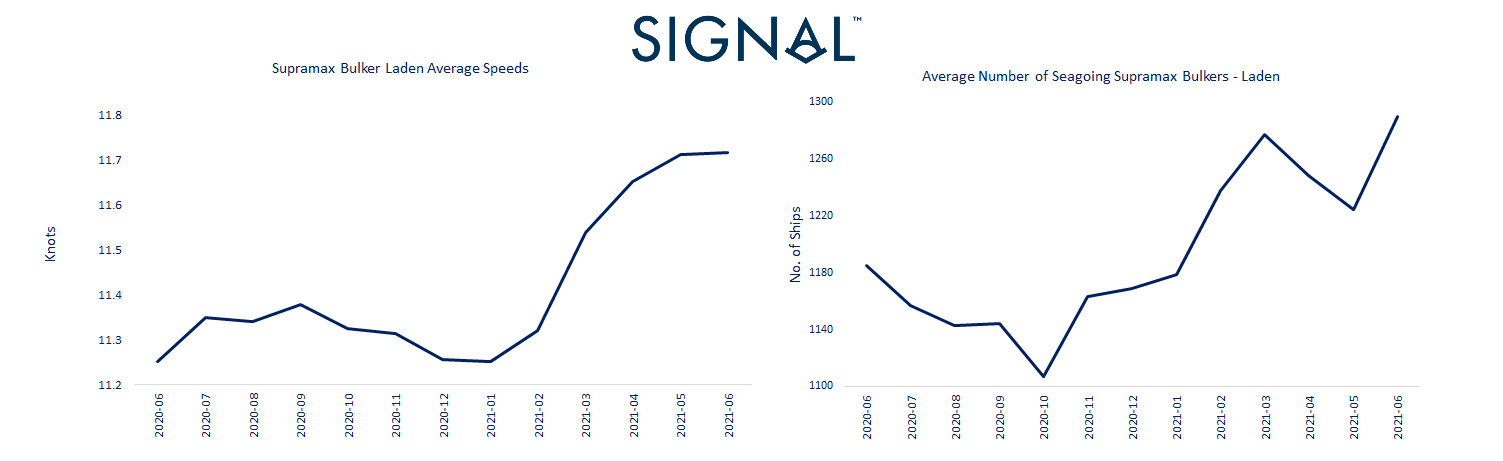

Average Speed

The strength in the current market conditions is also evidenced in the continuous increase in average laden speeds since January 2021, peaking at 12.2knots this month, up by 4% from 2020’s June average, despite bunker prices being on the rise. (Chart 6: Supramax Bulker average laden speed in knots)

In parallel with the increase of average laden speed, the number of seagoing operating vessels has moved up to 1290 ships, which is 9% higher than 2020’s June level and 17% up compared to lows of October 2020 of 1107 ships. (Chart 7: Average Number of Seagoing Supramax Bulkers-Laden)

Charts 6 & 7: Vessel Speeds Report, the vessel speeds of seagoing laden vessels’ figure captures the average speed of all the vessels that had broadcasted AIS data over selected areas. The ‘’number of seagoing laden vessels’’ captures the average number of vessels that contributed to the vessel speed figure.Signal Ocean Platform data.

The current trend of laden speed and volume of seagoing operating vessels signal positive momentum for freight rates to sustain high levels at firm levels of fleet utilization.

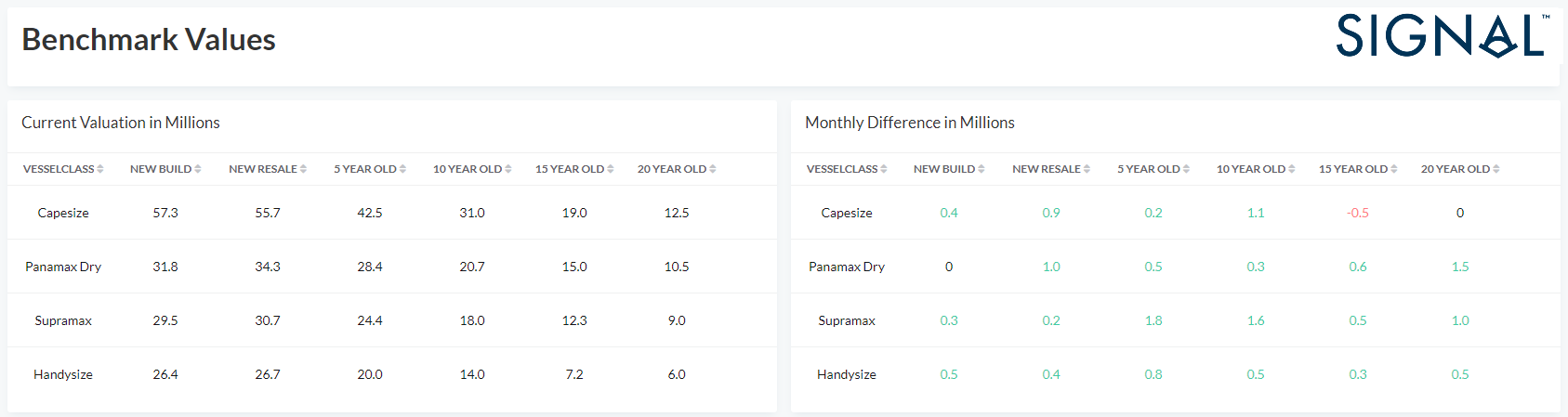

Market Values

Following the rebound in freight market rates, dry bulk spending for second hand tonnage is up and the combination of strong rates with high S&P activity has seen values increase. Among dry bulkers, supramaxes appear with the highest monthly differential in benchmark values for all age categories. The highest monthly increase is in the 5year old ship, ($1.80M more) and in the 10year old ship, ($1.60M more), whereas bigger ship sizes, capesize and panamax have moved at a softer price pace. In the below tables, the monthly differences are presented for second benchmark values from handysize bulkers up to capesize.

Tables 1&2: Benchmark Values Report, Values and their trend are estimated by aggregating a list of widely distributed Sales & Purchases transactions. Valuations are based on a benchmark vessel per vessel class with Deadweight : Capesize – 180.000 Tonnes, Panamax Dry – 75.000 Tonnes, Supramax – 60.000 Tonnes, Handysize – 38.000 Tonnes. Signal Ocean Platform data.

The view for coming days

Grain demand is here to support the vessel earnings as China’s needs lead the volume of destined cargo flows. To end this analysis, it’s worth mentioning that China is back with record US corn purchases. The Asian country made its largest purchase of U.S. corn in May of 1.36 million metric tons for the marketing year that begins Sept. 1, according to the U.S. Department of Agriculture.

The question is whether this firmness in the spot freight market of supramax bulkers is here to stay in the coming months. Combined fundamentals of supply trends, cargo flows and macro drivers outline that the summer season brings a buoyant sentiment for the third quarter of the year.

This dry bulk shipping market report for supramaxes was produced using insights, data and reports from the Signal Ocean platform.

Source: Signal Group (https://www.thesignalgroup.com/newsroom/dry-bulk-supramax-freight-market-surprises-for-the-first-half-2021)