Eneti Inc. reported its results for the three months ended June 30, 2021.

The Company also announced that on August 16, 2021 its Board of Directors declared a quarterly cash dividend of $0.01 per share on the Company’s common shares.

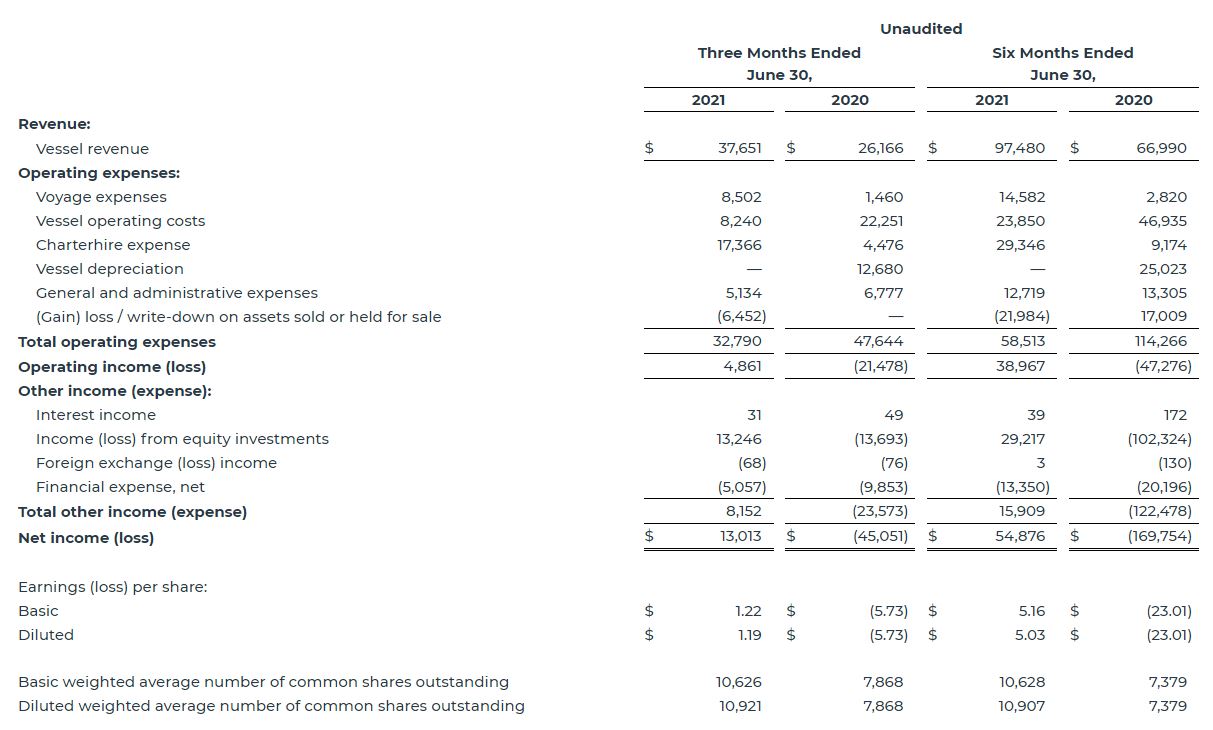

Results for the Three and Six Months Ended June 30, 2021 and 2020

• For the second quarter of 2021, the Company’s GAAP net income was $13.0 million, or $1.19 per diluted share, including:

• a gain on vessels sold of approximately $6.5 million, or $0.59 per diluted share, which is primarily the result of an increase in the fair value of common shares of Star Bulk Carriers Corp. (“Star Bulk”) (NASDAQ: SBLK) and Eagle Bulk Shipping Inc. (“Eagle”) (NASDAQ: EGLE) received as a portion of the compensation for the purchase of certain of our vessels;

• the write-off of $3.3 million, or $0.30 per diluted share, of deferred financing costs on repaid credit facilities related to certain vessels that have been sold; and

• a gain of approximately $13.0 million and cash dividend income of $0.2 million, or $1.21 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc. and the sale of the Eagle and Star Bulk shares received as part of the consideration for the sales of vessels to these counterparties.

• For the second quarter of 2020, the Company’s GAAP net loss was $45.1 million, or $5.73 per diluted share. These results include a non-cash loss of approximately $13.9 million and cash dividend income of $0.2 million, or $1.74 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc., and a write-off of approximately $0.4 million, or $0.05 per diluted share, of deferred financing costs related to debt repayments on vessels sold in the second quarter of 2020.

• Total vessel revenues for the second quarter of 2021 were $37.7 million, compared to $26.2 million for the same period in 2020.

• Earnings before interest, taxes, depreciation and amortization (“EBITDA”) for the second quarter of 2021 was $19.7 million and EBITDA for the second quarter of 2020 was a loss of $20.6 million (see Non-GAAP Financial Measures below).

• For the second quarter of 2021, the Company’s adjusted net income was $9.9 million, or $0.90 adjusted per diluted share, which excludes the impact of the gain of approximately $6.5 million related to the Company’s previously announced plan to exit the dry bulk industry due to an increase in the fair value of the assets to be received in exchange for certain vessels and changes in related selling costs as described above and the write-off of $3.3 million of deferred financing costs on repaid credit facilities related to certain vessels that have been sold.

• For the second quarter of 2020, the Company’s adjusted net loss was $44.7 million, or $5.68 adjusted per diluted share, which excludes the write-off of approximately $0.4 million of deferred financing costs related to debt repayments on to vessels sold in the second quarter of 2020.

• Adjusted EBITDA for the second quarter of 2021 was $13.2 million compared to a $20.6 million loss in the prior year period (see Non-GAAP Financial Measures below).

• For the first half of 2021, the Company’s GAAP net income was $54.9 million, or $5.03 per diluted share, including:

o a gain on vessels sold of approximately $22.0 million, or $2.01 per diluted share, which is primarily the result of an increase in the fair value of common shares of Star Bulk (NASDAQ: SBLK) and Eagle (NASDAQ: EGLE) received as a portion of the consideration for the sale of certain of our vessels to Star Bulk and Eagle;

o the write-off of $7.0 million, or $0.64 per diluted share, of deferred financing costs on repaid credit facilities related to certain vessels that have been sold; and

o a gain of approximately $28.8 million and cash dividend income of $0.4 million, or $2.68 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc. and the sale of the Eagle and Star Bulk shares received as a portion of the consideration for the vessel sales to these counterparties.

• For the first half of 2020, the Company’s GAAP net loss was $169.8 million, or $23.01 per diluted share, including a loss of approximately $103.0 million and cash dividend income of $0.7 million, or $13.87 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc.; a write-down of assets held for sale of approximately $17.0 million, or $2.31 per diluted share, related to the classification of three vessels as held for sale in the first quarter of 2020 (the sales of all three vessels were completed in the second quarter of 2020); and a write-off of approximately $0.4 million, or $0.05 per diluted share, of deferred financing costs on the credit facilities related to those three vessels.

• Total vessel revenues for the first half of 2021 were $97.5 million, compared to $67.0 million for the same period in 2020. EBITDA for the first half of 2021 was $71.7 million and EBITDA for the first half of 2020 was a loss of $120.7 million (see Non-GAAP Financial Measures below).

• For the first half of 2021, the Company’s adjusted net income was $39.9 million, or $3.66 adjusted per diluted share, which excludes the impact of a gain subsequent to an increase in fair value less costs to sell related to the assets held for sale of $22.0 million and the write-off of deferred financing costs on the related credit facilities of $7.0 million. Adjusted EBITDA for the first half of 2021 was $49.7 million (see Non-GAAP Financial Measures below).

• For the first half of 2020, the Company’s adjusted net loss was $152.4 million, or $20.65 adjusted per diluted share, which excludes the impact of the write-down of assets held for sale of $17.0 million and the write-off of deferred financing costs on the related credit facilities of $0.4 million. Adjusted EBITDA for the first half of 2020 was a loss of $103.7 million (see Non-GAAP Financial Measures below).

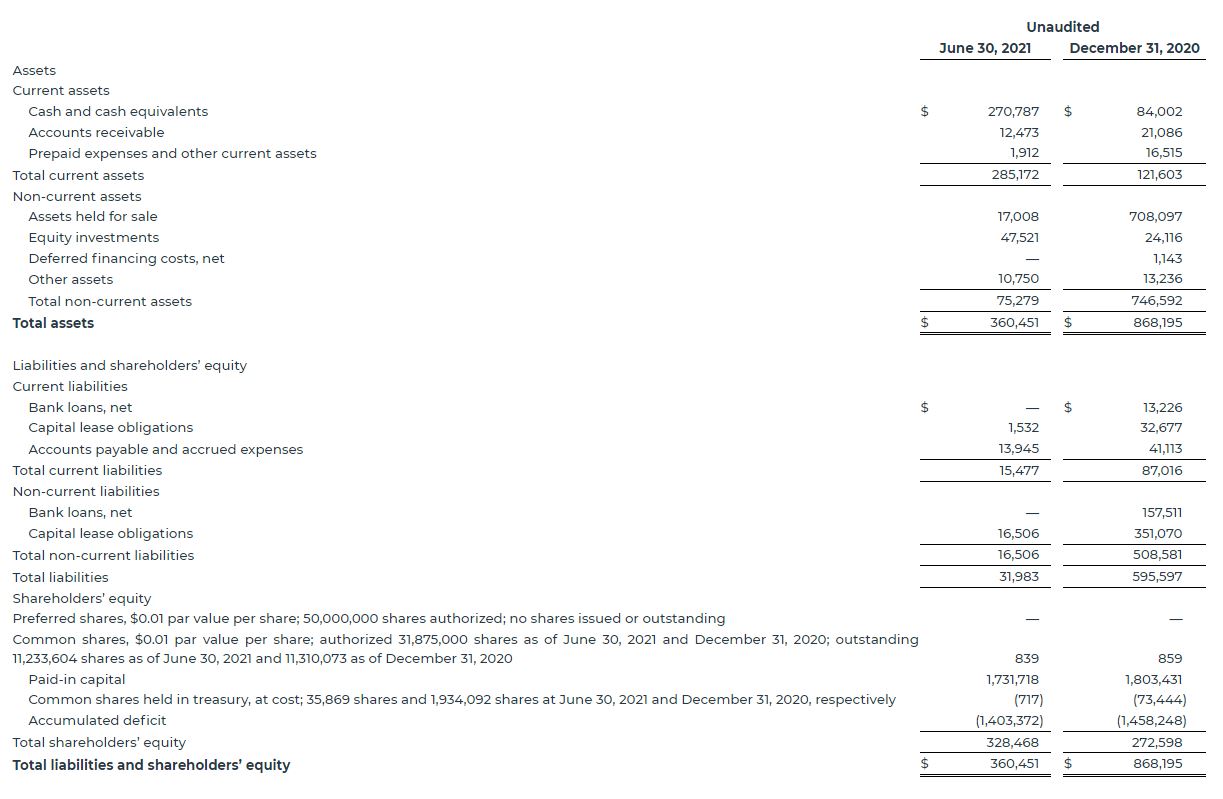

Liquidity

As of August 13, 2021, the Company had approximately $41.7 million in cash and cash equivalents. The Company also continues to hold approximately 2.16 million common shares of Scorpio Tankers Inc. (NYSE: STNG).

Seajacks Transaction

On August 12, 2021, the Company completed a previously announced transaction whereby one of its wholly-owned direct subsidiaries acquired from Marubeni Corporation, INCJ Ltd and Mitsui OSK Lines Ltd. (together, the “Sellers”) 100% of Atlantis Investorco Limited, the parent of Seajacks International Limited (“Seajacks”), for consideration of approximately 8.13 million shares, $302 million of assumed net debt, $71 million of newly-issued redeemable notes, and $12 million of cash. Upon completion, 7,000,000 common shares and 700,000 preferred shares were issued to the Sellers with the remainder expected to be issued prior to the end of 2021.

Seajacks (www.seajacks.com) was founded in 2006 and is based in Great Yarmouth, UK. It is one of the largest owners of purpose-built self-propelled WTIVs in the world and has a track record of installing wind turbines and foundations dating to 2009. Seajacks’ flagship, NG14000X design “Seajacks Scylla”, was delivered from Samsung Heavy Industries in 2015, and it is currently employed in Asia. Seajacks also owns and operates the NG5500C design “Seajacks Zaratan” which is currently operating in the Japanese market under the Japanese flag, as well as three NG2500X specification WTIVs.

Dry Bulk Exit

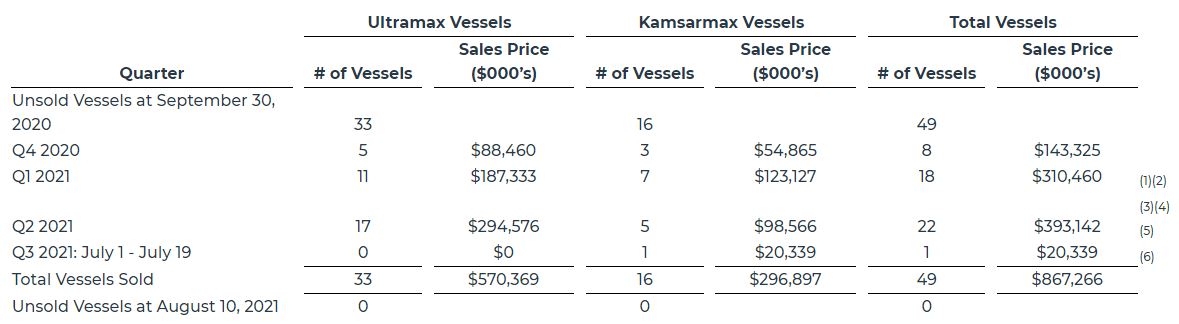

During July 2021, the Company completed its exit from the business of dry bulk commodity transportation. The following table summarizes when the Company delivered the vessels to their respective buyers.

Sale of Five Vessels

During the second quarter of 2021, the Company entered into binding agreements with counterparties in Japan to transfer the existing lease finance arrangements of the SBI Tango, SBI Echo, and SBI Hermes, Ultramax bulk carriers built in 2015, 2015, and 2016 respectively, and SBI Rumba and SBI Samba, Kamsarmax bulk carriers built in 2015, to affiliates of Scorpio Holdings Limited (“SHL”) for consideration of $16.0 million. This transaction was approved by the Company’s independent directors in January 2021. As of July 2021, the Company transferred all five vessels and the related debt to SHL.

Star Bulk and Eagle Common Shares

During May 2021, the Company sold approximately 0.4 million common shares of Star Bulk, which it received as partial compensation for the SBI Pegasus for net proceeds of $7.7 million. Star Bulk also assumed debt of $12.7 million and the Company was reimbursed for the February 2021 debt payment that was made in advance.

During June 2021, the Company sold approximately 0.2 million common shares of Eagle, which it received as partial consideration for the SBI Virgo for net proceeds of $10.2 million. The Company also received cash proceeds of $15.0 million as part of the purchase price.

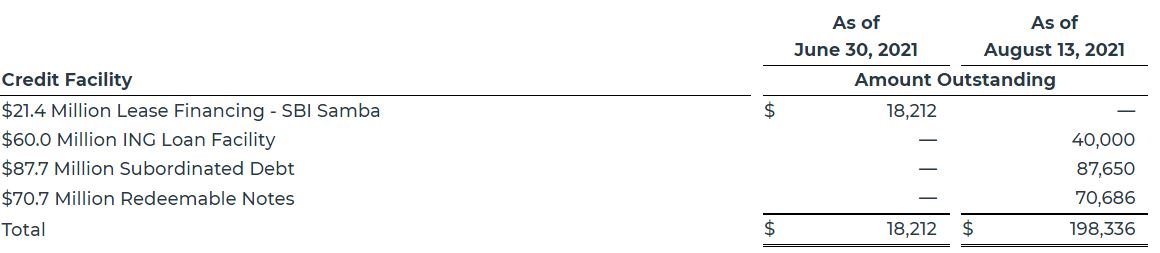

Debt Overview

The Company’s outstanding debt balances, gross of unamortized deferred financing costs as of June 30, 2021 and August 13, 2021, are as follows (dollars in thousands):

As part of the Seajacks transaction, the Company:

• Drewdown $40.0 million on a $60.0 million a senior secured non-amortizing revolving credit facility from ING Bank N.V. The credit facility, which includes sub-limits for performance bonds, and is subject to other conditions for full availability, has a final maturity of August 2022 and bears interest at LIBOR plus a margin of 2.45% per annum.

• Assumed $87.7 million of subordinated, non-amortizing debt due in September 2022 and owed to financial institutions with guarantees provided by the Sellers, which bears interest at 1.0% until November 30, 2021, 5.5% from December 1, 2021 and 8.0% from January 1, 2022.

• Issued subordinated redeemable notes totaling $70.7 million, with a final maturity of March 31, 2023 and bears interest at 5.5% until December 31, 2021 and 8.0% afterwards.

• Repaid the existing secured debt of approximately $267.5 million.

Quarterly Cash Dividend

In the second quarter of 2021, the Company’s Board of Directors declared and the Company paid a quarterly cash dividend of $0.05 per share totaling approximately $0.6 million.

On August 16, 2021, the Company’s Board of Directors declared a quarterly cash dividend of $0.01 per share, payable on or about September 15, 2021, to all shareholders of record as of August 31, 2021. As of August 17, 2021, 18,233,604 common shares and 700,000 preferred shares were outstanding.

Share Repurchase Program

As of August 17, 2021, the Company had $31.9 million remaining under the authorized share repurchase program. The Company did not repurchase any securities during the three months ended June 30, 2021.

COVID-19

Since the beginning of the calendar year 2020, the ongoing outbreak of the novel coronavirus (COVID-19) that originated in China in December 2019 and that has spread to most developed nations of the world has resulted in numerous actions taken by governments and governmental agencies in an attempt to mitigate the spread of the virus. These measures have resulted in a significant reduction in global economic activity and extreme volatility in the global financial and commodities markets. During the first quarter of 2021, the dry bulk charter market saw a significant recovery, however future charter rates remain highly dependent on the duration and continuing impact of the COVID-19 pandemic, as evidenced by the recent resurgence of cases in India and other parts of the world. When these measures and the resulting economic impact will end and what the long-term impact of such measures on the global economy will be are not known at this time. As a result, the extent to which COVID-19 will impact the Company’s results of operations and financial condition, including its planned transition towards marine-based renewable energy, will depend on future developments, which are highly uncertain and cannot be predicted.

Eneti Inc. and Subsidiaries Condensed Consolidated Statements of Operations (Amounts in thousands, except per share data)

Eneti Inc. and Subsidiaries Condensed Consolidated Balance Sheets (Dollars in thousands)

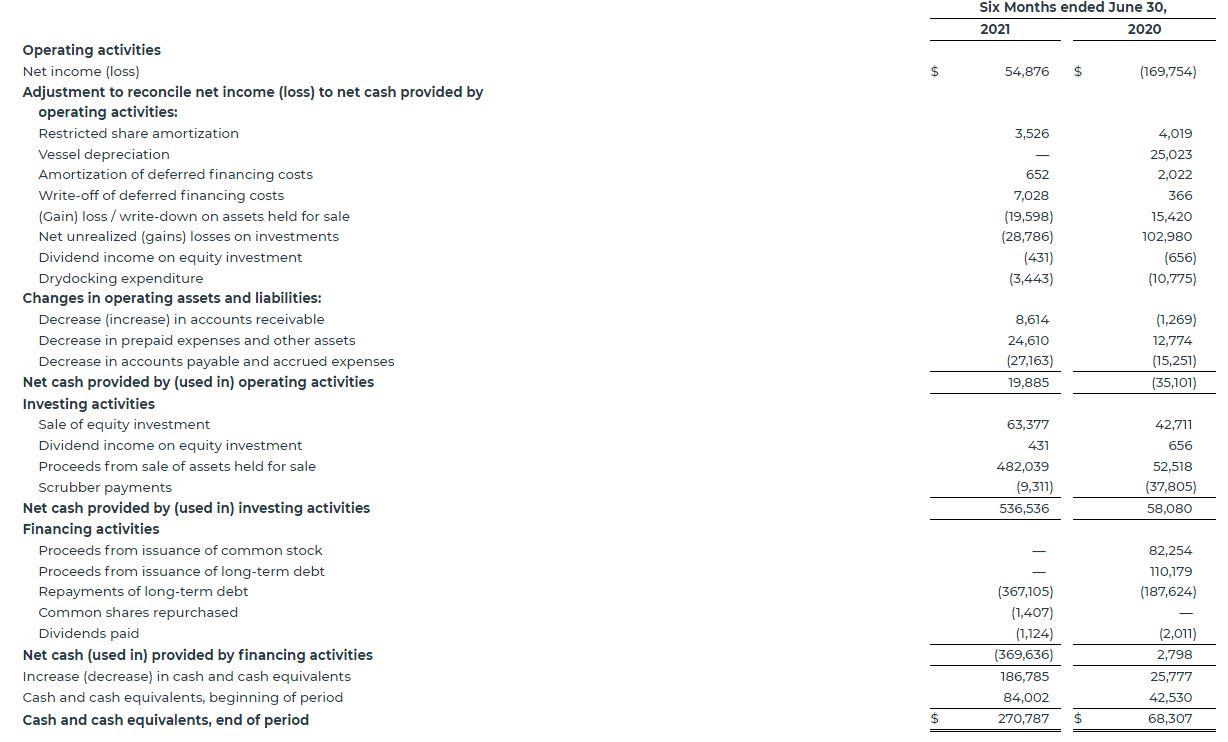

Eneti Inc. and Subsidiaries Condensed Consolidated Statements of Cash Flows (unaudited) (Amounts in thousands)

A conference call to discuss the Company’s results will be held at 10:00 AM Eastern Daylight Time / 4:00 PM Central European Summer Time on August 17, 2021. Those wishing to listen to the call should dial 1 (866) 219-5268 (U.S.) or 1 (703) 736-7424 (International) at least 10 minutes prior to the start of the call to ensure connection. The conference participant passcode is 9674972. The information provided on the teleconference is only accurate at the time of the conference call, and the Company will take no responsibility for providing updated information.

There will also be a simultaneous live webcast over the internet, through the Eneti Inc. website www.eneti-inc.com. Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

Source: Eneti Inc.