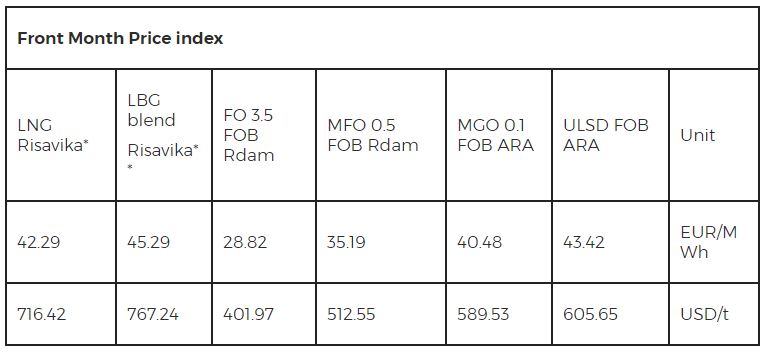

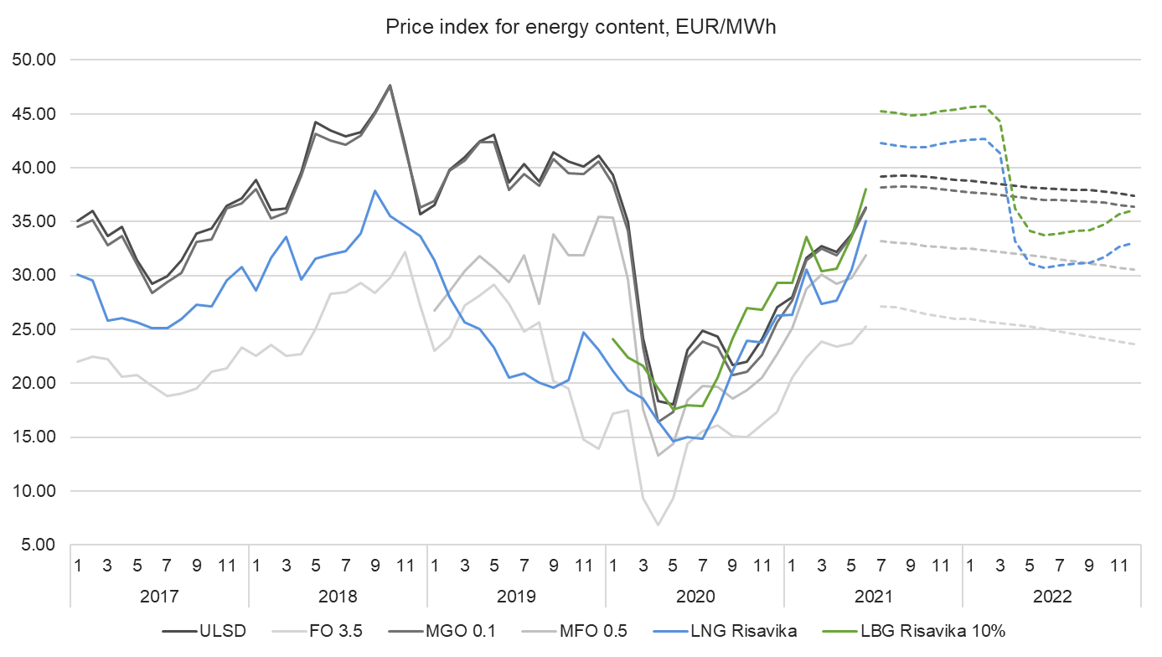

European gas markets prices rallied during last two weeks, Risavika LNG gained considerable 10.5 % and was at 42.29 EUR/MWh for July contracts. Summer prices reached record levels never seen before on lower supply of gas and demand for storage injections. The outlook for the rest of 2021 shows higher prices for LNG, however, flat with no seasonal increase during winter in anticipation of improvement in supply side.

Oil product prices also showed upside with benchmark Brent crude price increasing over 74 USD/BBL and increase in demand for oil products. Fuel oil 3.5 (FO 3.5) price gained 3.7 % to 401.97 USD/t, low sulphur oil (MFO 0.5) was up by 2.7 % to 512.55 USD/t, and marine gasoil (MGO 0.1) gained 1.6 % to 589.53 USD/t.

Looking further ahead, more oil to LNG switching could be seen in maritime shipping in the EU. The European Commission will next month put forward legislation to force ships to reduce average greenhouse gas (GHG) intensity of energy used by 6 % by 2030, by 49 % by 2040 and by 75 % by 2050, all from 2020 levels. This carbon intensity target would allow for LNG to be compliant for up to two decades. The environmental campaign group Transport & Environment (T&E) calculated that LNG in dual-fuel high-pressure, diesel-cycle engines would be the cheapest compliance option, at €0.85-€0.93/GJ in 2030. It sees waste-based biofuels as the second most cost-competitive option, with a forecast 2030 price of between €1.48-€3.20/GJ, and sees green ammonia’s 2030 price at €2.69-€6.72/GJ.

LNG Risavika – LNG FOB Risavika

LBG Risavika 10 % – 10 % blend of Liquified Biogas

FO 3.5 FOB Rdam – European 3.5% Fuel Oil Barges FOB Rdam (Platts) Futures Quotes

MFO 0.5 FOB Rdam – European FOB Rdam Marine Fuel 0.5% Barges (Platts) Futures Quotes

MGO 0.1 FOB ARA – Gasoil 0.1% Barges FOB ARA (Platts) Futures Quotes

ULSD FOB ARA – European Diesel 10 ppm Barges FOB ARA (Platts) Futures Quotes

Source: Gasum