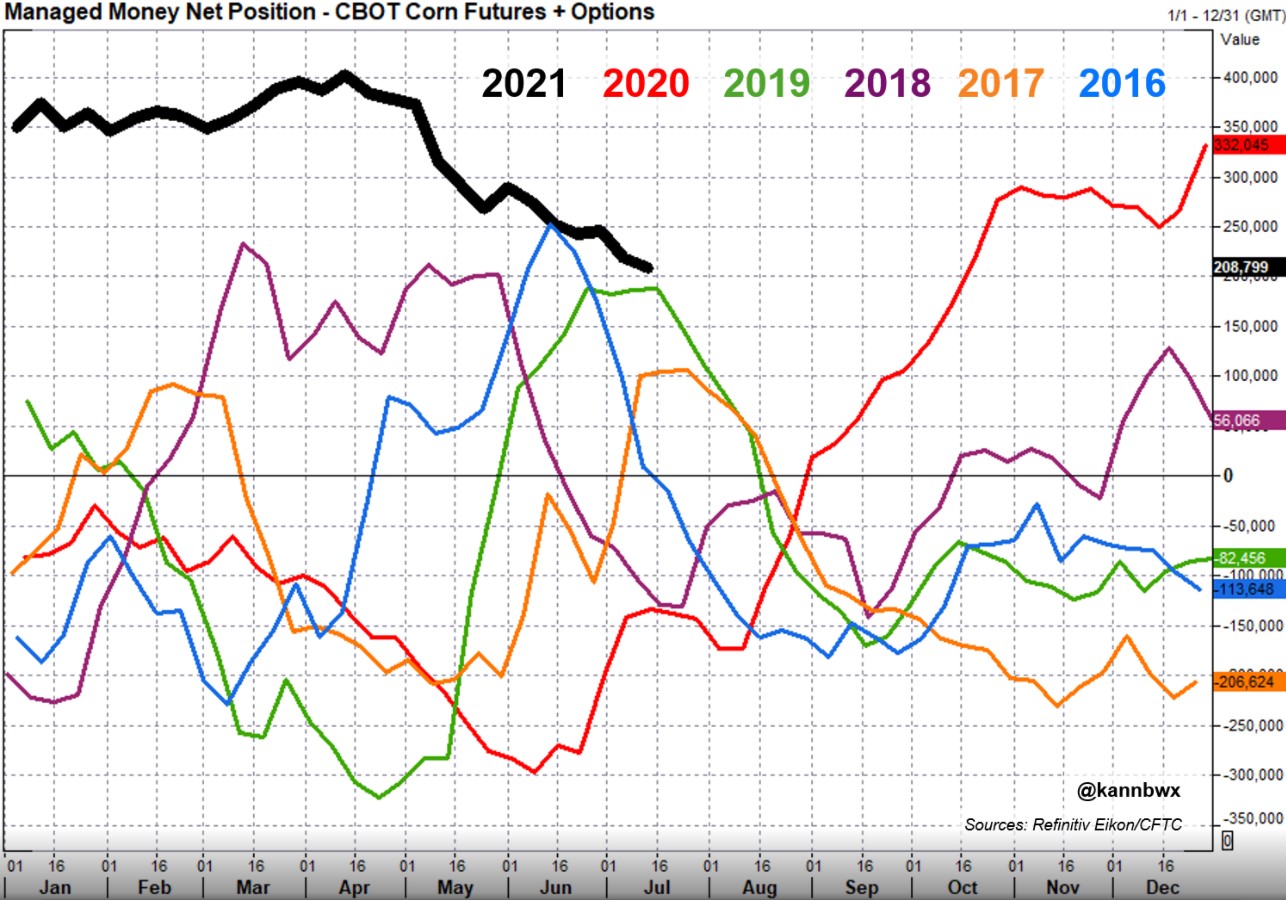

Chicago corn futures rebounded last week as drier weather forecasts maintained uncertainty over the U.S. harvest. However, speculators continued the selling trend they started three months ago.

Most-active corn futures rose fractionally in the week ended July 13, but they had surged more than 4% in the final two days of that period. Money managers reduced their net long in corn futures and options to 208,799 contracts from 219,371 a week earlier according to data from the U.S. Commodity Futures

The new stance is their least optimistic since mid-October, about two months after corn began to rally. Money managers’ outright long positions had approached all-time highs earlier this year, but now they stand closer to average levels for the dates. Gross corn shorts remain very conservative but slightly elevated versus recent months.

Speculators do not typically buy corn later in July except for when the U.S. corn crop appears to be deteriorating much further, as was the case in 2010, 2011 and 2012. Recent rains have been plentiful in key parts of the Corn Belt, but conditions in the north and west are dicey enough to cause concern.

Forecasts as Friday showed warmer and drier conditions were likely for many states over the next two weeks, particularly in those that are already struggling. Corn futures rose 2% between Wednesday and Friday, but the large downward gap created on July 6 has yet to be filled.

SOYBEANS

Both soybean and soybean oil futures notched significant gains in the week ended July 13. But speculators increased their bullish views by less than 1,000 futures and options contracts each, placing the managed money soybean and soybean meal net longs at 82,773 and 48,927 contracts, respectively.

Other reportable speculators reduced their soybean net long by more than 5,000 contracts through July 13 to 4,859 contracts, well off the near-record highs of close to 60,000 contracts at the start of 2021. That is also their least bullish stance since October 2018. Other traders were net short 1,384 contracts of soybean oil, not materially different from recent weeks.

Soybean meal futures fell slightly through July 13 and money managers reduced their net long by more than 4,000 to 16,704 contracts, which is largely unchanged within the last month.

Most-active soybeans jumped 3% over the last three sessions while soybean oil and soybean meal rose 2.7% and 1.7%, respectively. Hot and dry weather over the next couple weeks could hurt U.S. soybeans heading into their pod-setting phase, though August weather will be most critical for yield.

The soy complex has also been supported by surging ICE canola futures with top exporter Canada’s crop under extreme drought stress. November futures were up 13% on the month at Friday’s close and were trading above C$900 per tonne for much of last week, around 90% higher than in the same week last year.

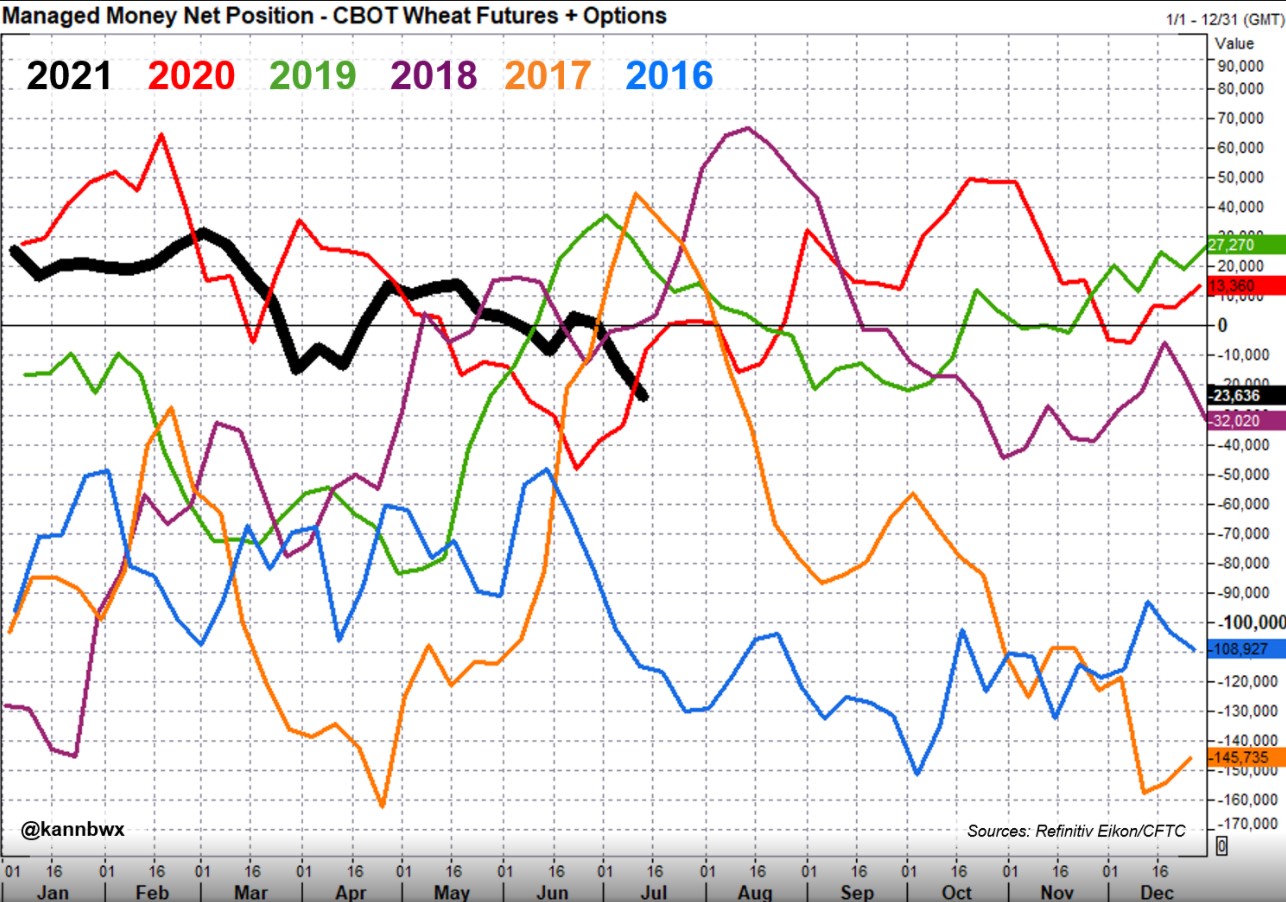

WHEAT

Money managers through July 13 increased their net short position in Chicago wheat futures and options to 23,636 contracts from 13,617 in the prior week based on an increase in outright shorts. That is funds’ most bearish CBOT wheat view in just over a year.

That was despite a 1% rise in most-active futures during the week and the expectations for buying. However, futures exploded 9.3% in the last three sessions, the contract’s biggest three-day rise since late April, due to severe crop problems in North America.

Trade estimates suggest commodity funds bought more than 30,000 CBOT wheat futures between Wednesday and Friday, which if true would put them back on the long side.

The U.S. government’s peg of the U.S. spring wheat crop last Monday came in significantly below market guesses, causing a surge in Minneapolis futures. However, money managers added just 156 futures and options contracts to their net long as of July 13, raising it to 8,982 contracts.

Minneapolis wheat futures rose another 6.4% over the last three sessions, on Friday reaching a contract high of $9.25 per bushel. That is the highest front-month price since December 2012. Kansas City wheat jumped 6.5% during that period but remains nearly $1 per bushel off the contract high.

As of July 13, money managers’ net long in Kansas City wheat futures and options stood at 21,667 contracts, up less than 1,000 contracts on the week after futures gained nearly 5%.

Source: Reuters (Reporting by Karen Braun; Editing by David Gregorio)