Dollar bullish sentiment eased before rally

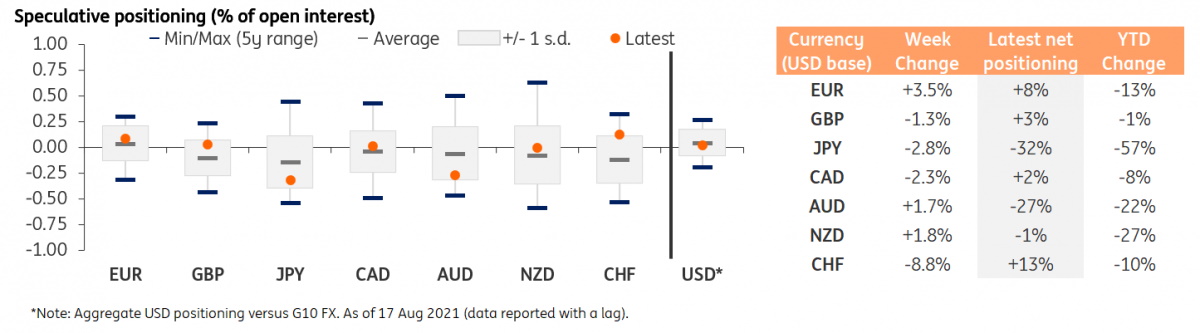

CFTC data for the week ending 17 August show a marginal decrease in the dollar’s net aggregate positioning versus reported G10 currencies (i.e. G9 excluding SEK and NOK), which was at +2% of open interest. This is broadly in line with movements in the spot market, as the dollar weakened against most G10 currencies between the 10th and 16th of August.

We have the impression that some of the moves on 17th August – which was the ignition of the dollar rally seen last week – are not mirrored in CFTC positioning data. The data reported here do, however, provide a good indication of where speculative positioning stood before the dollar rally.

EUR/USD net positioning saw a quite significant increase (+3.5% of open interest) in the reference week, rebounding to +8% of open interest after having dropped for eight consecutive weeks. The move is mostly mirroring the change in the dollar’s sentiment, as the combination of very dovish ECB and concerns about a slower recovery due to the Delta variant spread in the eurozone are likely preventing the creation of any clear idiosyncratic sentiment on the euro for the time being.

Temporary respite for antipodeans

AUD and NZD were the only two other G10 currencies that saw an increase in their net positioning in the week ending 17 August. Indeed, given their high exposure to China-related sentiment, the antipodeans have faced wider than normal swings lately. Considering the considerable drop in spot value in the past week we expect to see a build-up in short positions in both currencies next week. Here, it is also useful to note that the AUD is already starting from a meaningful net-short positioning, but also that (unlike NZD) it cannot count on a hawkish central bank, and is facing the negative impact of falling iron ore prices.

In the rest of G10, CAD and JPY both saw an increase in net shorts, with the loonie now having seen a full unwinding of its net long positions as global sentiment deteriorated and the USD gained ground. CHF saw a very wide change in positioning (-8.8% of open interest), oddly in a week where it was among the best G10 performers. This is another indication of how the positioning on the franc reported by the CFTC is not particularly accurate and very often shows wide swings that have no connection with the actual market sentiment on the currency.

Source: ING