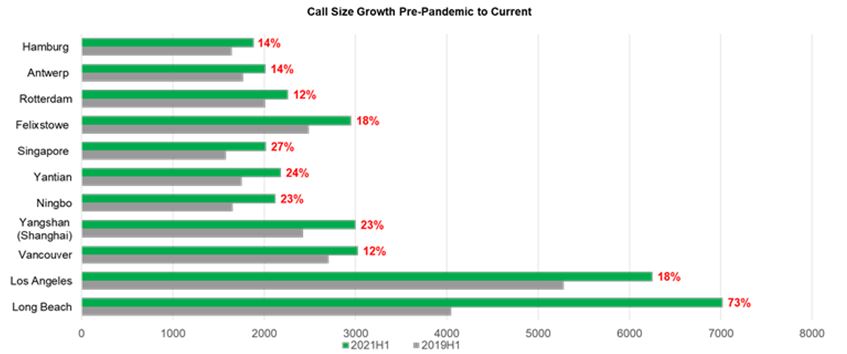

The average number of containers requiring loading and unloading per ship call at major global gateway ports has jumped during the pandemic, causing further delay and congestion at an already stretched supply chain. According to the latest Port Performance Data by IHS Markit, container call sizes are up between 10% and 70% (vs H1 2019) across major US, Northern European and Asian ports. The average vessel now requires more than 3000 container moves per single call as global trade volume bounces back.

At the Port of Long Beach, United States, average call sizes are now more than 70% higher than before the pandemic with terminals dealing with an average of more than 7,000 container moves per call on large ocean-going vessels. In Singapore and Yangshan (Shanghai), the call size increased by 27% and 23% percent respectively over the last two years. Whereas Felixstowe (UK) and Antwerp saw call sizes increase by 18% and 14%. Call sizes had been growing already prior to the pandemic due to increasing vessel sizes and optimization of liner networks. Strongly rebounding and unpredictable demand – as trade volumes recovered sharply from end of 2020 – amplified the trend causing delays at many global ports dealing with intermittent spikes in demand.

“The severe operational strain is caused by the surge in cargo volumes coming in much more concentrated loads. This spike in demand is placing heavy stress on ocean and landside operations, increasing yard congestion and cargo dwell times, with knock-on effects on equipment repositioning and intermodal links further fuelling the problem and resulting in sustained congestion at key global gateways.” Turloch Mooney Associate Director, Maritime and Trade at IHS Markit

Asian ports can load or unload a container more than twice as fast as their North American counterparts, taking on average 27 seconds compared to 76 seconds on large call sizes. The Northern European ports take an average of 46 seconds, according to IHS Markit’s Port Performance Data.

“The extent of the congestion has been a shock to many both inside and outside the industry and has prompted investigations into how certain container ports have become overwhelmed, and what can be done to improve resilience for the future.”

Turloch Mooney Associate Director, Maritime and Trade at IHS Markit

Higher volume and low productivity results in 40% of vessel calls at the large North American West Coast ports being required to drop anchor before a berth. This compares to 26% in South East Asia, nearly 23% in North Europe and only 12% in North East Asia. The average anchorage time in North America is 24 hours vs only 2 hours in North East Asia.

For this analysis IHS Markit compared key global gateway container ports in North America, Europe and Asia.

Source: IHS Markit