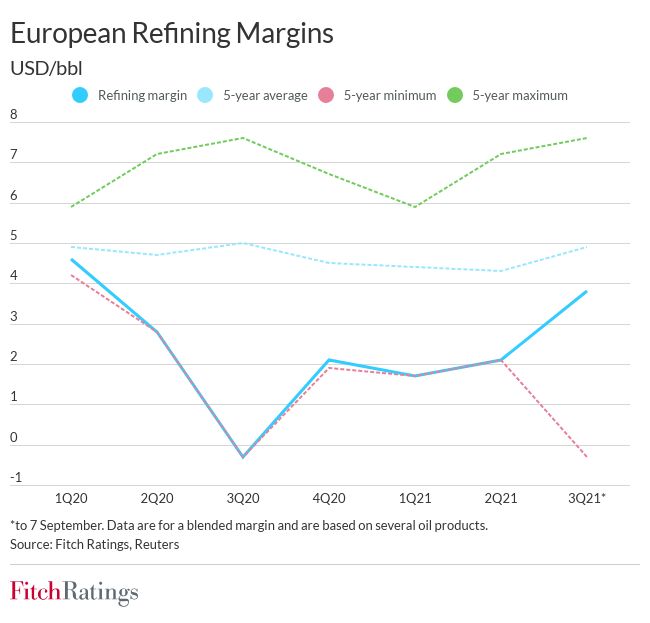

Recovering demand for oil products in Europe and production disruptions in the US have helped European refining margins to rebound in 3Q21, improving refineries’ cash flow generation, Fitch Ratings says. However, the sector’s performance remains vulnerable to potential pandemic setbacks and market imbalances due to planned additions to refining capacity.

Relaxation of lockdown measures has spurred demand for oil products in Europe, lifting refining margins from the lows seen during the pandemic, although many crack spreads remain below their five-year averages. Diesel and jet fuel cracks were hit particularly hard during the downturn due to a dramatic reduction in air travel. This caused some refineries to reduce jet fuel production and raise the share of diesel in their output, increasing volumes of this distillate in the market. The inventory built up during the lockdowns also weighed on refining product prices. However, inventories levels reduced gradually during the summer of 2021, alleviating pressures on margins.

Refining margins were further boosted in August and September as hurricanes in the Gulf of Mexico disrupted the production and transportation of refinery products in the region, particularly benefiting gasoline crack spreads.

*to 7 September. Data are for a blended margin and are based on several oil products. Source: Fitch Ratings, Reuters

The financial performance of PKN Orlen, MOL, Tupras, CEPSA and Repsol benefits the most from this margin recovery due to their large refining capacity. However, all oil and gas issuers in our rated European portfolio, both integrated and independent, are positively affected by the sector’s current strong pricing environment.

However, the recovery in the refining market remains vulnerable to possible pressures from pandemic setbacks, including the spread of more infectious variants, the reintroduction of lockdown measures and a slower-than-expected recovery in international and domestic travel. Furthermore, a reduction in available refining capacity during the downturn that has contributed to the margins rebound could be reversed in 2022-2023 due to planned refinery additions, mainly in Asia and the Middle East. This could squeeze refining margins if an increase in output volumes is not matched by growing demand.

The sector faces long-term pressures due to the energy transition, which sector participants plan to mitigate by growing petrochemicals sales and refocusing towards non-fuel retail, renewable electricity generation and hydrogen production using environment-friendly processes. These strategies involve significant upfront investments. The existing hydrocarbon businesses of Fitch-rated issuers are likely to remain their key cashflow generators in the next few years.

Source: Fitch Ratings