Horizons is a series of monthly thought-leadership articles designed to impart the wisdom of our research analysts around the globe and inform discussion on key issues in the energy and commodity markets. It’s been going down a veritable storm, so we thought we’d round up some of the key insights from the three editions published in the second quarter of 2021.

April – Reversal of fortune: oil and gas prices in a 2-degree world

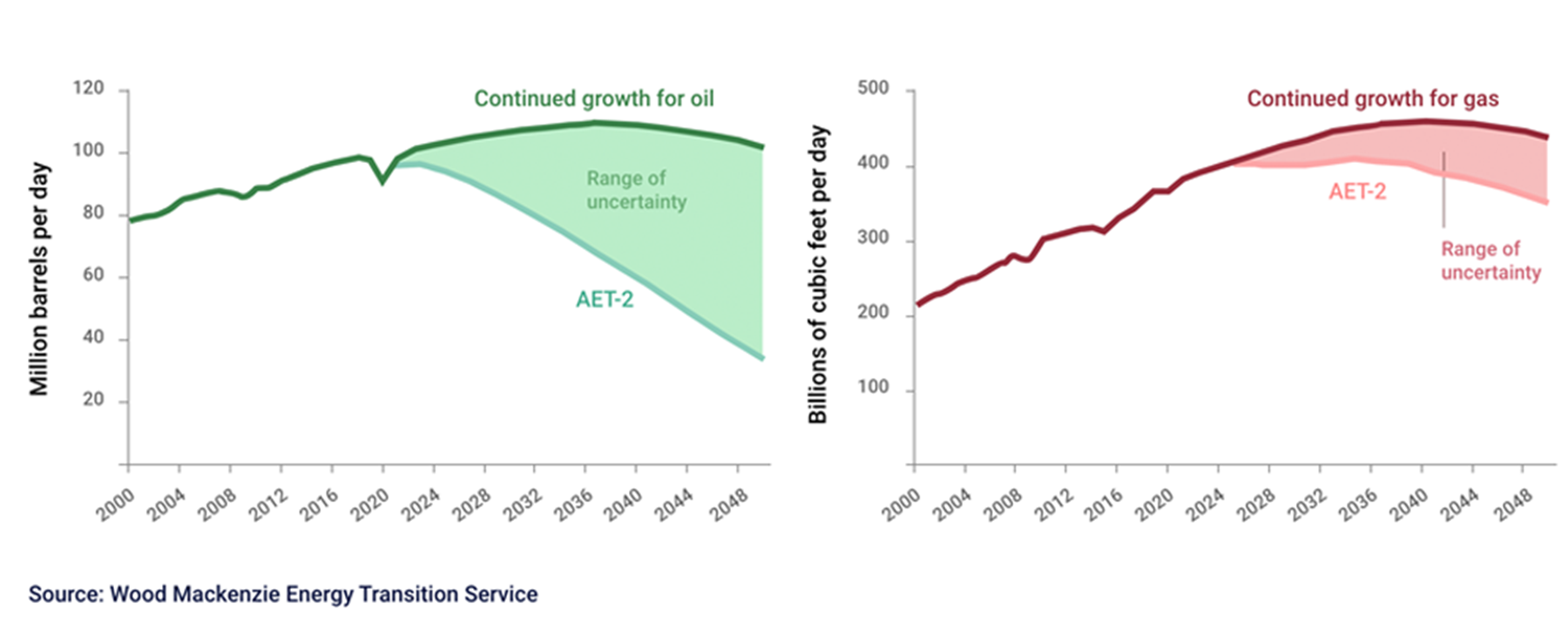

If the world cranks up its efforts to limit global warming to 2 °C, the consequences for the oil and gas industry will be severe. Under our accelerated energy transition 2 °C scenario (AET-2) to 2050, the energy market would be progressively electrified and the most polluting hydrocarbons squeezed out. Prices would come under pressure as demand fell and, in a ‘Copernican revolution’, the traditional relationship between oil and gas prices would be turned upside down.

To be clear, our AET-2 scenario is just that – a scenario – and not our base-case forecast. It envisions how one interpretation of the Paris Agreement could be achieved, based on our fundamental analysis across the natural resource sectors. Even so, the oil and gas industry cannot afford to be complacent. The risks associated with robust climate-change policy and rapidly changing technology are simply too great and the implications of a scenario akin to our 2 °C model are profound.

May – Swimming upstream: a survivor’s guide

Down the decades, the risks of the oil and gas industry have always been tempered by an unwavering assumption that demand would rise indefinitely. Now, however, as the energy transition gathers momentum and the upstream industry is forced to navigate uncharted waters, that belief has all but evaporated.

The upstream industry now finds itself having to supply oil and gas to a world in which future demand – and price – are highly uncertain. The range of possible outcomes is dizzying.

A gradual energy transition, for instance, could require the industry to invest in new production capacity for another decade or two. Our AET-2 scenario, in contrast, sees oil demand and prices slide while gas fares comparatively well. This makes strategic planning infinitely more complicated as the upstream sector positions itself for the challenges ahead.

June – Location, location, location: the key to carbon disposal

Even if we manage to meet the goals of the Paris Agreement and limit global warming to 1.5 °C of pre-industrial levels, fossil fuels will still account for close to 37% of the world’s primary energy demand in 2050. Moreover, we estimate that we would need to reduce emissions by 1.8 billion tonnes of carbon dioxide equivalent a year over the next three decades to have a chance of hitting that 1.5 °C target.

This is a colossal challenge and one that a transition to renewables alone cannot solve. Achieving a low-carbon future requires not just carbon avoidance, but also carbon removal, especially through carbon capture and storage (CCS). Much of the work in this area has focused on individual parts of the CCS value chain, as well as on policy and regulation, but we believe the real, scalable solution lies in basin-wide CCS. By taking advantage of economies of scale, we can find a community answer to a community problem.

Using proprietary data and screening, we have identified the location of 1,500 potential depleted oil and gas reservoirs that are technically capable of storage. Our asset-level emissions benchmarking tool has enabled us to map industrial point-source emitters to potential storage sites and we have validated our approach through case studies. Matching pre-screened storage sites with nearby industrial clusters, we believe, could be the foundations of a commercially viable carbon disposal industry.

Source: Wood Mackenzie