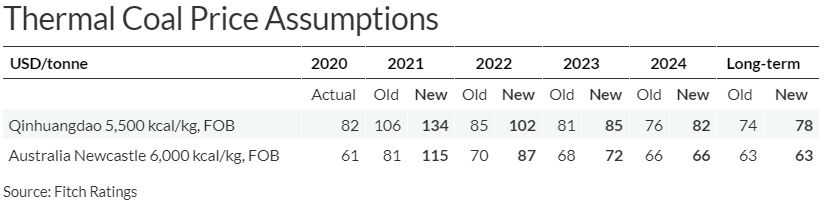

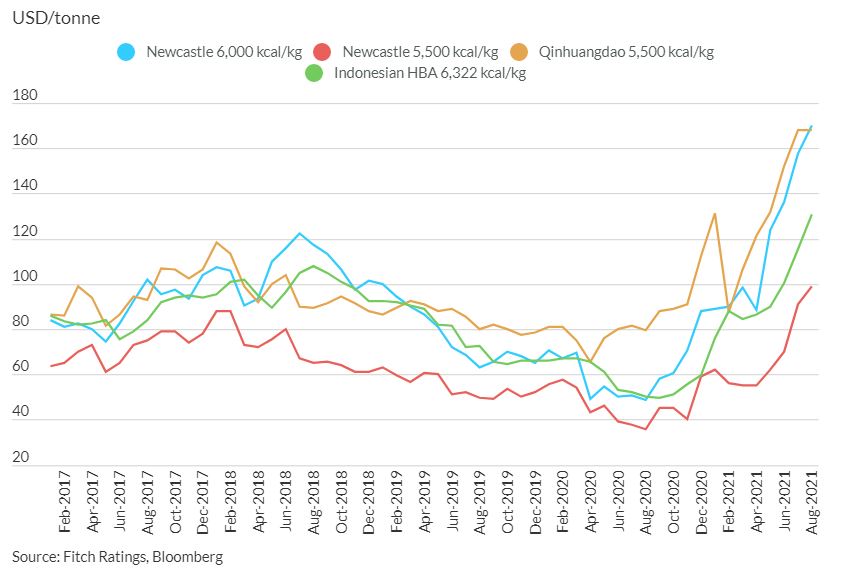

Fitch Ratings has increased all its Qinhuangdao 5,500kcal/kg price assumptions and short- and medium-term Newcastle 6,000kcal/kg price assumptions due to thermal coal supply constraints in China.

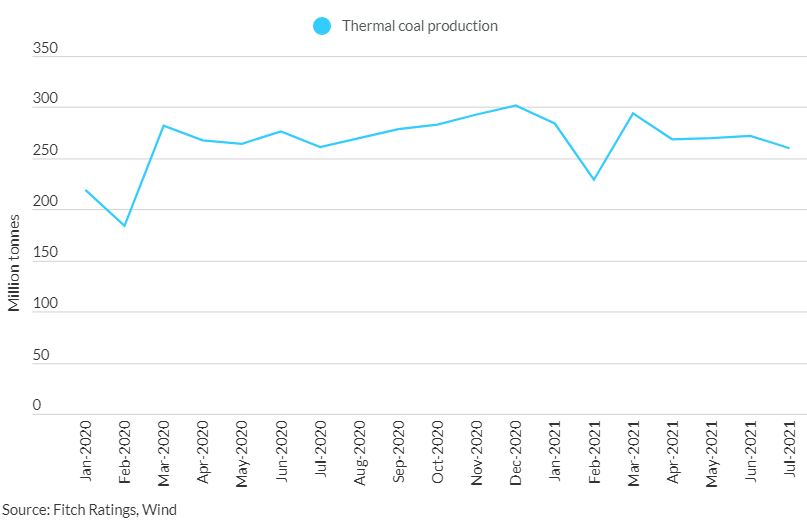

Chinese regulations further tightening the mine safety requirements implemented earlier this year have reduced thermal coal production in the country despite strong demand driven by the economic recovery. Thermal power generation increased in China in January to July by 13.2% yoy, while non-power coal consumption increased by 7.7% yoy, causing rapid increases in coal prices. Coal inventories have been declining, even though import volumes increased in June and July.

The government has launched some mitigating actions, including re-opening open-pit mines capable of producing 67 million tonnes of coal per year, approving new production capacities and requesting mines increase production volumes. These measures, and seasonally weaker demand in September and October, should help moderate prices from the current high levels; however, we expect average domestic prices for 2021 to be higher than in our previous price deck.

Our increased price assumptions for the Chinese benchmark in 2022 and thereafter reflect structurally tighter supply, lower incentives to invest in new coal mines and an emerging trend of local governments and mining companies closing older coal mines in order to meet carbon-reduction targets. Furthermore, the central government has demonstrated its tolerance of high coal prices, while local governments in coal-producing regions are motivated to keep supply relatively tight.

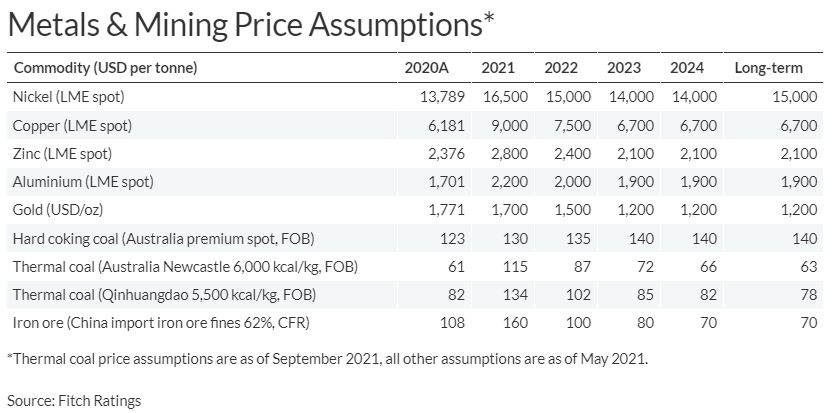

The stronger domestic prices in China have also affected seaborne prices, despite China’s ban on coal imports from Australia. Trade flows have adjusted as a result, with China now importing more coal from Russia, Indonesia and other countries, with Australia now exporting more to India and Korea. We therefore have increased our 2021–2023 Newcastle 6,000kcal/kg assumptions. We have kept longer-term price assumptions for the Australian benchmark unchanged. We anticipate that pressures to reduce coal power generation in many key markets consuming Australian coal will eventually lessen coal demand and help normalise the seaborne prices.

All other metals and mining price assumptions remain in line with the price deck published on 26 May 2021.

These price assumptions changes alone are not sufficient to trigger rating actions.

Source: Fitch Ratings