The last quarter jump in local steel plate pries (and at varying degrees) seems to have swept across all major recycling markets (including China) this week. The jump in levels varied from as little as USD 5/Ton from the Chinese market, all the way to USD 30/Ton on the Turkish end, with the sub-continent markets bridging the gap.

Despite the dry sector continuing to perform surprisingly well and keeping the markets starved of bulker and container units, as holidays descend upon India and China, it is time to take stock of what has been another busy quarter of mostly tanker scrapping, as this particular sector looks to get back on its feet next year, following a heavy year of recycling.

Local port positions across all sub-continent markets confirm this, given the number of wet units being delivered to Recyclers on a weekly basis.

Overall, it is expected to be another frantic finale to the year, as prices remain firm at historical levels at or above USD 600/LDT and tanker charter rates (for the most part) remain in the doldrums, providing an alternate lifeline to the ship recycling sector.

We have seen very few bulkers and containers for a majority of this year – with even older 90s built units passing surveys to continue trading, such has been the strength of current freight rates.

Whilst steel remains firm and the currency in India Pakistan and (especially) Turkey) have been facing their shares of wobbles over the last couple of weeks, we do not anticipate ship recycling prices to decline significantly any time soon.

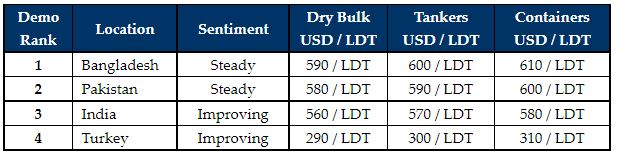

For week 42 of 2021, GMS demo rankings / pricing for the week are as below.

Source: GMS,Inc.