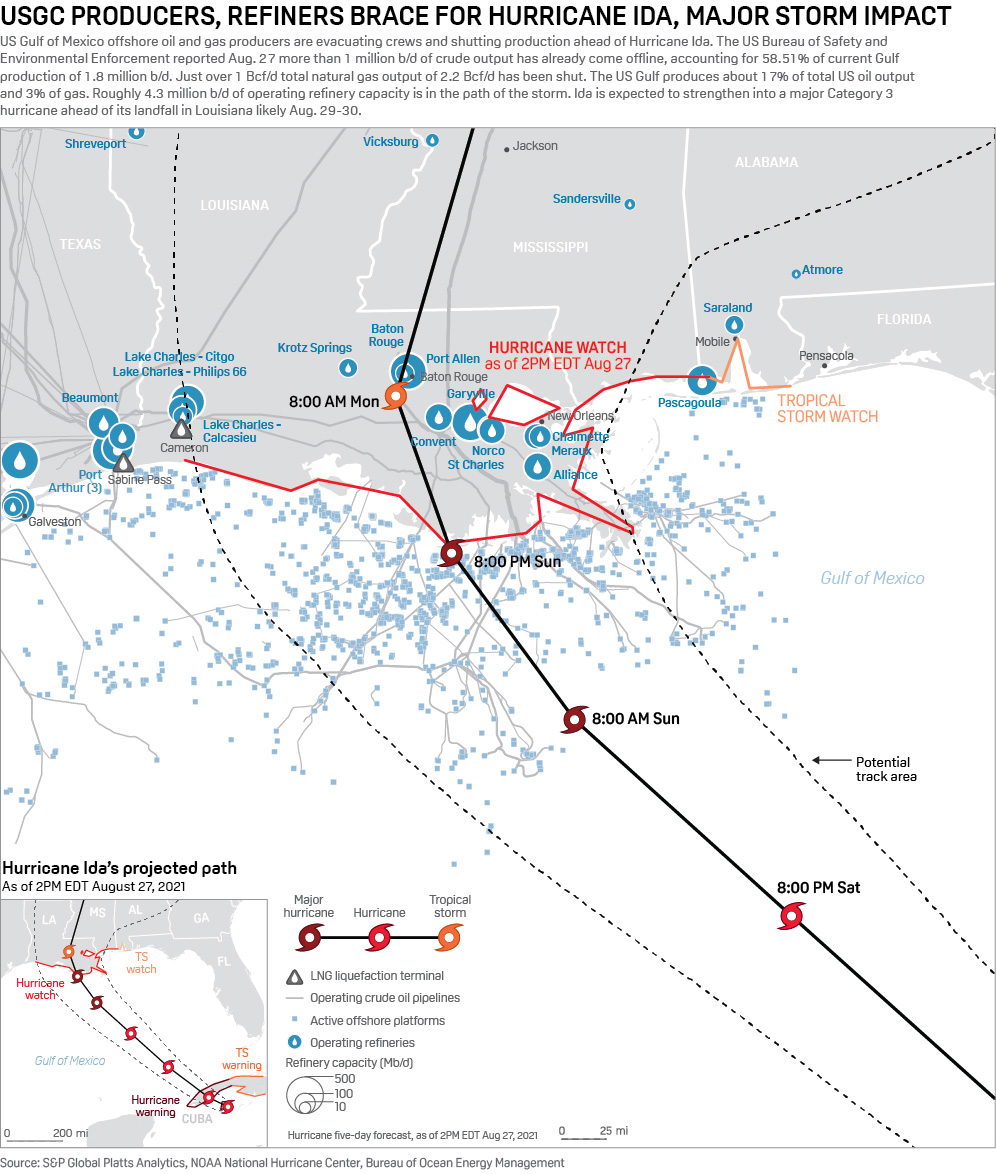

More than half of total US oil and gas production came offline in the Gulf of Mexico ahead of Hurricane Ida by Aug. 27, and Louisiana’s refining and petrochemical operators were bracing for the heavy winds and the storm surge of a major hurricane.

Ida was upgraded from a tropical storm to a Category 1 hurricane Aug. 27, with the National Hurricane Center projecting that it would strengthen to a major Category 4 storm before making landfall late Aug. 29 or early Aug. 30 along the Louisiana coastline — and likely just west of New Orleans.

The US Bureau of Safety and Environmental Enforcement said Aug. 27 that about 58.5% of the US Gulf’s crude oil, or 1.065 million b/d, was already was shut in, as well as 48.8% of the region’s approximately 2.2 Bcf/d of natural gas production, or about 1.088 Bcf/d. Ida is expected to become the first major hurricane of 2021 to significantly impact oil, gas and refining operations.

Close to 4 million b/d of operating refinery capacity is in the path of Ida as well, primarily in Louisiana. Ida’s wind speed will play a major role in how hard it strikes at the heart of USGC refining centers, said Rick Joswick, head of oil pricing and trade flow analytics at S&P Global Platts Analytics.

Joswick said if the hurricane came in with the 120 mph winds forecast earlier, it would be “a major factor.” Category 4 hurrict leanes have winds of aast 131 mph.

Prices

Oil

NYMEX September RBOB settled up 1.88 cents at $2.2742/gal Aug. 27.

NYMEX September ULSD climbed 2.60 cents to settle at $2.1092/gal.

ULSD assessed at a 4.55 cent/gal discount to front-month NYMEX ULSD, the highest level since March 26.

NYMEX October WTI settled $1.32 higher at $68.74/b.

Natural gas

Henry Hub prices gained 14 cents to settle at $4.34/MMBtu for the weekend, the strongest spot price since the severe winter storm in mid-February.

Henry Hub forwards saw strong support during Aug. 27 trading, with the prompt contract gaining 15 cents to $4.33/MMBtu.

Winter strip pricing increased by 10-13 cents as the January 2022 contract broke above $4.50/MMBtu.

Day-ahead on-peak power for delivery Aug. 30 was bid at $50/MWh and offered at $85/MWh on the Intercontinental Exchange, about $26 higher than the $41.50/MWh that power for delivery Aug. 27 settled at Aug. 26.

Trade flows

Oil

Louisiana Offshore Oil Port (LOOP) said it was executing its storm plan, although Clovelly Hub receipts and deliveries remained normal as of Aug. 27.

Ports along the Gulf Coast were open but restricted, according to the US Coast Guard.

Natural gas

As of late Aug. 27, there were two tankers at Sabine Pass, one at Cameron LNG and one at Freeport LNG, according to Platts cFlow.

Pilots who serve the channels leading to the liquefaction facilities reported fairly normal operations, though that was likely to change as Ida moved closer.

About a dozen LNG tankers were in the Gulf, some awaiting orders and others with captain’s destinations set for US facilities.

Infrastructure

Oil

Crews were evacuated from 89 production platforms, or 15.89% of the 560 manned US Gulf platforms, BSEE said.

BP said Aug. 27 it continued to shut in production and evacuate crews from its four US Gulf platforms.

Shell shut in production and evacuated Ursa, Mars, Olympus and Appomattox assets, and shut in Auger and Enchilada/Salsa facilities, while relocating Stones’ Turritella FPSO.

Chevron shut in production from its operated Gulf of Mexico platforms. Chevron’s largest-producing fields nearest Ida’s path are Blind Faith, Big Foot, Tahiti and Jack/St Malo.

Louisiana’s 17 refineries have aggregate capacity of 3.4 million b/d, representing about 20% of the nation’s total refinery capacity, according to US EIA data.

Mississippi has a total refinery capacity of 394,000 b/d, according to EIA.

Phillips 66 said it was shutting down Alliance Refinery in Louisiana.

Natural gas

Cheniere Energy and Freeport LNG did not disclose any immediate plans to reduce operations ahead of the storm.

Cameron LNG issued a statement saying it was activating its hurricane preparedness plan and would assess whether to reduce operations at the site.

Midcontinent Independent System Operator declared a state of Conservative Operations for its MISO South Region, including Entergy, Cleco, and other electric utilities in Arkansas, Louisiana and Mississippi.

Cleco, a large utility serving Louisiana, said it secured the help of an additional 1,100 workers to assist in restoring service that the storm may disrupt.

Source: Platts