Container freight rates continue to break records, with new data showing a further massive spike on the key Asia to Europe and Asia to US routes.

Chemical companies have been struggling with soaring container freight rates, delays and low availability since the second half of 2020 when a strong bounce back in demand caught shippers and supply chains by surprise.

Latest data from Freightos show rates now topping $18,500 per 40-foot container on the Asia to Europe route and almost $22,000 from Asia to the US east coast. Prior to the pandemic rates were below $3,000 on these routes.

Shipping companies removed capacity early last year as the global economy collapsed during the first, most severe wave of Coronavirus lockdowns. But the lockdown lifestyle changed consumer behaviour. People switched from spending on services such as holidays and restaurant meals to investing in home electronics, furniture and home improvements.

This resulted in a huge uptick in demand from the second half of 2020, especially for finished goods made in China and Asia for delivery in Europe and the US. Internet shopping also fuelled demand for packaging.

Shipping companies have been unable to meet this inexorable rise in demand, with the US polar storm and the closure of the Suez Canal for almost a week adding to the chaos. More recently, a new wave of coronavirus lockdowns in Asia has added more pressure to the global shipping network.

With the peak Christmas and Thanksgiving seasons approaching, demand for shipping is expected to remain robust. In a statement on its website, Feightos said: “Freight is really expensive, but with close to no capacity many importers and exporters are willing to pay premiums in addition to these rates just to keep their goods moving. And with high consumer demand and still-lagging inventory levels, prices aren’t going to let up anytime soon.”

CHEMICAL SUPPLY CHAIN CHAOS

The impact on chemical supply chains has been dramatic with global markets becoming more regional because of the costs and delays experienced in intra-regional shipping. Excess capacity in Asia has depressed prices there while shortages of feedstocks in Europe led to a wave of force majeures which is still ongoing.

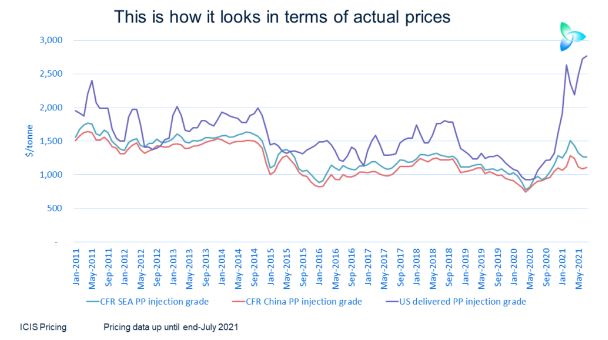

In his Asian Chemical Connections blog post this week, ICIS senior consultant for Asia, John Richardson, pointed out that stranded polypropylene (PP) markets have widened the price gap for between the regions to historic highs, creating opportunities for US buyers .

The Freightos prices also show how much cheaper it is to move material from Europe and the US to Asia compared with the opposite direction.

Source: ICIS, By Will Beacham, (https://www.icis.com/explore/resources/news/2021/08/06/10671655/freight-rates-continue-to-rocket-with-no-end-in-sight-to-container-crisis)