[ad_1]

World Energy Reports estimate that more than 100 wind farm installation and maintenance vessels will be required over the next decade. This is due to the proliferation of Offshore wind farm projects planned for construction over the next 10 years.

Last year, for the first time ever, Offshore renewable projects spending was higher than Offshore oil and gas spending with an estimated USD 56 bil sanctioned for renewables compared to USD 43 bil for oil and gas.

Demand for wind farm installation and maintenance vessels will be met by newly constructed vessels and re-purposed or upgraded existing Offshore supply vessels. Most of the existing fleet of wind turbine installation vessels will become obsolete by 2025 due to increased wind turbine sizes to accommodate higher MW capacity, larger foundation sizes and deeper water wind farm sites.

Image Credits: VesselsValue

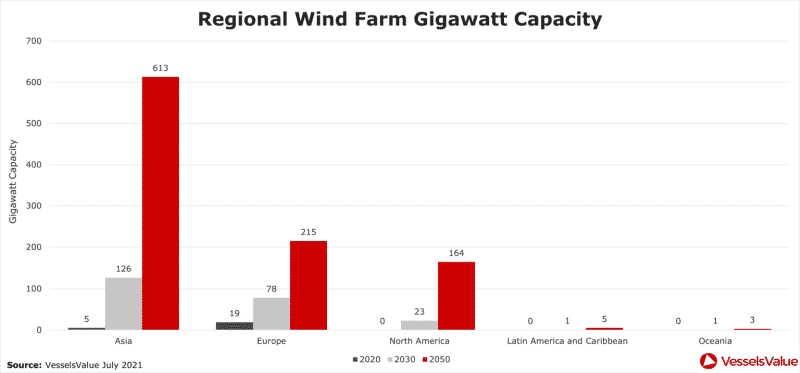

The global capacity of Offshore wind farms at present is 25GW but this will increase to an estimated 235GW by 2030, 520GW in 2040 and as much as 1000GW in 2050.

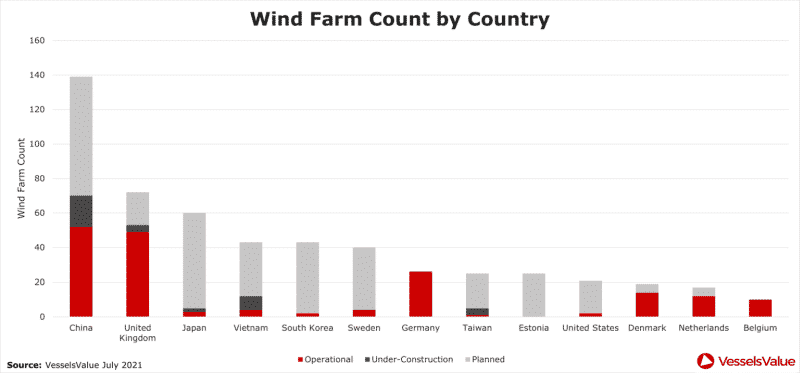

The major renewable operators at present are in Europe, with the UK having the most installed wind farms, followed by Germany, China, Denmark, Belgium and the Netherlands. This is due to Europe being the current world leader in Offshore wind power.

However, the majority of under-construction wind farms are found in China and Vietnam. This may be because the North Sea and particularly the UK/Germany sector already have many installed wind farms.

Asia has the highest number of future planned wind farm projects with China planning 69 wind farm projects followed by Japan with 55 planned projects and South Korea with 41 projects.

Within China, South Korea and Japan, all wind farm installation vessels inside of wind farms (OCV/Liftboat/OSV) were from the host country which suggests governments in China/Japan/Korea will restrict access to home markets to domestic shipyards and owners only.

VesselsValue’s Orderbook shows that of the 16 SOV and WTIV currently on order, half are for the European market and half are for the Far East market.

Installed gigawatt (GW) capacity at present is highest in Europe (19GW) with Asia far behind with an installed Offshore capacity of 5GW. However, when looking at predicted installed capacity for 2030, Asia pulls ahead of Europe with a GW capacity of 126 compared with 78GW in Europe.

When predicted wind farm capacity for 2050 is compared, Asia will have a predicted capacity of 613GW, Europe 215GW and North America 164GW.

VesselsValue data as of July 2021.

Press Release

Increased Demand Predicted Wind Farms In Next Decade: VesselsValue appeared first on Marine Insight – The Maritime Industry Guide

[ad_2]

This article has been posted as is from Source